Jack Colreavy

- Oct 10, 2023

- 6 min read

ABSI - Financial Markets on Edge:Israel-Hamas Conflict and US House Speaker Shakeup

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

I think the last seven days have revealed some of the most important new stories to affect financial markets over the entire year. ABSI this week will focus on the two stories which have the potential to create material ripples in the months and years ahead.

I think the last seven days have revealed some of the most important new stories to affect financial markets over the entire year. ABSI this week will focus on the two stories which have the potential to create material ripples in the months and years ahead.

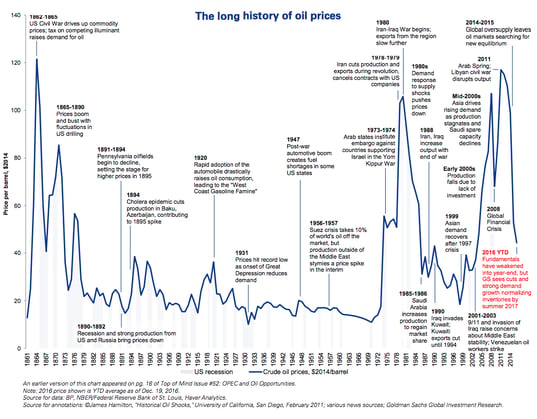

In a surprise act of violence compared to 9/11 and Pearl Harbour, the palestinian terrorist organisation known as Hamas, orchestrated a coordinated attack on Israel in the Gaza Strip and the adjacent border. In response, Israel PM, Benjamin Netanyahu, has officially declared war for the first time since the 1973 Yom Kippur War. The fact that these attacks occurred on the eve of the 50th anniversary is no coincidence, and while that war only lasted six days, it was the catalyst for the 1973 oil crisis which shut the Suez Canal for eight years and has been identified as a major contributor to the Great Inflation event of the 1970s and 80s.

The attack first occurred on the morning of Saturday 7th October (local time) and so far it is estimated that there have been over 1,000 fatalities, the majority being Israeli, as well as thousands more injured and many hostages taken. The Israel response has been to activate a complete siege of Gaza which includes cutting off all supply of electricity, fuel, food, and water to the ~3 million population in the strip. There is now great uncertainty as to what will happen next and if other parties join the fight, namely the Lebanese terrorist group Hezbollah.

Given the historical correlation, the most closely watched commodity in response to these attacks is oil. Already prices have risen modestly to trade at ~US$87.83 (3% higher) for Brent and US$86.07 ($5 higher) for WTI. Looking back at 1973, prices ended up almost 300% by the end of the embargo but there are several reasons for why the rise won’t be to that scale including that oil consumption growth has moderated, production is more diversified, and producers aren’t trying to boost prices materially higher.

Source: WEF

The black swan in this scenario though is the involvement by Iran in this event. Recently, the WSJ reported that Iran helped plot the attacks. If this proves to be true then this could be the catalyst for the oil price to spike over 50% to US$150 according to Alpine Macro. This would require an Israeli strike on Iran nuclear facilities, which is a 20% probability to them, but even a crack down on Iran oil exports could have a material impact on oil prices. Goldman Sachs analysts believe that every 100,000 barrel reduction in Iran production will add $1 per barrel to prices.

The second biggest story of the week was the removal of Kevin McCarthy from his role as Speaker of the US House of Representatives by rebel Republicans. This is especially notable because it is the first time in the history of the US government that this has occurred. The rebellion was led by congressman Matt Gaetz in response to the short-term spending deal passed the week prior to avert a government shutdown.

The reason for the importance of this event is that the US government hasn’t passed the required bills to fund all government services. A short-term deal was passed in early October but that will only fund the government until November 17. Without an official Speaker the House of Representatives has grinded to a halt until one is elected.

The conjecture for the inability to reach a resolution on US government funding is driven by the size of the budget deficit, the size of government debt, and the funding being allocated to Ukraine. In mid September the US debt topped US$33 trillion for the first time and it shows now signs of slowing down. Last week Treasury data showed a US$275 billion increase in US debt in a single day. Interest of the debt is approaching, or may have already breached, US$1 trillion annually and forecasts are for US debt to surpass US$50 trillion by 2033.

The straw that broke the camel’s back was the blank cheque being offered to Ukraine. To date, over US$100 billion in aid has been directed to help Ukraine fight the war against Russia. However, support for the war is waning and in the recent government funding negotiations, Democrats couldn’t get a scaled-back US$6 billion aid package across the line. European leaders fear that if the US withdraws its support, they will be unable to fill the void.

Contributions to real GNI per person growth (measured in percentage points)

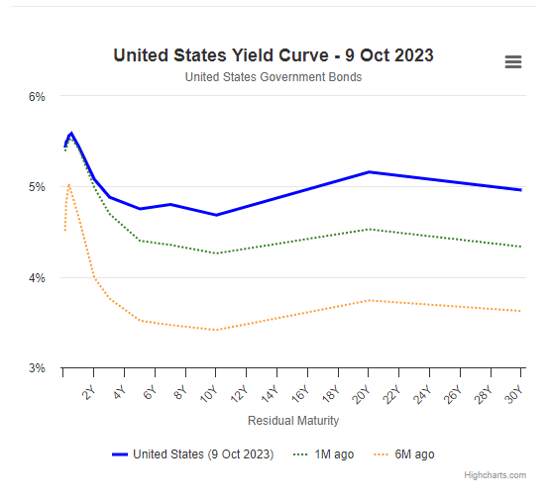

Source: World Government Bonds

Importantly, all this fiscal drama is playing out in the market for US debt. Over the past 6 months, all US government bonds have materially increased in yield. Of particular focus is the longer-dated 10y, 20y, and 30y treasuries which have seen their yields spike 127.2 bps, 142 bps, and 133.7 bps respectively making borrowing more expensive for the US government. While a loss isn’t recorded unless a bond is sold, bond prices are marked-to-market which cause paper-losses. Given the recent spike in yields, economists are fearing another wave of bank failures as paper losses wipe out balance sheet equity.

Circling back to the Speaker election, you may recall that McCarthy was only elected to the position in January after a monster 15 rounds of voting over the course of a week. This time round is shaping up to be longer.. At this stage two candidates have raised their hands for the position and internal closed-door elections will be held on Wednesday by the Republicans. While the war in Israel may help to expedite the vote, at the earliest it will be Thursday for a new Speaker to take the gavel, but, given the internal Republican fighting, I believe it is unlikely we will see the position filled until next week. This leaves ~30 days for a spending bill to be agreed to which will be no small feat. My money is on a government shutdown.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link