Jack Colreavy

- Mar 7, 2023

- 4 min read

ABSI - Increasing the Supply of Lithium in Australia

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

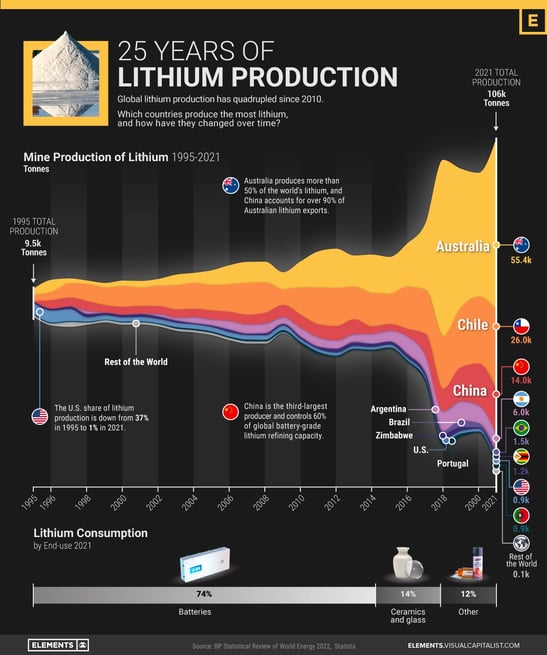

Critical to the global transition to zero-carbon renewable energy are the critical minerals required to build the required infrastructure. Lithium is the metal that gets the most exposure due to its necessity for current battery technology. Australia is the largest producer of the raw lithium mineral but has a negligible impact on the refinement process which is dominated by China. ABSI this week looks at Australia's plans to move up the supply curve in lithium.

Lithium is a soft, silver-white, highly reactive metal that belongs to the alkali metal group and is the lightest metal. Lithium is a highly reactive element that can quickly react with water or air giving it versatility across many industrial applications, including in the production of ceramics, glass, lubricants, and batteries.

It is important to appreciate the range of methods for extracting lithium from the ground, including:

- Brine mining - pumping underground brine (saltwater) into evaporation ponds where the water evaporates and leaves behind lithium salts. Commonly used in South America, where there are large salt flats with high concentrations of lithium.

- Hard rock mining - extracting lithium from rock formations, such as spodumene, which contain high concentrations of the metal. Australia and Canada are where hard rock deposits are more common.

- Geothermal extraction - utilising geothermal energy to extract lithium from brine. This method is still in the experimental stage and is not widely used. Vulcan Energy Resources (ASX:VUL) is a listed entity attempting to pioneer this method in Germany.

- Hydrometallurgical processing - chemicals and water are used to dissolve lithium from the ore. The resulting solution is then treated with additional chemicals to remove impurities and increase the concentration of lithium. Finally, the lithium is recovered by precipitation or crystallisation.

- Pyrometallurgical processing - heating the ore to high temperatures to melt and separate the different components. The resulting molten metal is then refined to remove impurities and increase the concentration of lithium.

- Electrolytic processing - dissolving the ore in a solvent and then passing an electric current through the solution. This causes the lithium ions to move towards the negative electrode, where they can be collected and refined.

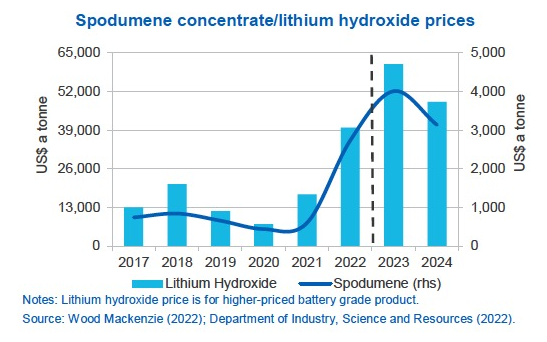

Australia is the largest producer of lithium in the world, accounting for over half of the world’s production in 2021, however virtually all it is exported to China in its raw form for refinement to battery grade hydroxides. In 2022, the average spodumene price was US$2,730/t but lithium hydroxide averaged US$39,900/t and the Australian government forecasts this to increase in 2023 to US$61,200.

Source: Mining.com

Leaving this much value on the table is why the Australian government and business are making a push into lithium refinement in Australia. Through the support of the A$1.3b Modern Manufacturing Initiative (MMI), refineries are being planned by Wesfarmers (ASX:WES), Mineral Resources (ASX:MIN), and Liontown Resources (ASX:LTR). Australia’s first refinery, Kwinana - a JV between Tianqi and IGO (ASX:IGO), commissioned first production in May 2022 and is ramping up capacity to 24 tpa. If all plans progress on time, it is forecasted that Australia will capture 10% of the market by 2024, and 20% by 2027.

A boost to these refinement plans is the USA’s Inflation Reduction Act (IRA) which grants tax credits on EVs where 50% of material have been produced in the US or one of its free trade partners. Japan and South Korea, both large battery producers, have also earmarked Australia for further investment to lock in critical supply.

All this investment is catapulting lithium up the Australian export ladder, putting it on track to surpass beef and wheat as the country’s fifth biggest export. It is forecasted that total exports will reach A$13.8b in FY23, a 10x increase but still pales in comparison to Australia’s biggest export, iron ore. And therein lies the holy grail for Australia, harnessing modern green manufacturing practices for the smelting of steel rather than exporting iron ore.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link