Jack Colreavy

- Jan 23, 2024

- 4 min read

ABSI - Deciphering Australia's Employment Puzzle:Mixed Signals for 2024 Economics

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

In the first major piece of Australian economic data for the year, Australian unemployment fell by 65,000 in December. Economists are mixed on this report with some saying this is the start of broader economic weakness while others are acknowledging the seasonality of hiring patterns. ABSI this week will parse through the numbers.

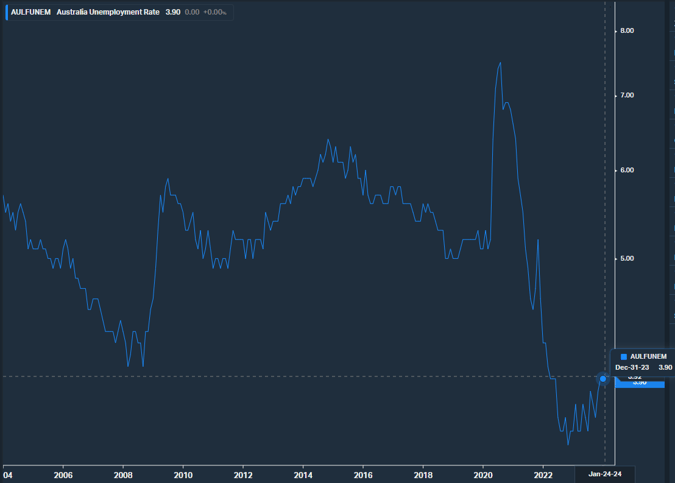

Last week the ABS released the December jobs report and the headline figures weren’t fantastic. In seasonally adjusted terms, part-time employment increased by 41,400 but that wasn’t enough to offset the 106,600 decrease in full-time employment. Despite the decrease in employed people, the unemployment rate remained steady at 3.9% due to a drop in the participation rate from 67.3% to 66.8%.

Australian Unemployment Rate

Source: Koyfin

The stats also wrap up the year 2023 which saw a 2.8% increase in employed people and a 1.2% increase in monthly hours worked. However, that wasn’t enough to end record-low unemployment moving from 3.5% to 3.9% due to a 15.3% increase in unemployed people stemming from a small increase in the participation rate and underemployment rate.

Taking a look at the bigger macroeconomic picture of 2023, I have been surprised by the resilience of the labour market. Interest rates increased 125 bps over the year while wages increased 4% to Sept 2023, Q4 data isn’t released until Feb. The fact that unemployment has remained below 4% is a bit of a miracle.

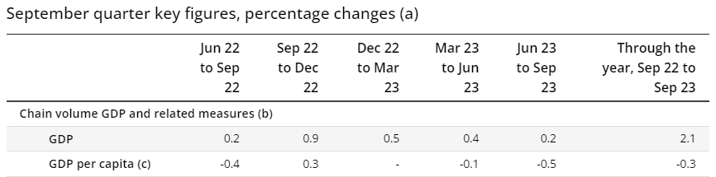

Australian GDP Per Capita

Source: ABS

To me, the primary driver behind the miracle has been migration with temporary migration hitting historic highs of ~500k in 2023 as students and tourists returned to Australian shores in droves. This has created sustained demand in the economy reinforcing the demand for labour and is best epitomised in Australian GDP data whereby headline grew 2.1%, real basis, to Q3 2023 but on a per capita basis we’re going backwards at an annual rate of negative 0.3%.

Many economists are trying to put a positive spin on the recent jobs report by pointing to a change in hiring patterns in the months leading to Christmas, evidenced by the strong job numbers in Oct and Nov as a shift to Black Friday/Cyber Monday sales continues to trend upwards.

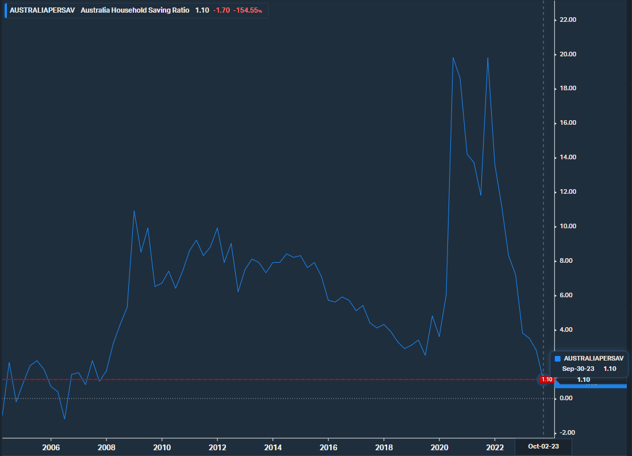

Australian Household Saving Ratio

Source: Koyfin

However, I think the Dec jobs report, which is reflective of a global trend, is an indicator that tight monetary policy is having its desired effect in reducing discretionary spending. Couple this with new rules to tighten immigration and diminishing household saving rate, currently at a 10-year low of 1.1%, and we have a recipe that will see a softer jobs market in 2024.

The good news is that this will increase the odds of a reduction in inflation and therefore Australian interest rate cuts which will take pressure off household expenses. Keep an eye out for Q4 CPI data released next week.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link