Jack Colreavy

- Sep 13, 2022

- 5 min read

ABSI - UK's July GDP Figures

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

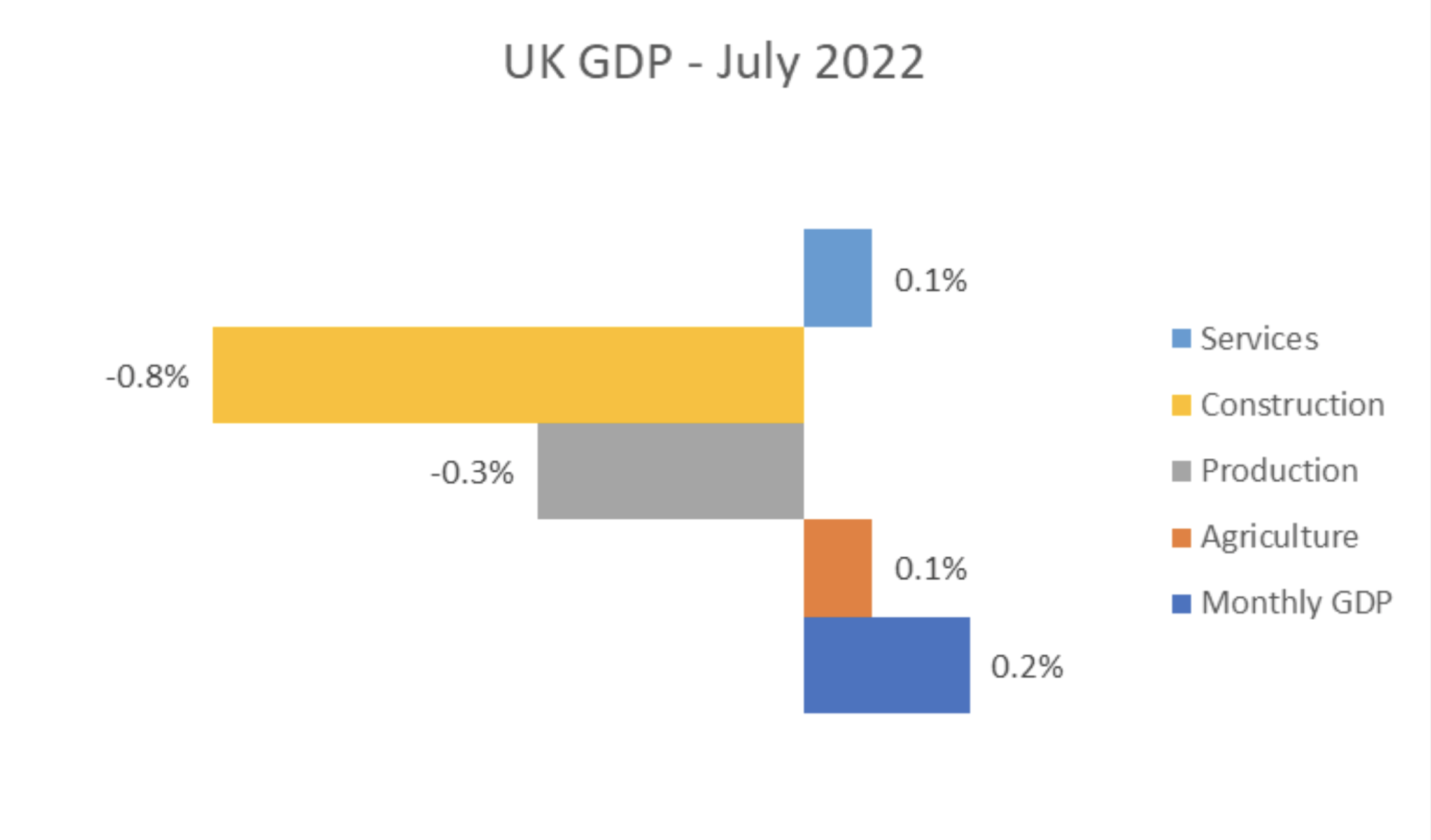

British July GDP figures were released yesterday, eking out a 0.2% increase to rebound from the 0.6% decline in June. However, the result was disappointing considering that June had two fewer working days due to Platinum Jubilee celebrations and July had the benefits of the Commonwealth Games and Women’s Euro tournament to buoy tourism. As the economy heads into winter, with no end in sight for the energy crisis, the outlook is bleak for GDP growth for the rest of 2022. ABSI this week reviews the latest GDP results from the UK and extrapolates what it might mean for the year's remaining growth.

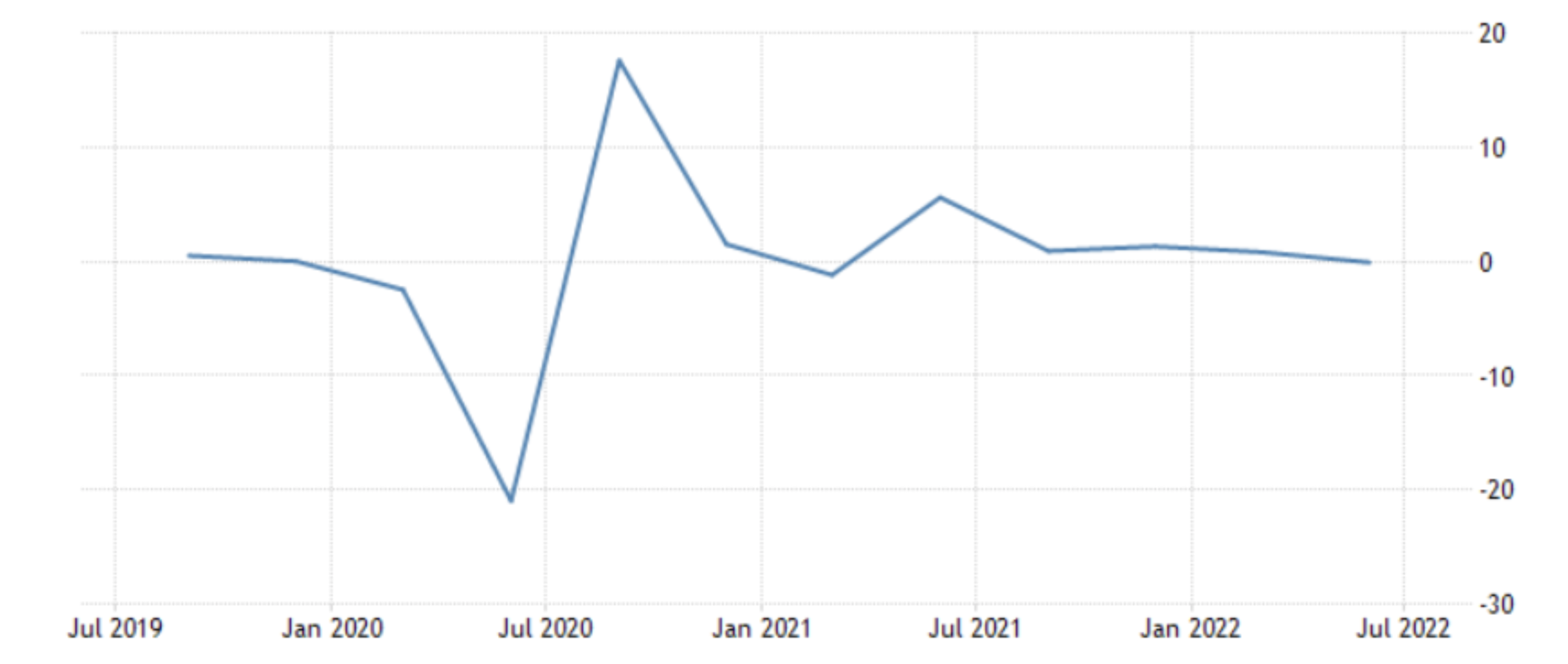

Unlike in Australia, British GDP figures are released monthly by the Office for National Statistics, and the consensus for July was for a rebound in growth of 0.4%. The result means that the UK economy has been the same size for the past 6 months and only 1.1% above pre-pandemic (Feb 2020) levels, as the cost of living crisis and monetary tightening is squeezing the life out of economic activity.

UK GDP Growth Rate

Source: Trading Economics

Combing the data, the services sector was the biggest contributor, adding 0.4%, driven largely by an increase in IT services. Concerningly, the largest detractor to the services industry falls in advertising and architecture. It then comes as no surprise that the biggest sector fall came from the construction sector which shrank 0.8% in July, adding to the 1.4% lost in June. The other major sector losses from the production industry (-0.3%) are due to a 3.4% decline in energy supply.

Source: BPC, ONS

Like most developed nations, the UK is going through the economic pain of high inflation and tightening monetary policy. In July, inflation hit 10.1% while the Bank of England continues to aggressively tighten interest rates in response. Currently, rates are at 1.75% with the market pricing in another 75bps hike in Sept. Interestingly, there has been a reprieve for those exposed to higher rates with the BoE postponing the interest rate decision until 22nd Sept due to the death of the Queen. Moreover, with August inflation figures due on Wednesday, the result will sway the decision in either direction depending on the outcome. Having said that, if the Netherlands is a barometer (12% in August from 10.3% in July) then a hike of 75 bps is all but guaranteed and 100bps will move into the equation.

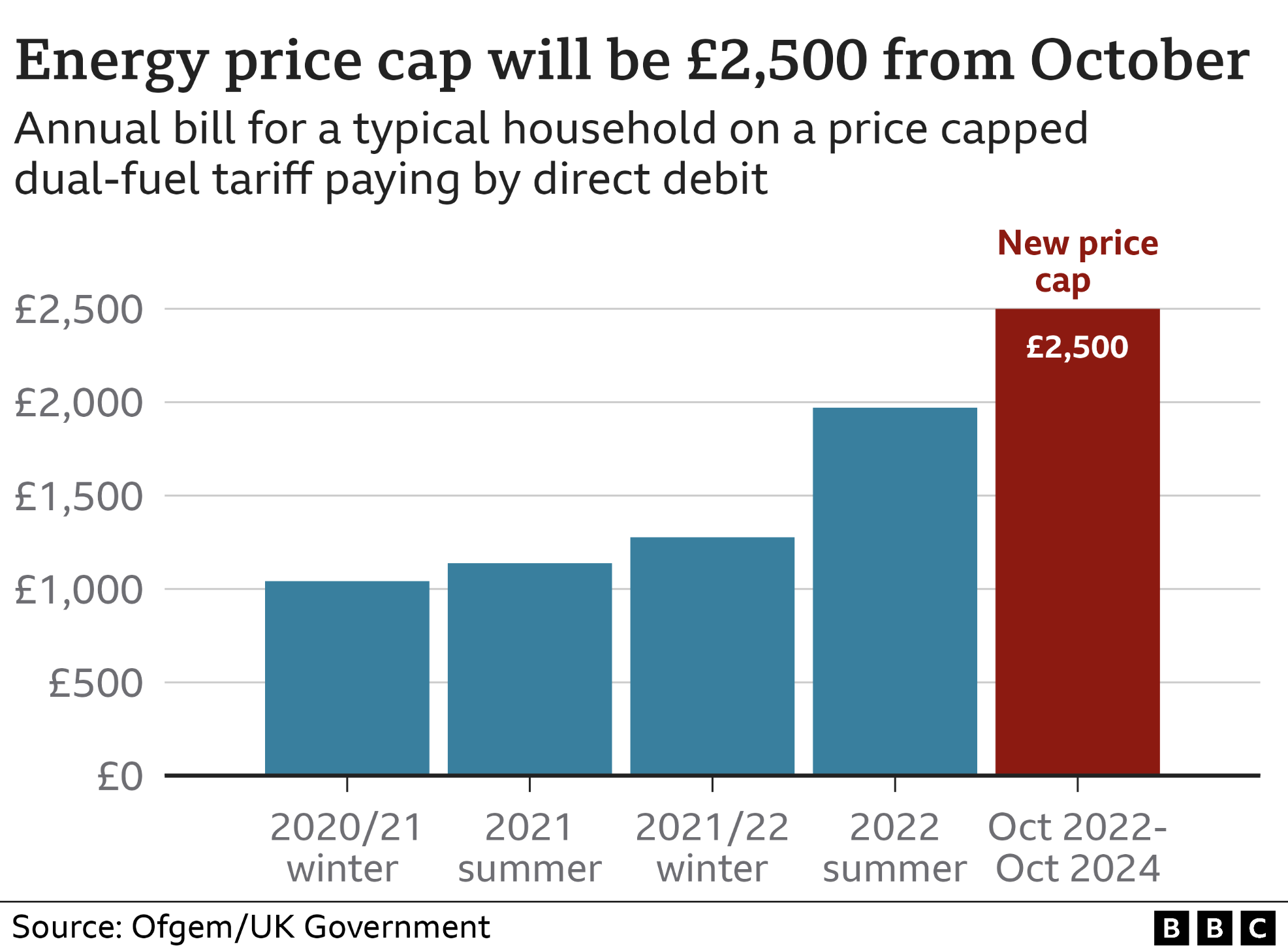

Source: BBC

The latest GDP figures paint a bleak outlook for the UK. The failure to snap back from a disappointing June suggests that there is little momentum in the economy and the headwinds will only get stronger for the rest of 2022. The biggest concern will be energy supply as the colder weather starts to hit and the price cap on power bills increases by almost £2,000 on October 1st. This has resulted in forecasts above 22% by leading investment banks. Thoughtfully, new PM Liz Truss has floated a policy to cap all UK power bills at £2,500, but all this policy will do is fail to change consumer behaviour, i.e. reduce energy demand, and raise the prospects of blackouts or energy rationing which will further curtail productivity and add potentially over £100 billion to the UK national debt.

Read the Conversation:

Jack Colreavy:

“The UK released their July GDP figures yesterday, and while the number was positive, it was only 0.2% and economists were looking for a bigger rebound from the 0.6% decline in June, especially considering the Commonwealth Games was on and the Women's European soccer Tournament would've avoided tourism.

However, the construction sector, which lost 1.4% in June continued to really drag on the economy shrinking. Point eight. The production industry also declined 0.3% due to a 3.4% decline in energy. So what this is saying is that the energy crisis facing Europe at the moment and the tightening of monetary policy, is having this combined effect of really dragging back the economy.

And it's likely that the UK will enter recession, especially as we hit the winter months with no sign of the energy crisis being solved. To learn more, please subscribe to, As Barclay Sees It, by clicking the link in the description.”

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link