Barclay Pearce Capital

- Mar 18, 2024

- 5 min read

Market Map with James Whelan - Quick update on last week's messages

New job, new firm but the same Free Whelan. Thank you for your continued support and keep unlocking valuable insights into the global market every week with me!

Firstly, and from an old derives hack like me this is fascinating, I've mentioned the growth of 0 Days to Expiry (or 0DTE) options before as being a big part of the reason for the decline in the relevance of the VIX, and a clear sign of the growing trend for market participants to take more casual risk.

There's more speculation to be done in the market than before.

There's an ETF that has a 0DTE-covered call strategy that now has 0DT options written over it. Leverage on leverage on leverage.

Source: Roundhill Investments - X

Extraordinary.

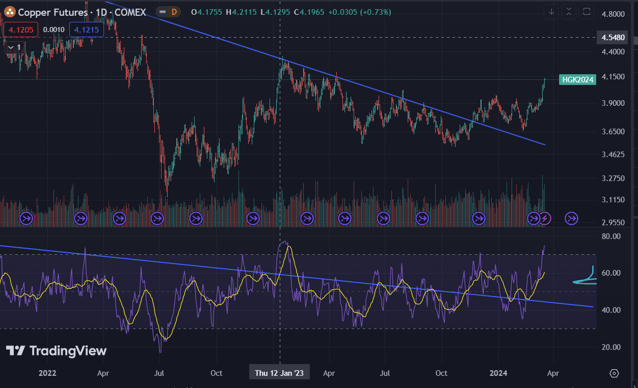

Review

Last week we mentioned copper. A few weeks ago we thought it looked cheap at the levels it was. Last week we started to really see it move. We have been quite bullish on copper the last few weeks and maintain that stance.

This week we saw Chinese smelters pledge to explore to drop their output due to sharply declining processing fees.

(Education corner: The fees are paid by concentrate sellers to smelters to convert concentrate into refined metal and their movements are directly correlated to supply.)

The cuts won't last forever but there's enough bullish momentum behind it for now. The narrative has turned back to shortages so hopefully (hope is not a strategy) we'll see a continuing trend up. The best picks are BHP in the large cap and ALM for something small and directly levered to the copper price.

Source: TradingView

Last week I mentioned Boeing as being a fairly simple short in the US market. They have some real problems that were easy to see (source: every second news article about how their planes are falling apart in the sky).

The call was to sell it down to election night when Trump wins and then pick it up cheaper to benefit from the massive push that will come from NATO in defence spending.

When I posted the chart it was at USD 200 a share.

now...

Source: TradingView

Looks like we may be at a price that looks buyable, only I still have zero confidence in Boeing at the moment, which is bad because I have more travel to do this year.

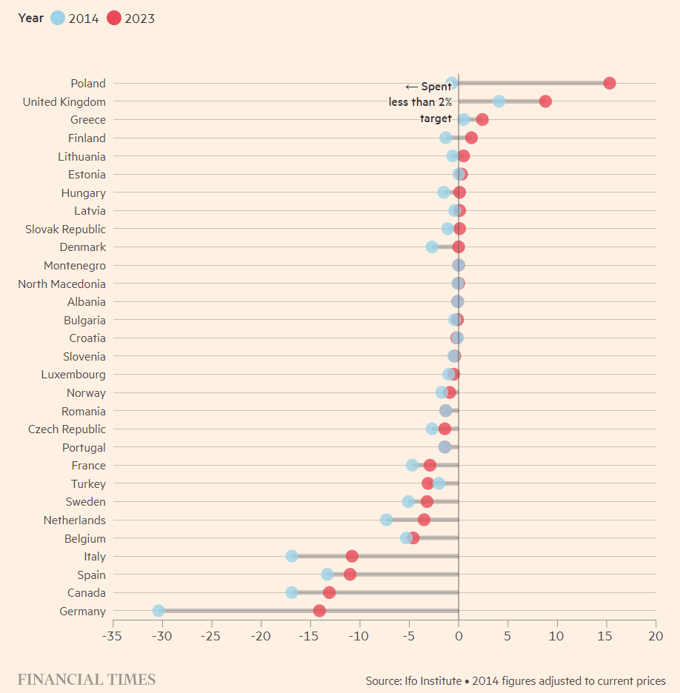

As an update, the FT actually ran an article on Saturday highlighting just how far behind the spending target of 2% GDP NATO countries are. Is 44 billion Euros a lot of money?

Source: Financial Times

To be fair, Germany is increasing their defence spending at the largest pace since WW2, which is something I'm not going to comment on right now.

Fun fact: next year the EU is bringing in rules that limit a country's debt to GDP. Countries over that limit face EU Commission sanctions, which may be lighter if you happen to breach the limit due to increased defence spending. You know where this heads.

We cover this and more in the most recent episode of the Theory of Thing podcast. Link here

Finally, we leave a light on for Kate

Last week I said that the doctored photo of Princess Kate was taking up a lot of attention. That turned out to be an understatement. The amateur investigations into "that photo" and the movements of the Princess of Wales over the last 6 months put the Kennedy Assassination investigations to shame.

The world needs answers.

But in a more relevant tone, it's shown to the world that we now live in an era where you can't trust the photos put in front of you and how much more dependence we have on our own logic and on the media to protect us from mistruth.

The US election will be a comical series of gaffes in which each side will easily get to claim any photo or recording is AI-generated. Nothing is real anymore.

On that chirpy note, stay safe and all the best,

James

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer. Sign up and join the game!

Share Link