Jack Colreavy

- Dec 12, 2023

- 5 min read

ABSI - Brookfield's Bid: Fallout and Future Prospects in Australian Energy

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

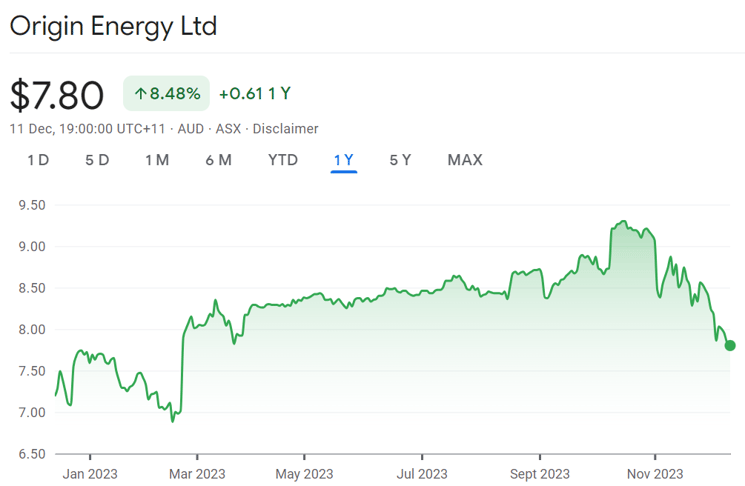

On the 10th of November 2022, Australia’s largest energy operator, Origin Energy (ASX:ORG), received an indicative A$9/share takeover consortium bid led by Canadian giant Brookfield. Fast forward over 12 months to December 4th when Origin shareholders finally got the chance to voice their opinions. Brookfield required 75% approval to get the deal done but activism from Australian Super, who acquired a ~17% stake, was enough to see ~31% vote no to the deal. ABSI will assess the fallout from this ~A$20 billion failed transaction.

It is well established that the renewable energy transition presents a huge opportunity for investment into important future infrastructure. That makes it an attractive industry for asset managers with huge swaths of capital needing to be deployed. Brookfield Corporation is a great example of this archetype with ~CA$800 billion under management and has identified Australia as a prime region to deploy capital given the country’s high utilisation of coal-fired electricity generation. In 2021, Brookfield successfully led a consortium to acquire AusNet Services, which essentially is the electricity transmission infrastructure in Victoria.

Source: Google Finance

Buoyed by the win, Brookfield teamed up with Aussie billionaire Mike Cannon-Brookes to acquire Australian energy generator and retailer AGL Energy for over A$8 billion in 2022. However, the deal was quickly knocked back by the AGL board as undervalued and they endeavoured to proceed with a demerger of the retail and generation assets. In a win for Cannon-Brookes though, the demerger plans were scuttled with several board members stepping down and the CEO resigning. Damien Nicks is the new AGL CEO and is committed to setting out plans to accelerate the Company’s renewables plan.

Source: Google Finance

Undeterred by the setback, Brookfield bounced back with a bigger plan to acquire the larger Origin Energy in late 2022. Over the next 400 days, there was due diligence, valuation negotiations with the board (which included an upgraded bid to A$9.32/share), positive rulings from the competition regulator (ACCC), and a commitment to invest A$20-30 billion to add 14 GW of renewable energy to the Australian energy market. Despite all this, an activist no campaign won the day, led by Australian Super.

So where does Origin and Brookfield go from here?

It has been reported that Brookfield is done with Origin and will not be coming back to the table for a higher bid. I suspect that they will sit out for a while to lick their wounds after a drawn-out deal failure like this. However, I don’t think we’ve seen the last of their efforts to crack into the Australian energy generation sector which is ripe for renewable disruption. One of the most interesting outcomes from the Origin saga was the fact that the ACCC approved the deal despite Brookfields ownership of AusNet Services. Traditionally, an owner of a monopoly asset, such as the poles and wires, would be prohibited from owning generating assets that utilise the network due to the incentives to prioritise access. While these concerns were noted by the ACCC, they acknowledged that the benefits of an accelerating reduction in Australia’s greenhouse gas emissions outweighed the perceived risks.

Given Brookfield has had a crack at AGL and Origin, I wouldn’t be surprised if they go for the trifecta and approach EnergyAustralia for collaboration. EnergyAustralia is the third biggest electricity and gas supplier in Australia and is owned by Hong Kong-listed company CLP Group. EnergyAustralia has been struggling in the modern energy environment, recording an A$1 billion loss in 2022. As a result, CLP Group has been looking for a 50% partner to help finance new renewable energy assets for the Company. Macquarie Bank was in discussions to partner but walked away earlier this year, leaving a gap that could be filled by Brookfield.

As for Origin, it is hard to imagine things will go back to business-as-usual considering almost 70% of its shareholder base were willing to sell their shares to Brookfield. Like AGL, the Company is being torn in two directions. Half would like to see the majority of profits issued as dividends and to leave the energy transition to others. On the other hand, the other half would like to see greater reinvestment of profits into new renewable assets. Australian Super for one has put its hand up to supply the A$20 billion needed to accelerate this rollout.

I personally, with no shareholding in Origin Energy, would like to see the incumbent energy leader in our country take a bigger role in the energy transition. This would be in the best interest of shareholders, as a value creation mechanism, and be in the national interest of the Australian people. Origin is in the best position to succeed and in the shortest possible time frame. Australian Super have done well in blocking Brookfield and now is the time for them to put their money where their mouth is and stump up the cash for the future.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link