Jack Colreavy

- Nov 14, 2022

- 6 min read

ABSI - Global Market for Green Hydrogen

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

The government green hydrogen arms race is officially in full swing with the announcement last week that Canada will introduce a 40% tax credit, in an effort to avoid being “left behind”. Other regions globally are offering very generous subsidies and grants to attract green hydrogen production investment and ABSI this week takes a look at some of these schemes.

Governments love the concept of green hydrogen for many reasons. Energy importers, such as Germany and Japan, see it as a way to diversify their energy supply network. On the other hand, energy exporters, such as Australia and Saudi Arabia, see it as a way to ease the financial burden when fossil fuel use goes the way of the dinosaur. That is because green hydrogen is the conduit by which the export of renewable energy is enabled.

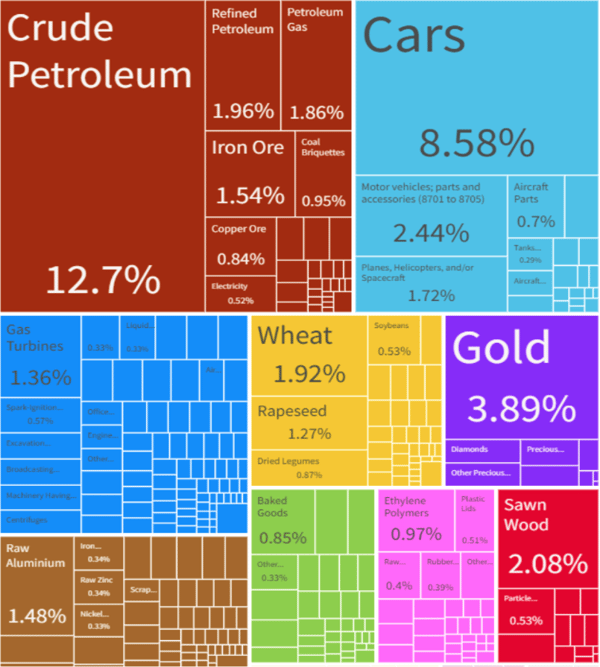

Canada falls into the energy export category. In 2021, according to World’s Top Export, Canada exported US$120 billion worth of mineral fuels making it, by far, Canada’s largest export product at almost a quarter of total Canadian exports. While currently in high demand due to the Ukraine war, most western economies are taking steps to eliminate their reliance on fossil fuels. Hence, the clock for this export product is limited and the need to find a replacement.

Canadian Export Tree

Source: OEC

Enter green hydrogen, with its ability to enable the transportation of renewable energy. In a similar sense to fossil fuels, some countries are richer than others when it comes to renewable energy; the difference being it is what’s measured above the ground, not below it. Solar panels require large land masses and lots of predictable sun, wind turbines require consistent gusts of wind, while hydro needs very specific natural land formations and flows of water. Sun shining in Canada can be captured by a solar panel, directed through an electrolyser, transformed into green hydrogen, shipped to Germany, and run through a hydrogen gas turbine to create electricity for the local grid.

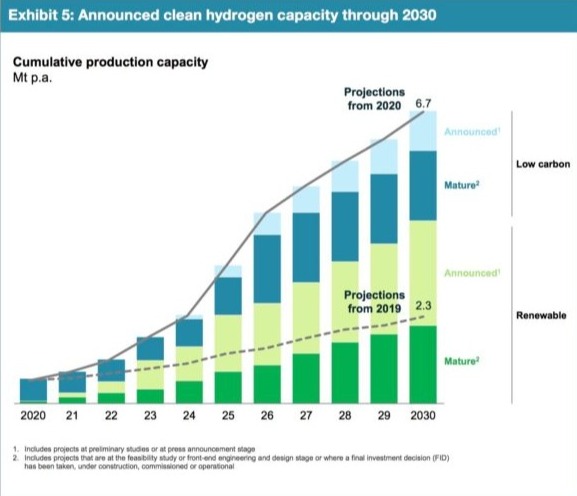

Economics is the study of resource allocation in a world with limited resources. This aptly sums up the predicament facing Canada and other similar countries. Governments can’t provide all the capital and expertise needed to develop a hydrogen export industry. However, they can stimulate private investment through the use of grants and subsidies. These incentives have been relatively modest until Russia invaded Ukraine and caused a global energy crisis. Since then countries have been clambering to secure the private investment necessary to turbo boost green hydrogen production. The EU has announced the establishment of a €3bn hydrogen bank with plans to stimulate 10mt of annual domestic production and 10mt of imported green hydrogen. Off the back of this, funds such as Copenhagen Infrastructure Partners and Hy24 have raised a combined €5bn to invest in green hydrogen projects, primarily in Europe. Meanwhile, the US has passed the Inflation Reduction Act (IRA) which offers a US$3 per kg credit for green hydrogen production. Given that, at a sufficient scale, hydrogen can be produced for less than $3/kg, companies could produce a product with a negative COGS.

Source: PV Magazine

Canada had no choice but to act with a statement from the Department of Finance stating “without new measures to keep pace with the IRA, Canada risks being left behind.” The new measure is a 40% tax credit on green hydrogen production which should bring the incentive regime close to the US in terms of generosity.

The light now shines on others to step up, notably Australia and the UK. In a recent interview, the CEO of FTSE 250 company Johnson Matthey, claims that the UK is falling behind in the hydrogen race after having set early leadership. JM has already redirected projects to the US and risks further outflows unless new policies are enacted. Likewise, in Australia there are some incentives around, especially from the state governments, but these are all laughable when compared to those being offered elsewhere. Australia has the potential to be the largest exporter of green hydrogen, but it cannot simply rely on its superior solar, wind, and hydro assets to create a hydrogen powerhouse. The Federal government needs to step up by cutting red tape on renewable energy projects and providing tax incentives in order to stay in the race.

Read the Conversation:

Jack Colreavy:

“ Good news for green hydrogen continues to flow through the newswire with the Canadian government announcing a 40% tax credit for the production of green hydrogen. Now, this was enacted as a result of avoiding being left behind by other jurisdictions that are offering very generous subsidies. The US, for example, offers a subsidy of up to $3 a kilo for green hydrogen production, the EU is launching a green hydrogen bank.

There are a lot of strategies out there by governments to attract the billions of investment needed in order to get this industry up off the ground. Now, governments love green hydrogen because it enables them to export their renewable energy resources so it really can create an entirely new export industry for these countries.

Now, Australia's a country with great renewable energy resources. But the subsidies being offered to get green hydrogen off the ground really paling in comparison to, to some of their other counterparts. So Australia really is at risk of being left behind unless the government comes to the table and works on new ways in order to stimulate the investment necessary to get the industry off the ground. To learn more, please subscribe to, As Barclay Sees It, by clicking the link in the description below.”

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link