Jack Colreavy

- Apr 9, 2024

- 5 min read

ABSI - Gold Miners Poised for Golden Run

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

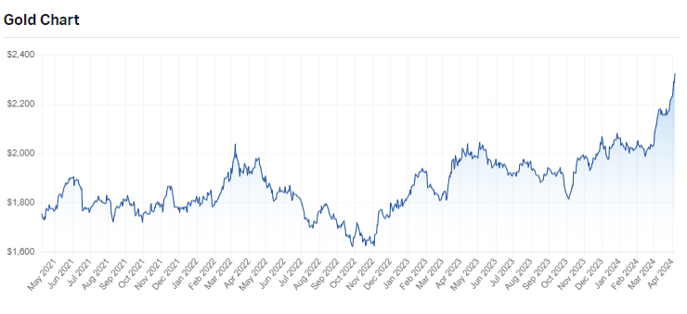

It’s been a golden year for gold as the precious metal continues to set new all-time record highs in US Dollars. In trading on Monday, the US$2,350/oz barrier was breached with a high of ~US$2,356/oz recorded. Despite these positive price moves, global mining stocks have been lagging. ABSI this week will address the divergence between gold stocks and the underlying commodity.

It is an understatement to say that Gold has been having a stellar run over the past 6 months. At the start of October 2023, gold hit a low of ~US$1,825/oz but has since rallied aggressively to a recent all-time high of ~US$2,354/oz, a 29% gain. These are big moves in the safe-haven asset, which typically trades in a tight range.

Source: Market Index

Traditionally gold hasn’t performed in higher interest rate environments due to the cost of carry, meaning it costs an investor to hold gold and doesn’t pay any income. The initial rally in the precious metal was based on indications from the US Fed that interest rate cuts would be imminent, thus reducing the cost of carry for gold. However, these cuts are looking less likely as inflation remains sticky and the US economy continues to steam ahead.

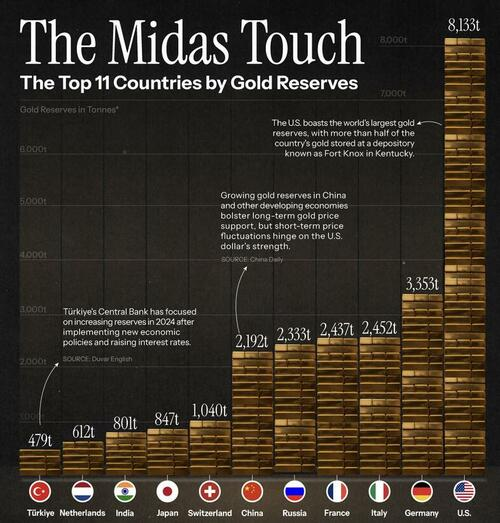

What appears to be fueling the gold price are a number of factors including persistently high inflation, geopolitical risks in Ukraine and Gaza, greater central bank demand off the back of de-dollarisation, and a greater focus on the debt spiral in US federal debt, which is increasing ~US$1 trillion every 100 days.

Source: Zero Hedge

Source: Zero Hedge

Despite the record highs and positive tailwinds for gold, this isn’t fully transferring to the stock price of gold miners. To start, I will note that I am talking about the sector in general and that there are individual gold miners who have performed extremely well and poorly over the past 6 months due to unsystematic factors (stock-specific).

The Visual Capitalist recently noted the divergence in the gold price and mining stocks in the US. They note that amongst the largest gold companies, Newmont (NYSE: NEM) has experienced a 24% drop over the past year, while Barrick Gold (NYSE: GOLD) has also declined 6.5% in the same period.

Source: Visual Capitalist

Looking at the ASX All Ords Gold Index (ASX: XGD), the performance over the past month has been strong at 11%, however, taking a wider 2024 YTD and 1-year view shows gains of only 5.2% and 6.2% respectively. Large gold producers such as RED 5 (ASX: RED) and Emerald Resources NL (ASX: EMR) have been the best performers, up over 100% each over the past 12 months. At the other end of the spectrum, larger gold producers such as Tietto Minerals (ASX: TIE) and Alkane Resources (ASX: ALK) have experienced negative returns over the past 12 months.

It is difficult to determine where the price of gold will go over the next 12 months. However, with the price currently trading higher than A$3,500/oz, there is no better time to own gold miners who are able to capitalise on the current price action in the commodity. With over 200 companies exposed to gold, the ASX is a great hunting ground to find the gold producers capable of extracting the most benefits from the latest gold rush.

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer. Sign up and join the game!

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link