Barclay Pearce Capital

- Feb 19, 2024

- 6 min read

Market Map with James Whelan - Running like a tap on hydrogen and mixed messages on the economy

New job, new firm but the same Free Whelan. Thank you for your continued support and keep unlocking valuable insights into the global market every week with me!

Good afternoon,

A note to start that, if not joined already, I am strongly encouraging colleagues and clients to please join our NRL tipping comp! Link is here. It's an innovative comp with a little fun as we go. Sometimes you need some time away from the buzz of markets.

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season is set to kick off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer when announced. Until then, sign up and get tipping for Round 1.

Now on with the usual programming. Hydrogen is first off the list and I put out a hydrogen note a little while ago so I won't go over it again but there's been a few discoveries of natural hydrogen around the world, the "big one" being the 200 tonnes per annum discovery in Albania.

There's always been an issue for my favourite transportation method with the creation of hydrogen and the storage of it.

Having significant quantities flowing freely from the ground does solve a big part of that problem. I prefer to invest in the tech that uses hydrogen as opposed to the parties trying to create it so if the supply is easier than that's better for the industry gaining ground on the lithium mob.

This is positive...

Source: Financial Times

Source: Financial TimesIt's estimated that 5 tonnes of hydrogen exists underground and that, according to the project leader at the US Geological Survey, “Most hydrogen is likely inaccessible, but a few per cent recovery would still supply all projected demand — 500mn tonnes a year — for hundreds of years.”

Were this to be the case a number of projects become unsustainable (because alternative sources are more viable) but the positive part is how cheaper it makes the fuel.

Good things ahead.

Inflation

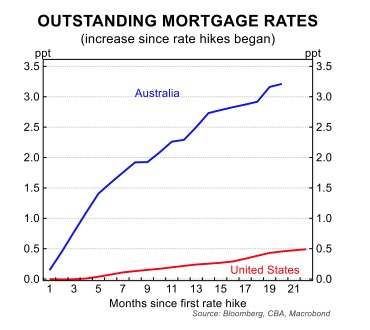

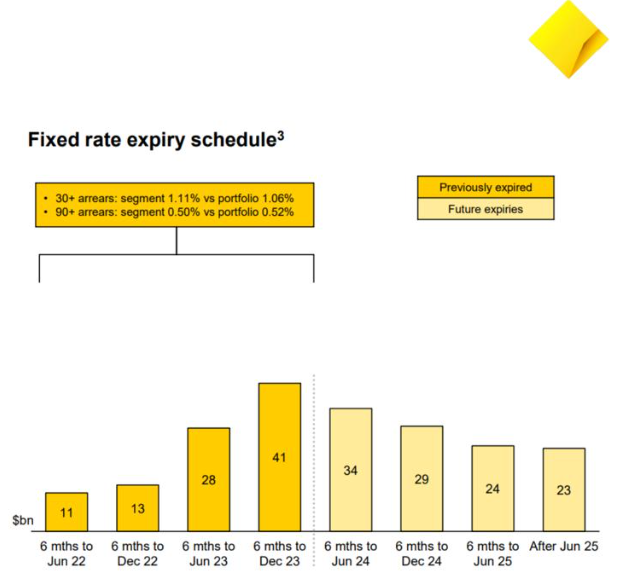

We really are a Tale of Two Countries when it comes to inflationary data and there's a few reasons why. Ours, particularly in services, is declining quite This would be a big one.

Source: ABC News

With this still in the pipes. Yes, we've passed the peak but there's a fatter tail of loans coming off fixed to variable. Look out!

Source: Firetrail - Linkedin

So no we're not out of the woods yet and I hold fast that cuts are quicker than expected over 2024. I was right about the margin in the Super Bowl so surely I can be right about this too??!

In that vein and in light of my whole schtick this year of righting classic, usually panicky wrongs that at first glance look shocking but always need to be extrapolated here's something that seems like a panic in the US, but isn't, that is actually a bit of a worthwhile panic here.

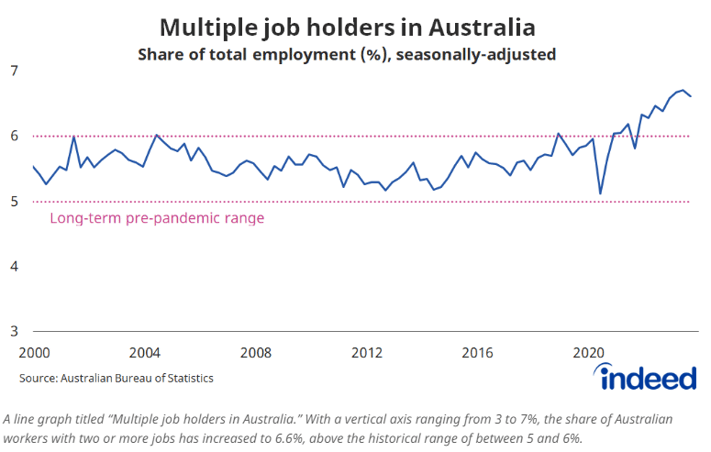

Take the fact that if people are working two jobs it means things are bad, right?

In the US 5.1% of the labor force is working two, which could be a panic. But in fact it's actually below where it sat during the sweet economic period of the mid to late 90s.

Source: FRED

Now in Australia, we have people working two jobs above 6.5%. Do we have the same health situation?

Source: Callam Pickering - X

No, we don't. I've actually seen this data back to the mid 90s and it's about 5.4% then.

Things are tight locally but there's still work and people are working. There are also levers to pull to ease the squeeze. Bank reporting continues to show that loan losses are low. People, in this country, find a way forward.

In the US all signs point to a No Landing scenario with an economy booming and a market to match. I'll go into that in more detail next week.

We do touch on this and more in the latest cut of the podcast where I'm joined by the amazing David Scutt of StoneX group. Link here

Stay safe and all the best,

James

Share Link