Jack Colreavy

- Dec 19, 2023

- 5 min read

ABSI - 2024 Economic Outlook: Powell‘s Pivot, US Election Drama, and China's Economic Shift

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

Christmas has come early for financial markets with a roaring Santa Claus rally that has seen many global stock exchanges rally since November off the back of anticipation that we have hit peak interest rates. For the final ABSI of 2023, we will cast our gaze ahead to 2024 to break down some of the potential trends emerging.

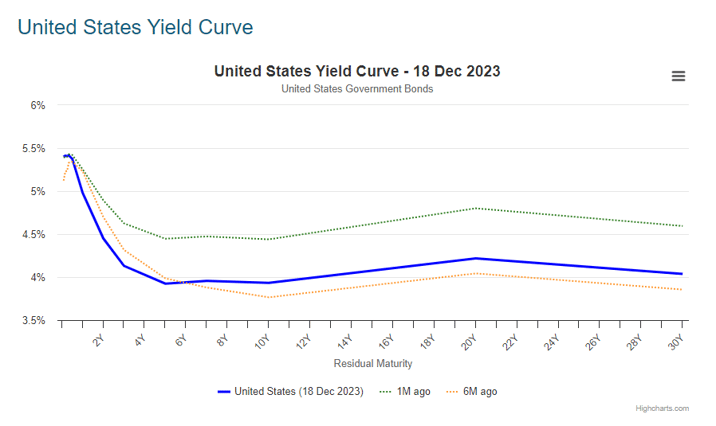

Last Friday, the Dow Jones notched a 3rd consecutive all-time record close at 37,305.16 while the Nasdaq-100 also set a fresh record close. The recent catalyst for these record moves were the dovish comments from US Fed Chair Jerome Powell in the Fed’s final monetary policy meeting for 2023. If you recall, it was only two weeks ago that Powell was trying to talk the prospect of rate cuts down, saying it was premature to speculate on cuts and that rate rises were still very much on the table. In what’s been dubbed the “Powell Pivot”, the Chairman made his position clear by stating that cutting rates had “now come into view”. Furthermore, policymakers expect to trim the cash rate by 0.75% in 2024. The news sent treasury yields plummeting and risk assets skyrocketing.

Source: Google Finance

The candour from Powell was a surprise given the tendency for central bank chiefs to talk in riddles and it appears that rate cuts will occur in 2024, given how clear the signal was. The question to come into focus now will be how many?

Given that core inflation is still at 4%, unemployment holding strong at 3.7%, and GDP roaring at an annualised rate of 5.2%, I find it surprising that rate cuts are starting to enter the equation for the Fed. As a result, unless the economy takes a major turn for the worse, I don’t believe there will be 3 rate cuts in 2024 and that March may be a bit premature for the first cut. However, I do feel (and yes I know central banks are independent) that the 2024 election may have some influence here.

Source: World Government Bonds

Speaking of elections, there will be over 40 countries holding elections in 2024 including Russia, Iran, Taiwan, the UK, and India. However, all eyes will be on the main event, the United States of America, and it is set to be a doozy. At this early point in the cycle, the likely match-up is Biden vs. Trump but this could suddenly change. On the Democrat side, Biden is constantly being questioned on his cognitive ability at 81 years old and Congress has recently officially started impeachment inquiries into corruption within the Biden family led by troubled prodigal son, Hunter.

On the republican side, Trump is fighting several lawsuits for varying actions but the most important being the trials relating to the Jan. 6 riots that saw Trump supporters breach the capitol building. The reason why this legal proceeding is so important is because having a criminal record doesn’t exclude a person from being elected US President, however, the 14th amendment, ratified in the wake of the civil war, does disqualify a person who has engaged in insurrection or rebellion against the country.

In the event that either, or both, withdraw from the race then there are a plethora of candidates vying to take their place as the official candidate for the established parties. Noteworthy is the black swan in this whole affair being Robert F. Kennedy Jr’s third-party candidate bid for the presidency. Traditionally, the US has been a staunch two-party system, with the last somewhat viable third-party candidate being Ross Perot back in 1992, who managed to secure 18.9% of the popular vote and was credited with disrupting the reelection of George H. W. Bush. RFK has the ability to cause similar headaches for both parties, but it is not entirely clear if he will take more votes from Democrats or Republicans. A recent Quinnipiac poll has support for Biden, Trump, and Kennedy at 39%, 36%, and 22% respectively.

NYT poll shows RFK JR. leading in 6 battlegrounds among voters 18-29:

- Joe Biden: 30%

- Donald Trump: 29%

- Robert F. Kennedy JR. : 34%

-- Source: NewsNation

So far we’ve been talking about the US but what about China?

China has been fairly muted in 2023 primarily due to issues in the real estate market. However, it seems like President Xi changed political tack this year and is looking to embrace cooperation over wolf/warrior diplomacy. This was evidenced recently with Anthony Albanese’s visit to China and the thawing of some trade restrictions. Federal trade minister recently expressed his optimism that the remaining restrictions will be lifted in early 2024 which should mark the final step towards normalising trade between the two countries.

While a lot of focus has been put on Chinese real estate, it is important to appreciate that the rest of the economy isn’t doing too bad. At last report, China’s economy was growing at 4.9%, unemployment at 5%, but there was deflation which was dragging on economic growth. However, with monetary policy set to 3.45%, policymakers have the ammunition to supercharge growth in 2024 if they choose to cut rates. This is no sure-thing though as they will seek to learn from their Japanese neighbours who are currently caught in a catch-22 on their debt burden.

That’s a wrap for 2023. I hope everybody has a safe and joyful holiday season. See you in 2024.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link