Jack Colreavy

- Nov 30, 2022

- 8 min read

ABSI - Future of Australia's iron ore exports

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

|

Australia is 'the lucky country' due, in part, to its large reserves of natural resources and top of those natural resources is iron ore. Australia is the undisputed king of iron ore thanks to hematite iron ore, better known as direct shipping ore (DSO). The problem is that Australian and global reserves of high-grade DSO are fast approaching depletion. ABSI this week explores what the future holds for iron ore exports, particularly in Australia.

|

|

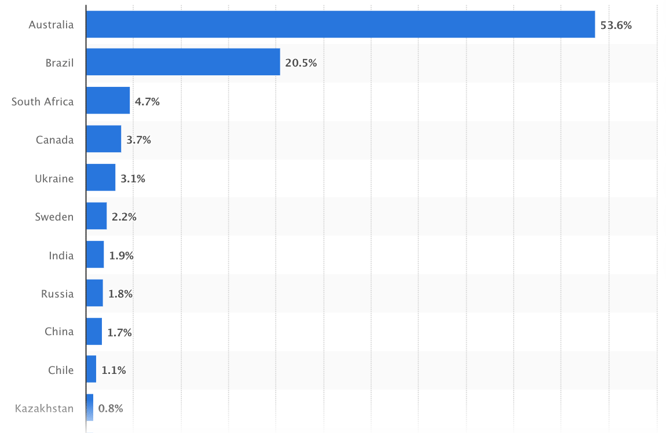

For context, DSO is a naturally high-grade product that requires minimal processing before being shipped to steelmakers. Miners pushed into DSO because it was an easy product to produce and formulated the integration of sophisticated logistics chains. Steelmakers were attracted to DSO by the low cost, high volumes, and acceptable grades that were being shipped to their smelters. The industry benchmark for a DSO product is 62% Fe. According to data, Australia exported ~US$342 billion worth of goods and services in 2021 with iron ore comprising ~US$117 billion, or ~34%, making it their largest export resource. Most interestingly, it is estimated that 96% of that is DSO hematite iron ore that comes from WA iron ore deposits.

Source: Statista |

|

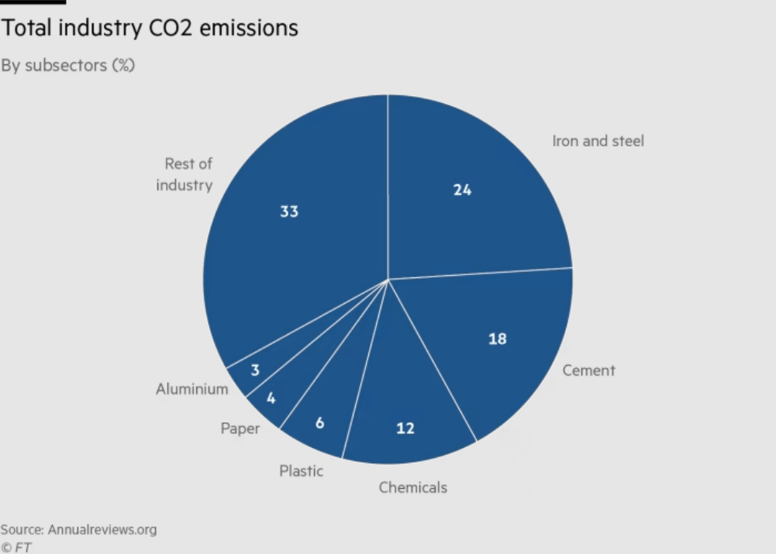

It is important to appreciate the two major shifts for the iron ore market over the next decade are related to the exhaustion of existing DSO deposits and the need to reduce carbon emissions from steel production, which currently produce up to two tonnes of CO2 per single tonne of steel produced. These two themes have major ramifications for how the industry operates and for the overall wealth of major iron ore exporters such as Australia. BloombergNEF notes that “Australia, however, currently produces lower grade ores, and could lose its number one place in the supply chain, if it does not invest in equipment to upgrade its product”. The equipment investment relates to the long term solution for the iron ore industry - magnetite iron ore. Magnetite is a naturally lower-grade orebody, however, it possesses ferromagnetic properties that make it well suited for beneficiation (processing) to bring up the grade to a much higher +66% Fe. It is important to appreciate that while beneficiation requires additional investment into infrastructure, the resulting product is of a much higher quality and purity that commands a premium price in the marketplace. Continually, steel smelters, particularly those using direct reduction (DR) methods, are willing to pay more because the higher quality means less reducing agents, such as natural gas or metallurgical coal, and thus making the resulting product better for the environment. It is no wonder that magnetite has been dubbed the “green iron ore of the future”. |

Source: FT

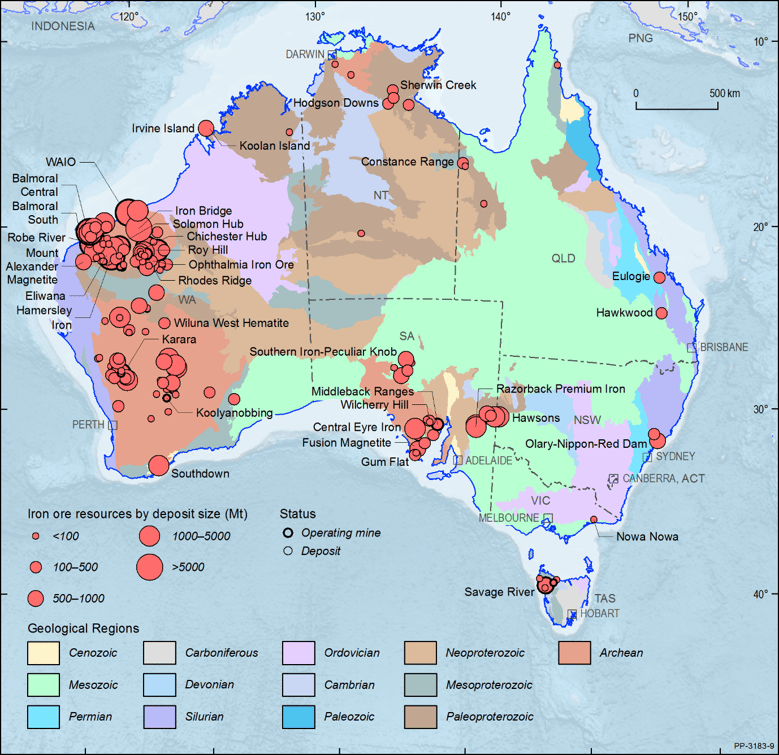

It is critical to note that Australian iron ore companies may need to start turning their eyes away from the Pilbara for magnetite iron ore production. As a result of the extra layer of processing, access to infrastructure such as water and electricity is vital for the economics of the project. As an example, the Sino Iron Ore Project is one of the biggest magnetite projects in operation out of the Pilbara and supplies a very high-quality iron ore pellet to smelting plants in Asia. However, the project experienced delays and cost overruns due to the need to build a 51GL desalination plant and a 480MW gas-fired power plant. A lower risk option would be projects that tap into existing infrastructure such as Constance Iron's Norseman Iron Ore Project which is situated in close proximity to the existing town of Norseman. This project will use existing power, water, road, rail, and port infrastructure to produce a high purity iron ore concentrate.

Source: Geosciences Australia

The shifting trends in the iron ore market provide a net-benefit for the environment as we prepare to usher in a new age of green steel made from green hydrogen and high-purity magnetite iron ore. Importantly, with change comes the opportunity for investors to benefit from the first-movers who take advantage of the new global benchmarks.

Constance Iron is a corporate client of Barclay Pearce Capital. To learn more about the projects and the upcoming London Stock Exchange IPO, please contact your BPC rep today.

Read the Conversation:

Jack Colreavy:

“Australia's the undisputed king of Iron Ore. There's no argument around that, whereby far the world's largest exporter and to put it into contexts, Australia exported 342 billion. That's in US dollars worth of goods in 2021, and Iron Ore comprised 117 billion or 34% of it, so it's critical mineral. The problem is that most of the iron ore comes from hematite reserves, which are starting to deplete and exhaust themselves. So where does the future come? And the answer is magnetite Iron Ore.

Now, while Magnetite has a much lower grade, naturally, it possesses different properties which enable it to be processed into a much higher grade product, which possesses a lot less impurities. Now the steel smelters love this because they then use less coal and therefore there are less emissions when they're producing the steel from the magnetite Iron Ore. So really, the future of Iron Ore is in this green Iron Ore that is magnetite.

To learn more, please subscribe to, as Barclay sees it, by clicking the link in the description.”

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link