Roberto Russo

- Jul 27, 2022

- 5 min read

ASX Market Review - EOFY

Our Trading Operations Manager, Roberto Russo, discusses stand-out companies amongst the market's poor economic performance.

In June, the All Ordinaries index pulled back just shy of 10%; creating a negative investor sentiment at month's end. In a macroeconomic sense, the steady flow of negative news coinciding with a bleak start to the calendar year essentially added fuel to the fire.

Here are some of the highlights for the month:

Tempest Minerals (ASX:TEM)

Tempest Minerals had an extraordinary run in June off the back of speculation from management, however, no news has come out to address this besides a ‘speeding ticket’ from the ASX. Traders took control and bought up in force- essentially creating something out of nothing as most investors wait for tangible news flow.

*07/07/2022

Link Admin Holdings (ASX:LNK)

Link continues to negotiate the proposed takeovers and potential buyers for the company as Duy & Durham have trouble getting the ACCC across the table; compounded with current market conditions most investors are already pricing in the deal falling through. Risk-on investors are looking towards arbitrage trading, while most other investors look elsewhere for stability.

*07/07/2022

Paygroup Limited (ASX:PYG)

Paygroup announced they have entered into a scheme of arrangement with Deel.Inc & Deel Australia to acquire 100% of the Company at $1.00 a share. The Company was listed in the middle of 2018 at 0.50c a share; those who have held the stock since then have seen a 100% return, a favourable outcome as the stock has seen a steady decline since listing.

*07/07/2022

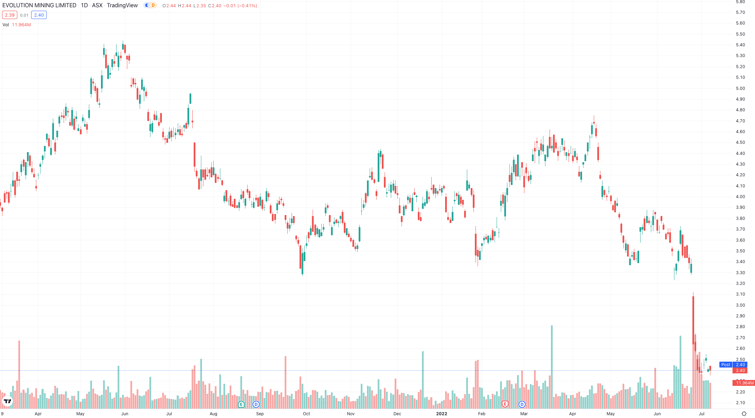

Evolution Mining (ASX:EVN)

Gold is no longer acting as a safe-haven hedge. Evolution Mining on the 27th of June announced a business update that was met with a large selling of shares coupled with a poor outlook. This resulted in a 20% drop for the large-cap miner, primarily due to staffing issues and higher-than-expected costs.

*07/07/2022

Summary

The month of June saw a number of harsh tax-loss sales that coincided with negative economic performance and several poor news releases. Reporting season is quickly approaching, and most investors are waiting to see what the upcoming numbers will reveal in order to decide whether to keep continue their economic worries or embrace a bullish mindset.

To learn more, feel free to contact me directly or pop into our Adelaide Office!

Where to from here?

Trading equities is all about having access to the right investment opportunities and making decisions based on accurate, unbiased information. Often, this means hours of research on a daily basis, keeping up with several ASX announcements, understanding economy-impacting events and regularly consuming broader news updates. If you're not an equities trader by profession, then it can quickly become rather overwhelming, especially once you have built a considerable-sized investment portfolio.

Our Equities Trading team, backed by our independent research department is the ideal solution for said situation. Our clients receive access to exclusive investment opportunities, daily ASX research reports, our expert weekly outlook on the Australian markets and direct access to our equity traders.

Trading with Barclay Pearce Capital is about building long-term returns, trust, confidence and a mutually beneficial relationship.

Trading with Barclay Pearce Capital ensures the needs of investors of all magnitudes are met by our highly skilled and attentive trading professionals.

~ Trent Primmer, Director of Trading, Barclay Pearce Capital.

Share Link