Jack Colreavy

- Feb 21, 2023

- 4 min read

ABSI - What is Renewable Hydrogen? EU's New Rules on Green Energy

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

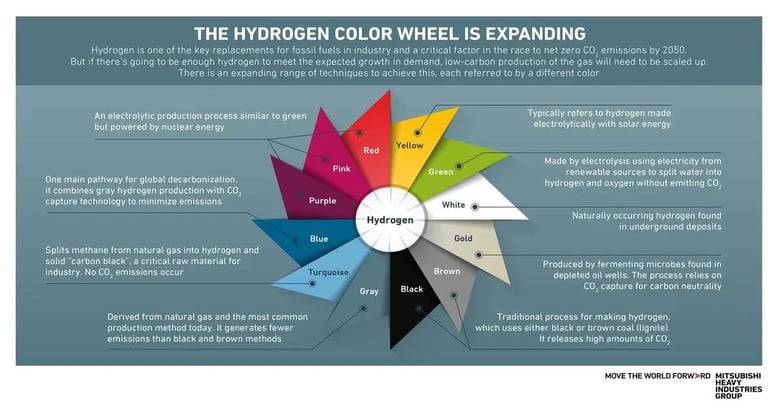

By now most people would be familiar with hydrogen and the “hydrogen rainbow” that has sprouted to distinguish between the many sources in which hydrogen can be produced. Given the numerous sources, major questions plaguing the industry focus on how consumers can distinguish between the colours when buying hydrogen and what exactly is the definition of green hydrogen? Last week, the EU helped set the standard by releasing rules on what constitutes “renewable hydrogen”. ABSI this week takes a look at this definition and what it may mean for hydrogen production in the EU.

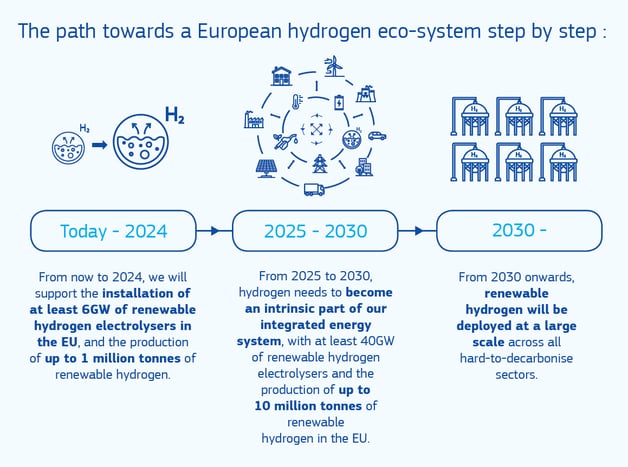

Long overdue, and as part of a EU regulatory framework for hydrogen, the European Commission released detailed rules defining renewable hydrogen as part of their target for 10 million tonnes of domestic renewable hydrogen production and 10 million tonnes of imported renewable hydrogen as set out in their REPowerEU plan. The rules outline three levels used to determine if hydrogen is “renewable”.

The hydrogen color wheel

Source: Mitsubishi Heavy Industry

The first level is a direct connection between traditional renewable energy, solar and wind, and an electrolyser. This is seen as the easiest way to classify renewable hydrogen, however, it is expensive and time consuming so the EU has built in flexibility mechanisms to encourage new supply faster. The second level is a grid connection to a “green” grid with a corresponding offset through a renewable PPA; definition of a green grid being less than 18g of GHG per 1kWh. The third level is direct power-purchase agreements (PPAs) with renewable energy infrastructure that isn’t hooked directly to the electrolyser. However, there are some important caveats to this method.

The “additionality” clause requires that hydrogen facilities are not drawing power from existing renewable energy infrastructure that would result in increased fossil fuel usage elsewhere. Renewable hydrogen needs to be made from new wind and solar assets. Noteworthy, this won’t be enacted until 2028 and there are some exemptions in place.

Critically, there is also a matching system for the audit whereby renewable hydrogen producers need to match their production with renewable energy on a monthly basis. While, eventually this matching system will be done on an hourly basis, there is a lot of criticism with the monthly arrangement as it opens the door to greenwashing because the energy going into the electrolyser isn’t necessary green but it would be considered green if the ledger is squared by the end of the month.

The path towards a European hydrogen eco-system step by step

Source: H2GreenTECH

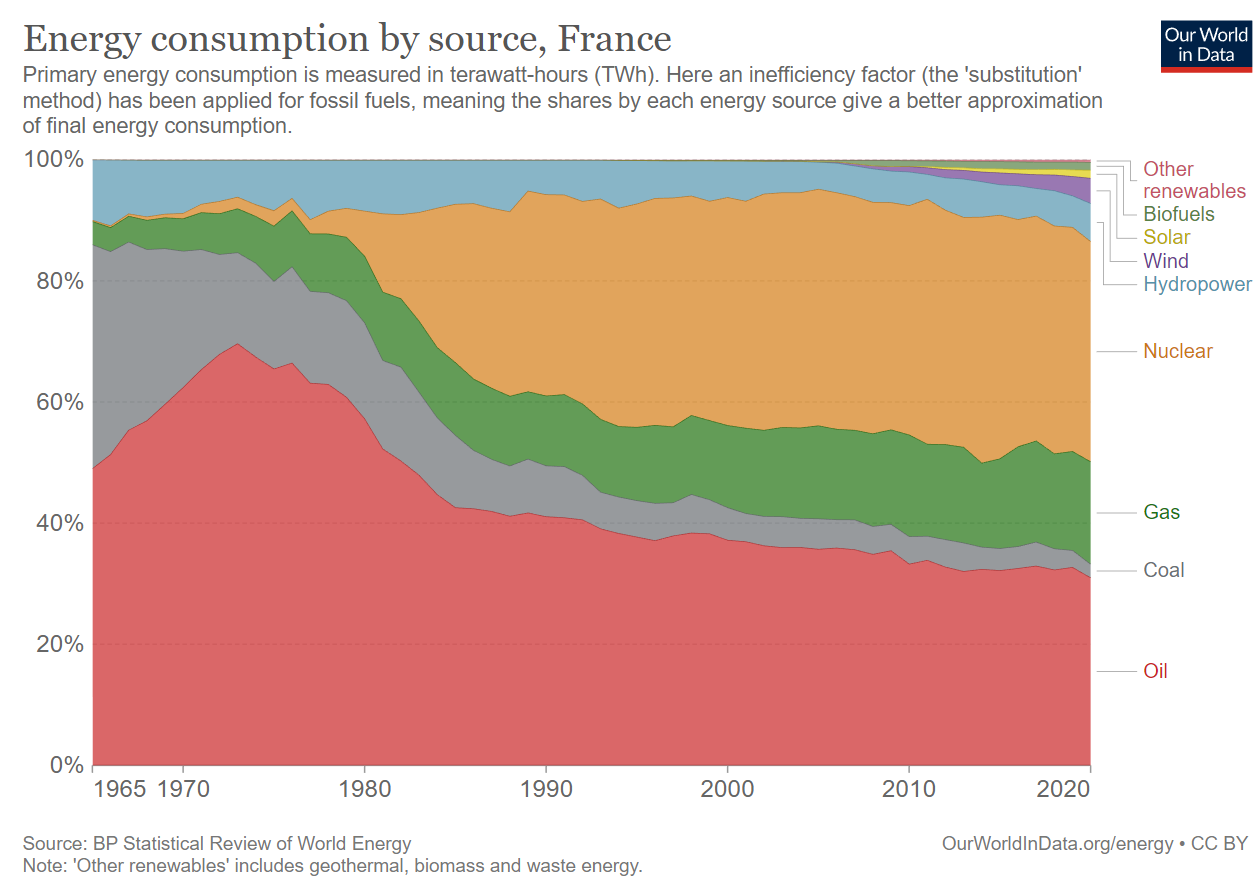

One of the reasons for the delay in defining the rules is due to the politics between the various countries in the EU. Specifically, Germany and France had several disagreements on the contribution of nuclear energy to the equation with the Germans being steadfast in nuclear not being renewable. Ultimately France won the initial bout with the inclusion of the “greed grid” mechanism allowing their nuclear powered grid to produce renewable hydrogen.

Energy consumption by source, France

Source: Wikipedia

As expected, the feedback to these rules has been mixed. Proponents are happy that the definitions are falling into place which enables clarity for investors to accelerate project development. In contrast, detractors focus on the issue that renewable energy may be redirected from one sector to another due to the exceptions in the “additionality” clause. Renewable energy is best utilised directly by the grid with hydrogen acting as a storage mechanism. If renewable energy is directed away from households to electrolysers and the households need to source that deficit from fossil fuels, then it isn’t providing a solution to the carbon problem.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link