Jack Colreavy

- Apr 18, 2023

- 4 min read

ABSI - Gold: The Resilient Safe Haven of 2023

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

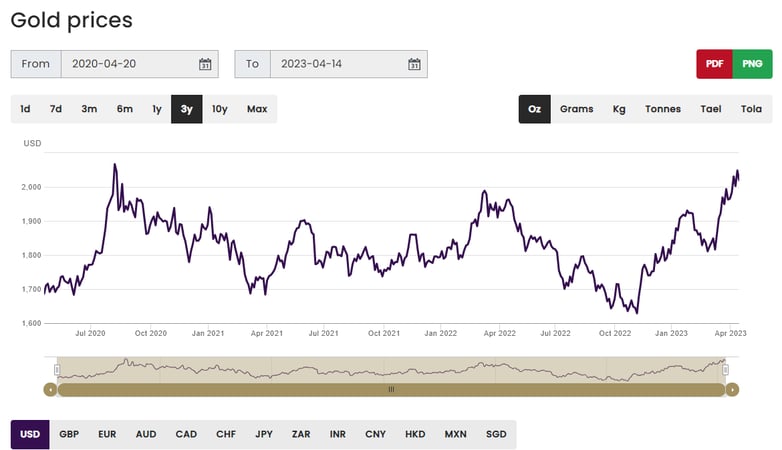

In a somewhat volatile 2023 year-to-date gold has been a sparkling safe haven for many investors with the precious metal trading above US$2,000 and not far away from its August 2020 all-time high of US$2,069.40. ABSI this week takes a look at the forces propelling gold higher.

It’s no secret that gold is a monetary asset, it has been for thousands of years due to its rarity and durability making it the best store of value. This essentially makes gold a form of currency so when you see the gold price appreciate it's a proxy for investors moving away from fiat currency and into a hard asset. Importantly, central banks hold gold reserves as a way to protect their currencies from fluctuations in the value of other assets.

Source: Gold.org

At time of writing, gold is trading at ~US$2,009/oz which is a ~22% increase since its previous low of ~US$1,630 in Nov 2022. The most likely factor for the price surge would be the flight to safety spurred by several bank failures over the past month. But it is more than with other tailwinds flowing from the potential for lower bond yields, probability of recession, a weaker US dollar, persistent inflation, and central bank net purchases of physical gold.

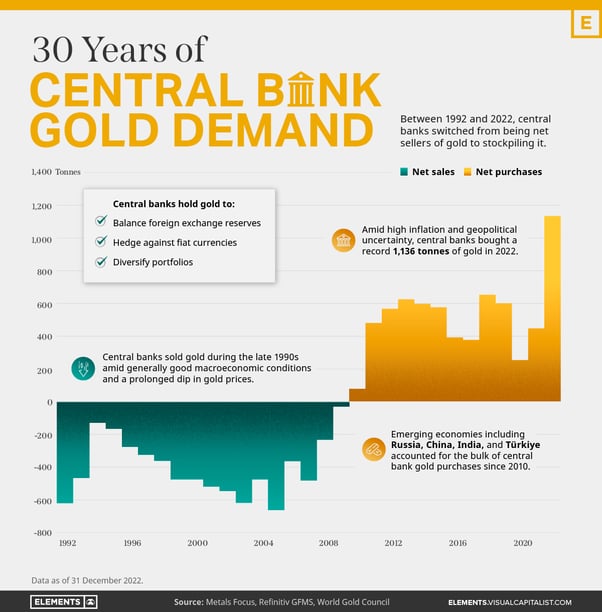

The most interesting of these tailwinds is the record purchasing of physical gold by central banks as I believe it speaks to the de-dollarisation trend discussed in last week’s edition of ABSI.

Source: Visual Capitalist

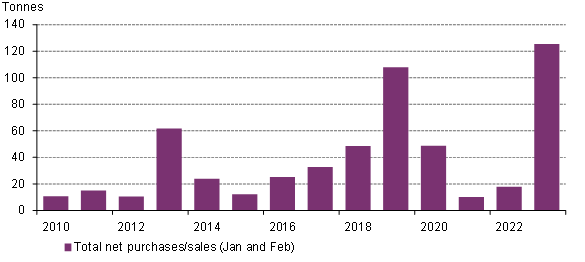

One-fifth of all gold mined is held by central banks and that volume of ownership is set to continue to rise. In 2022, global central banks added a record 1,136 tonnes of gold worth ~US$70 billion to their balance sheets. Continually, in January and February 2023 another net 74 and 52 tonnes respectively were added to balance sheets, according to data from World Gold Council. Türkiye has been the largest accumulator, officially, due to the country battling rampant inflation of up to 85% in 2022. I say “officially” before because Russia is excluded from this list and it is speculated that China grossly under-reports its purchases after only resuming official reporting in November 2022 after a ~3 year absence. It is thought that several thousands tonnes of gold is held “off the books” in an entity called the State Administration for Foreign Exchange (SAFE).

Central Bank Demand in Jan/Feb - Annual

Source: World Gold Council

It is important to appreciate that central banks haven’t always been buyers of gold. During the 1990s and early 2000s they sold their gold due to a downturn in the gold price and strong economic growth. However, since the 2008 GFC attitudes have changed and central banks are accumulating the asset as a store of value against other volatile fiat currencies.

It is difficult to definitively say the reason for the uptick in the gold price so far in 2023, namely because there isn’t one such reason. While the fears of a banking crisis are fading, the gold price remains elevated due to the US dollar’s weaknesses stemming from inflation, recession fears and the impending debt ceiling issue coming to a head in June or July. From a central bank perspective, it is clear that there is a growing desire to diversify portfolios away from fiat currency, particularly US dollars, and protect against continued inflation.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link