Jack Colreavy

- Nov 23, 2022

- 5 min read

ABSI - ASX Ltd Scraps its System Update Program

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

Last week ASX Limited, the company behind the Australian Securities Exchange (ASX), announced they were scrapping their blockchain clearing project and writing down the ~A$250 million spent over the previous 7 years. This week, ABSI takes a look at the role ASX Ltd plays in clearing and settling share transactions in Australia.

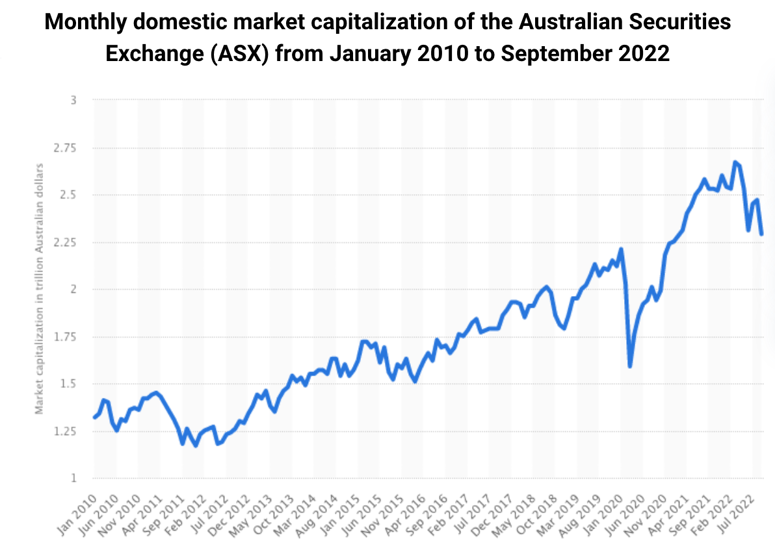

ASX Ltd was incorporated in April 1987 to operate the Australian Stock Exchange after it amalgamated the six stock exchanges from various Australian states. In 2006, the ASX merged with the Sydney Futures Exchange to form the Australian Securities Exchange. Today the ASX trades in equities, bonds, FX, and derivatives, making it a world leading financial market. The World Economic Forum ranks the ASX 5th in financial systems and capital markets, boasting a total market capitalisation of ~A$2.3 trillion.

Source: Statista

Critical to the operation of any financial market is the clearing house that settles transactions on a daily basis ensuring that the beneficial ownership is successfully transferred. ASX Clear operates the Clearing House Electronic Subregister System, better known as CHESS, to fulfil this important role. According to ASX listing rules, listed companies are required to set up a CHESS subregister, in which all equities are held. Security holders are allocated a Holder Identification Number (HIN) in CHESS by a CHESS Participant, broker or approved non-broker, and these controlling participants are the only parties allowed to initiate transactions on CHESS. In an attempt to avoid going to far into the weeds, ASX transaction settle two trading days following the initial trade (T+2) and are recorded through a number of different services including SWIFT FIN, Reserve Bank Information and Transfer System (RITS), Australian Payments Clearing Association (APCA), and the Exchange Settlements Account (ESA).

The point I make from the above summary is that, what seems like a simple buy and sell transaction, is actually a catalyst for a whole web of background activity. This backoffice infrastructure is criticised for being cumbersome, slow, and expensive - traits usually befitting a monopoly. It is estimated that the additional costs to investors is in the realm of A$5 billion per annum, with ASX Ltd earning over A$150m in revenue from its clearing and settlement services last financial year.

In 2015, the ASX announced a review of CHESS and would look to update the ~20 year old system to bring it well into the 21st century. One year later, they had decided that distributed ledger technology, also known as blockchain, would underpin the next iteration of the system. Hopes were high given the rise of Bitcoin, providing a case study that a system offering instantaneous and low-cost transactions could exist at an enterprise scale.

Unfortunately, after years of delays and significant cost blow outs, the ASX decided to cut its losses, approx. A$250 million, and scrap the whole program to start from scratch. The news disappointed many in the market including ASIC and the RBA who released a joint-statement condemning the decision.

Source: AFR

Most importantly, the move has put the spotlight on the ASX monopoly and parliamentary committee’s are forming to analyse whether the ASX is fit to run this vital service. Noteworthy, it is rare for an exchange to also operate the clearing and settlement services. In the US, this task falls on the Depository Trust and Clearing Corporation, which is owned by the major banks and brokers, and allows independence from the exchanges. Independence might also relegate some of the conflicts of interest, as the ASX tried to appease all stakeholders who might be set to lose millions in revenue from a better system. A lobby group, CHESS Replacement Stakeholder Group, was established by registries and other market participants to influence the structure of the new system. As a result, ASX Ltd capitulated on several aspects of the new system, such as maintaining delayed settlements and preserving the role of registries.

Ultimately, these compromises added to the complexity of the new system and contributed to its downfall. The independent report from Accenture confirms this by stating that ASX’s “priorities to minimise impact to participants and uphold commitments made to the market” relating to the design and delivery of the new system were “inconsistently assessed against strategic objectives for the ASX”.

Source: Google Finance

An efficient and low-cost settlement and clearing system for financial products is like a utility, in that it will provide a greater good for all participants. Upgrading this system should be a national priority and given the ASX's failure over the past seven years, I will not be surprised if they’re stripped of this responsibility for the greater benefit of all market participants.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link