Jack Colreavy

- Nov 28, 2022

- 5 min read

Green hydrogen is needed to feed the world

Green hydrogen has come a long way in a short period of time, going from relative obscurity to being touted as the “swiss army knife” of the net zero future in only a few short years. However, like everything in life the molecule does have its critics who argue that electrolysis, the process of splitting water into hydrogen and oxygen using renewable energy, is an expensive and very inefficient exercise. These are criticisms that have their validity but there is one immediate business case for the production of green hydrogen that is untouchable - green fertiliser.

Rewind 3 years, a time before the invention of the hydrogen rainbow, the hydrogen industry was a ~US$142 billion/year industry with demand for ~91 Mtpa. The overwhelming majority of production was through steam reforming of fossil fuels, most notably natural gas. Moreover, the use was split primarily for the fracking of petrochemical wells and the production of ammonia for the eventual manufacturing of fertiliser.

Global Hydrogen Production by Technology

The importance of the fertiliser industry is difficult to overstate. Due to a growing global population, we just hit 8 billion today, and the diminishing yield on fertile soil, the demand for fertiliser is consistently growing. According to data from Statista, the fertiliser industry was valued at US$193 billion in 2021, a 12% increase from 2020, and is forecasted to grow at a CAGR of ~3% to US$242 billion by 2030.

Global Fertiliser Market Size

Source: Statista

In a back-of-the-envelope calculation, and without going into the precise chemical reactions of the steam reforming process using methane (aka natural gas), 1kg of hydrogen produces 9kg-10kg of CO2. Therefore it should come as no surprise that the fertiliser industry was responsible for ~1.13 GtCO2e in 2018, representing over 2% of global GHG emissions according to a Nature scientific report by Menegat et al.

Fertiliser Production Process

Source: Yara International

Herein lies the lowest-hanging fruit for green hydrogen production in the short term. Initial green hydrogen production should be prioritised for the fertiliser industry and not just for carbon emissions but to combat world hunger.

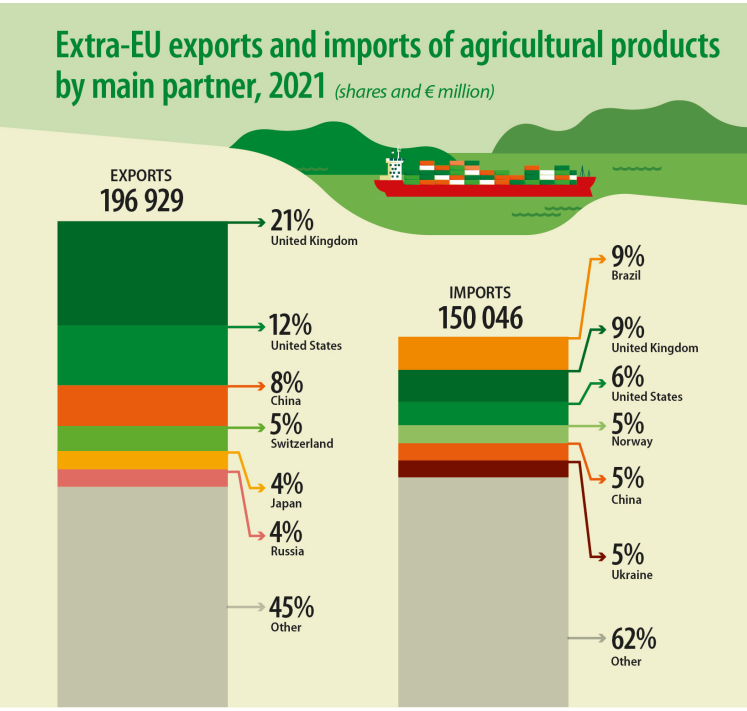

Recently, the UN World Food Program warned that 2023 will be another year of record hunger, which is due to a multitude of factors, but the shutdown of two-thirds of European fertiliser production, due to skyrocketing natural gas prices, will be a major contributor. The EU is an essential exporter of agricultural products, exporting almost €200 billion in 2021. However, given the shortage of natural gas due to the war in Ukraine, supplies are being rationed for winter and therefore there will be a massive shortage of fertiliser for EU farmers in 2023, resulting in lower yields and less food to export.

Source: Eurostat

Green hydrogen has been proposed for a multitude of applications such as gas turbines, fuel cell electric mobility, and green steel. Unfortunately, most of these applications require advances in technology, the mass construction of new infrastructure, or just have alternative emission-free competition. However, for fertiliser production, there is no viable alternative and given the importance of the industry to essential human needs, green hydrogen production for the fertiliser industry should be prioritised to feed the world.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link