Jack Colreavy

- Aug 15, 2023

- 5 min read

ABSI - Is the 2% inflation target about to be increased to 3%?

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

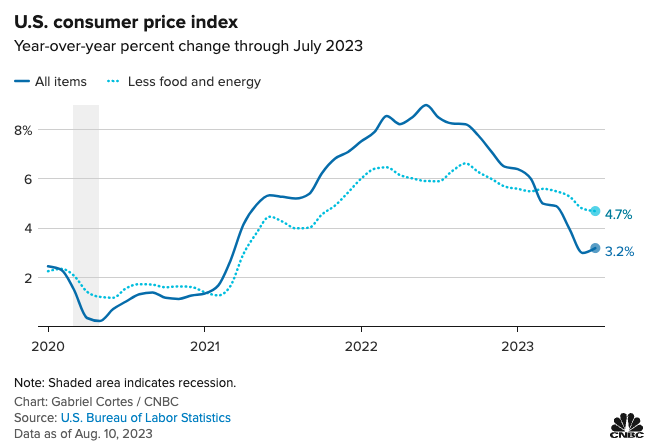

US monthly CPI data was released last week which showed the first uptick in the annual inflation rate since June 2022. However, markets shrugged off the increase of 3.2% due to the result beating market consensus of 3.3%. Others pointed to the 0% base-effect from July 2022 as the reason for the uptick and that consumers shouldn’t be worried about inflation resurging again despite the Fed's tight monetary policy stance. However, while things rarely run in a straight line, the result has prompted pundits to comment that a 2% inflation target is unrealistic and the Fed should increase it to 3%. ABSI this week assesses these claims.

Over the past 12-months in the US, prices have risen by 3.2% on an absolute-basis and 4.7% on a core-basis (the exclusion of volatile items such as energy and food). This is a great result considering that 12 months prior the CPI rate was 8.3%, however, the result wasn’t as rosy if you consider that last month inflation was at 3%. The result demonstrates that significant progress has been made but getting down that last ~1% to the target rate of 2% will be excessively difficult.

Source: CNBC

Interest rates in the US, like in large portions of global economies, are at multi-decade highs. When the US Fed met last month, they raised rates from 5.25% to 5.5% as they believed rates needed to be higher in order to achieve a CPI target of 2%. The feverous discussion within markets is at what level will that be or is it even achievable without completely blowing up the economy?

It is important to appreciate that most global central banks have a stated mandate or outline of objectives. Australia and the US have very similar mandates in that they’re tasked with the economic prosperity of their constituents through the maintenance of full employment and the stability of the currency. Monetary policy is the only real tool available to achieve this mandate but it can prove to be an effective lever to influence consumer and business economic decisions.

Importantly, a CPI goal of 2% is never explicitly mentioned in the stated objectives which are underpinned by the legislation of the Reserve Bank Act 1959 (Australia) and the Federal Reserve Act 1977 (USA). The respective boards implemented the current 2% targets under the economic theory that too much inflation is bad but also disinflation can be catastrophic to economic prosperity. In the US, the Fed explicitly outlined a 2% target in January 2012, stating:

“The Committee judges that longer-term inflation expectations that are well anchored at 2 percent foster price stability and moderate long-term interest rates and enhance the Committee’s ability to promote maximum employment in the face of significant economic disturbances.”

Source: Federal Reserve

As the inflation target is arbitrary and not legislated, the Fed does have the flexibility to change the target. This wouldn’t be unprecedented as well considering in 2020 the Fed tweaked its 2% target to be a long-term average that allowed for periods above that rate when inflation had been persistently lower than the 2% target. The members of the FOMC obviously knew that their excessive money printing and low interest rates would come back to haunt them eventually so they wanted to give themselves some flexibility prior to the outbreak.

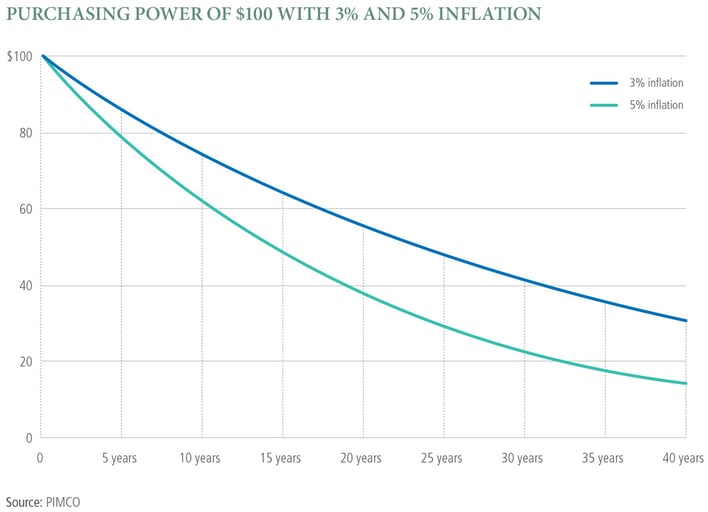

Source: PIMCO

In a recent Bloomberg interview, retired “Bond King” and PIMCO co-founder (a two trillion-dollar US fixed income asset manager) Bill Gross made the case for increasing the target from 2% to 3% which has added fuel to the fire. In a speech earlier this year, Dallas Fed President, Lorie Logan, outlined that core services ex housing makes up ~50% of core inflation and has been running at 4-5% for the past two years. It is in this area that persistent deflation needs to be in order to achieve a CPI rate of 2%, saying:

“If core services inflation excluding housing remained in its current range, while other categories returned to their prepandemic pace, total inflation going forward would settle much closer to 3 percent than to our 2 percent goal.”

Source: Dallas Fed

I think it's too early to tell if investors like Bill Gross are right and that the Fed will move the target higher but I do get the sense that, similar to the war in the Ukraine, people have become desensitised to inflation and are growing more accepting of higher levels. Adopting a 3% target would enable the Fed to immediately stop raising rates and would bring forward the date when they would implement rate cuts. However, moving the goalposts would be taking the easy way out and would have damaging consequences long-term. For example, a $1 today would be worth $0.43 and $0.21 in 40 years time under 2% and 3% inflation respectively; a difference of over 50%. Inflation is a hidden tax on income and we shouldn’t accept an acceleration of the erosion of our purchasing power.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link