Jack Colreavy

- Mar 14, 2023

- 5 min read

ABSI - SVB's Fall From Grace: A Wake-Up Call For The Banking Industry

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

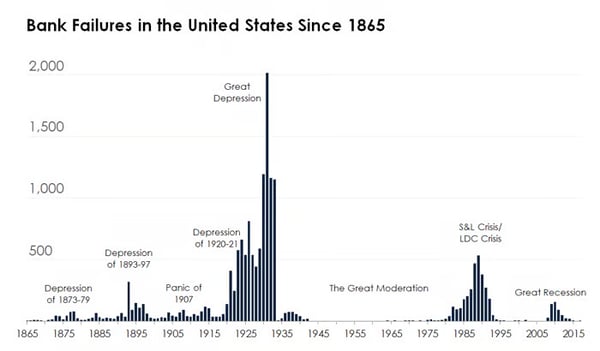

Silicon Valley Bank (SVB) is currently the world’s most talked about banking institution due to its collapse last week in the US. The fallout has the market fearing contagion effects as the entire banking system is called into question. ABSI this week breaks down the chaos and our views on the risks moving forward.

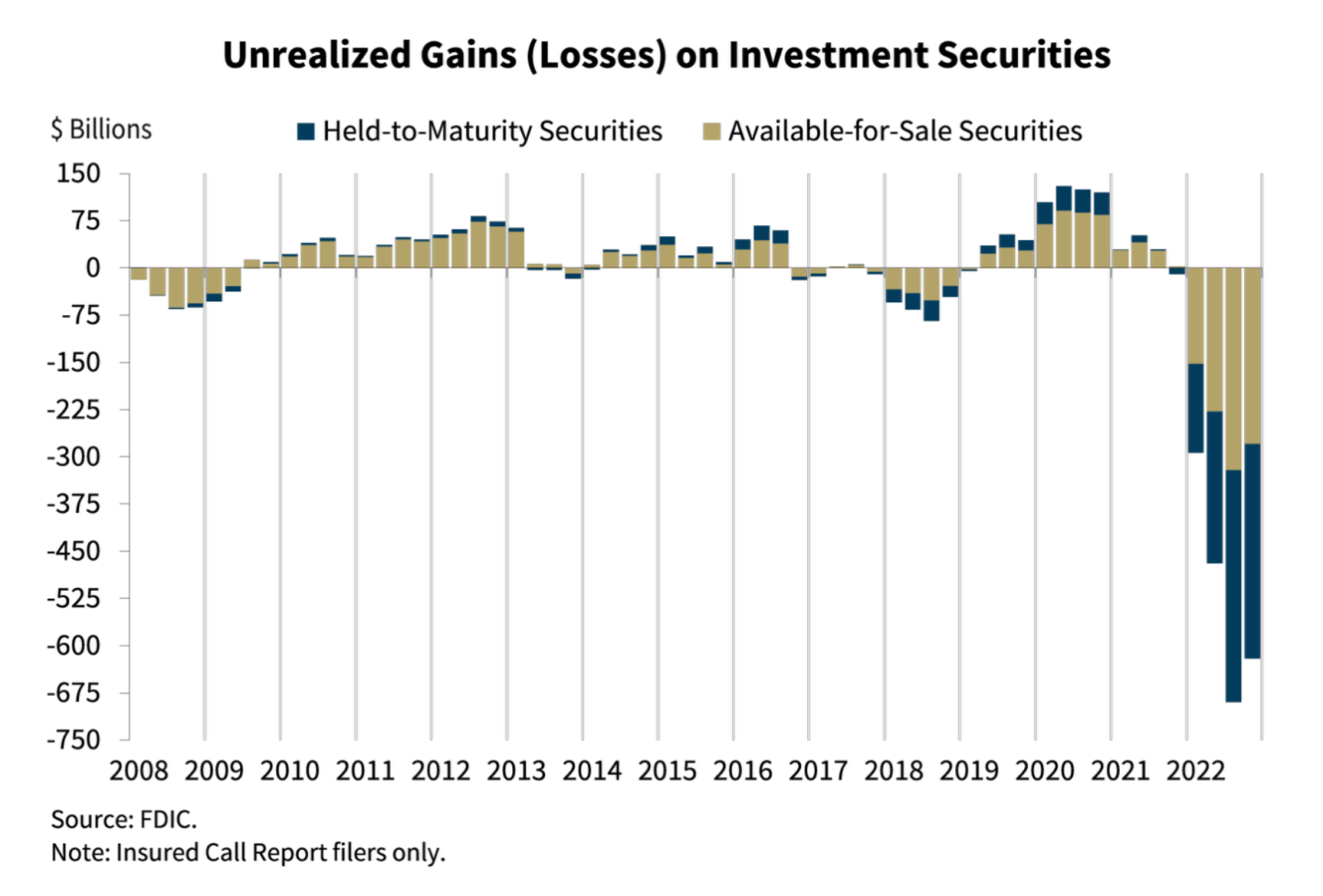

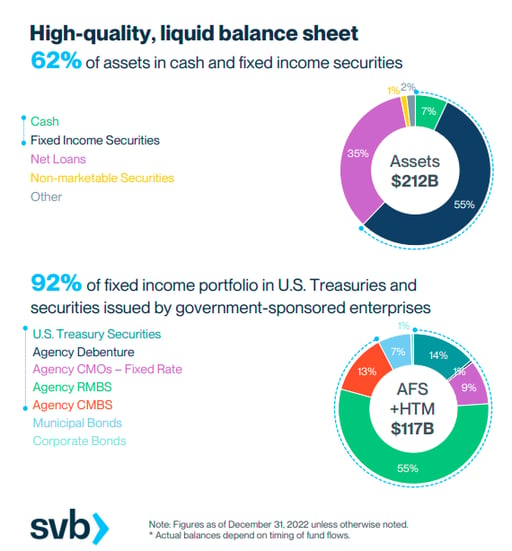

Last Friday, the 18th largest bank in the US, SVB with ~US$212 billion in assets, collapsed leaving ~US$173 billion in deposits at the mercy of the Federal Deposit Insurance Corporation (FDIC). In a nutshell, the collapse came as a result of a bank run that was sparked by the large losses realised in its Available for Sale (AFS) assets and unrealised losses on its Held to Maturity (HTM) assets. In the US, banks guarantee balances of up to US$250,000, meaning that any deposit above that limit becomes a creditor in bankruptcy proceedings.

Source: Fortune

Naturally, there has been significant panic in the market as depositors of SVB worry how they will make payroll and other business expenses while they wait for the rest of their funds. Meanwhile, every bank account holder in the world is now closely scrutinising the health of their banking institution and wondering if they could fall into the same peril.

Unfortunately, the initial response from regulators was that insured funds would be available Monday and uninsured funds would receive a creditors certificate. Rightfully this caused a market-wide panic and even resulted in the failure of another US bank, Signature Bank in New York with ~US$82 billion in deposits.

Thankfully the regulators moved quickly over the weekend to stem the bleeding by announcing that all depositors will have full access to their funds on Monday at both SVB and Signature Bank. Additionally, they launched the Bank Term Funding Program (BTFP), which are 12 month loans collateralised by specific bank securities, such as treasuries, valued at par not market. The market reaction was modestly positive and there is hope that contagion will be minimal from here, however, it remains to be seen if it will prevent further runs on smaller banks.

There has been a lot of Monday-morning quarterbacking on this topic but I wanted to focus this article on the how and what needs to change. Banking is a cornerstone industry in our modern society and being a profitable bank is a difficult task. Banking involves holding on-demand deposits of customers, labelled as a liability on its balance sheet, and making profits on those deposits through investments, largely loan origination. The difference between the interest earned on loans and the interest paid to depositors is the Net Interest Margin (NIM).

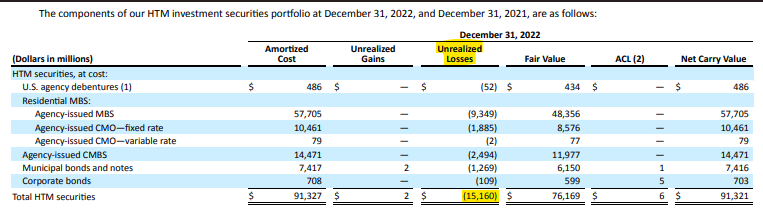

Ultimately it was a bank run that sank SVB, but a bank run ensues when the customers perceive risk to the institution's financial viability. It is important to appreciate that SVB followed the capital adequacy regulations and therein lies the problem. SVB held ~US$12b in paper equity on ~US$200b of liabilities with assets comprising ~US$82b in HT mortgage-backed securities, ~US$55b in liquid AFS, and ~US$74b in risky loans to clients (primarily VCs). According to the regulatory requirements, the AFS and loans needed to be held at fair value but the HTM assets could be held at cost. In SVB’s December 2022 quarterly results, given the fast rise in interest rates, it was disclosed that these HTM assets held unrealised losses of ~US$15b which would completely wipe out the equity cushion of ~US$12b. As a result, the bank attempted to restructure its balance sheet by selling ~US$21b in AFS assets, at a ~9% loss to book value, and to raise equity by selling newly issued shares. These actions spooked customers, mostly VCs and their silicon valley tech investments, and sparked a lemming-like run on the bank.

Source: SVB10K

HTM securities are the genesis of the problem. If they were marked to market, like the rest of the assets, regulators and other stakeholders would have a better view of the true capital adequacy of a bank and the institution would’ve been forced to improve the balance sheet or close down with a sufficient equity buffer to cover all depositors. Without a doubt, there will be some regulatory changes coming for the US banking system. A good start would be to move away from their own requirements and comply with the Basel III framework.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link