Jack Colreavy

- Feb 27, 2024

- 5 min read

ABSI - The Woolworths Witch Hunt

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

They say all publicity is good publicity, but tell that to Woolworths CEO, Brad Banducci, who has had himself and the Woolies name dragged through the mud on accusations of price gouging Australian consumers during a perilous cost-of-living inflation crisis. This culminated last week with the 8-year CEO handing in his resignation to the board of directors and “retiring”. The supermarket industry is concentrated in Australia but it is taking advantage of a crisis and unfairly raising prices to line the pockets of executives and shareholders. ABSI will aim to set the record straight this week.

Most would’ve seen the Four Corners footage last week of Brad Banducci getting flustered in an interview when pressed on the issue of supermarket competition in Australia. The moment was the pinnacle of what has been a tough month or so for Woolworths and Coles, who are being railroaded with accusations of using their duopoly to price gouge consumers.

Is this really true or are politicians using supermarkets as a scapegoat for their failures in the fight against inflation?

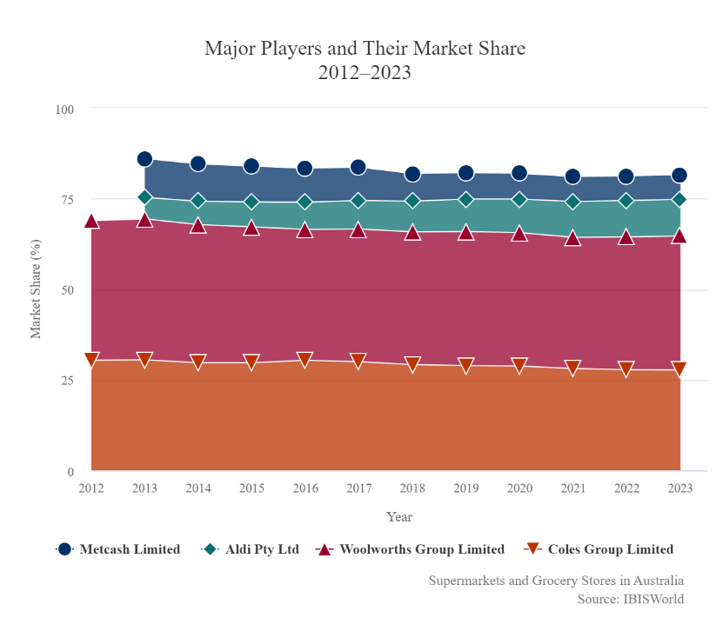

To start, let's look at the market concentration of supermarkets in Australia. According to industry research, the Australian grocery market is worth A$135b and four retailers control 80% of the market. Woolworths is the market leader with 37%, Coles 28%, Aldi 10%, and Metcash 7%. At a combined 65% market share, many consider the market to be a duopoly but most definitions ascribe a 70% combined market share to a duopoly. The Australian market is an oligopoly with Coles and Woolies losing market share over the past 20 years thanks to the entrant of new players such as Aldi and Costco.

Source: Hunt Export Advice

Furthermore, Australia has a small population, especially on a density basis, which limits the amount of competition in the marketplace; we see this in aviation, banks and mining as well. If you look at the USA, for example, you see that 6 companies make up the top 50% of market share but this is still dominated by Walmart which controls 25.2% of the market in 2022. Moreover, at an estimated market size of US$810b, a 4% market share would be the equivalent of Woolworths market share in Australia.

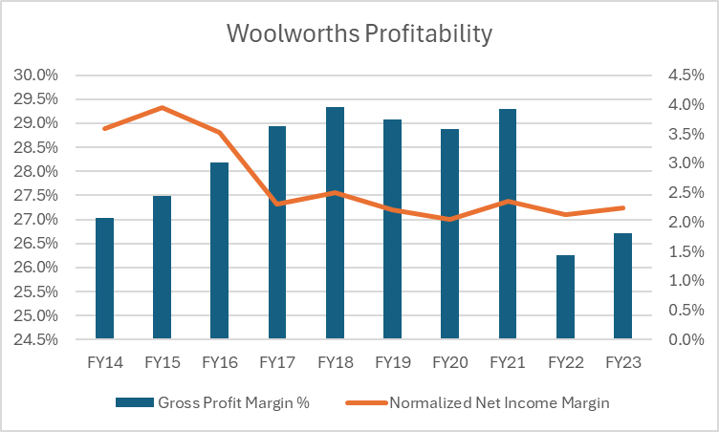

Market share is one data point but what really matters is profitability. Excessive profit margins are the true litmus test of whether a company is exploiting market share. Importantly, the focus should be on the margin, not the absolute number as that fails to account for inflation. Taking a look at Woolworths profitability shows a 10-year average gross profit margin (revenue minus cost of goods sold) of 28.1%, EBITDA margin of 6.5% and a normalised net profit margin of 2.7%. Critically, these margins are shrinking as more competition enters the market. In FY15, Woolies posted a gross profit and net profit margin of 27.5% and 4% respectively while in FY23 this was 26.7% and 2.2% respectively.

Source: Woolworths Annual Reports

In my opinion, these are not the profit margins of a duopoly or one gouging profits. If we compare profitability to Walmart, it operates on a 10-year average profitability of 24.9% gross margin, 6.5% EBITDA, and 2.4% net profit. While less than Woolworths, the difference is small and the USA is a substantially bigger market. If you want to know what excessive monopolistic profit margins are, take a look at NVIDIA’s most recent earnings which puts gross profit margin at 72.7% and net profit margin at 48.9%.

If supermarket profit margins are not the cause of sticker shock at the checkout, then what is?

The answer is simply inflation.

Inflation has permeated throughout the economy and is proving quite sticky. It started with pandemic helicopter money and an energy crisis but this has now filtered through the economy to wage growth. A recent AFR freedom-of-information inquiry into Treasury analysis found that labour costs made up almost two-thirds of headline CPI in the 12 months to June 2023. It also recognised import prices, due to the weak Aussie dollar, as a key contributor.

The Australian Senate is currently conducting an enquiry into grocery prices, led by Greens Senator Nick McKim, with a report due in May. I doubt anything serious will eventuate from such an affair but it does highlight the balancing act that some Australian brands, such as Woolworths, Qantas and Commonwealth Bank, face in keeping shareholders and stakeholders happy. Nonetheless, I would say it’s a dangerous time to be making a profit in Australia, even if it’s a paltry 2.2% of your revenue.

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season is set to kick off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer when announced. Until then, sign up and get tipping for Round 1.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link