Jack Colreavy

- Sep 12, 2023

- 4 min read

ABSI - Productivity Challenges and Solutions in Australia: Insights from Departing RBA Governor Dr. Philip Lowe

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

As departing RBA Governor, Dr. Philip Lowe, calls time on his 43 year career this week at Australia’s top bank, he used his final monetary policy meeting to keep interest rates on hold but also departed with some important analysis of the challenges ahead in his final public address as RBA Governor. One of the points highlighted was the importance of productivity to the Australian economy. ABSI this week will delve into the problems with productivity.

As departing RBA Governor, Dr. Philip Lowe, calls time on his 43 year career this week at Australia’s top bank, he used his final monetary policy meeting to keep interest rates on hold but also departed with some important analysis of the challenges ahead in his final public address as RBA Governor. One of the points highlighted was the importance of productivity to the Australian economy. ABSI this week will delve into the problems with productivity.

Labour productivity is a key economic concept that measures the efficiency and effectiveness of a country's (or firm’s) use of labour in producing goods and services. It is typically expressed as the amount of output (goods or services) produced per unit of labour input (usually hours worked or number of workers). Multifactor productivity (MFP) is a complementary measure which adds the input of capital to the equation.

Source: RBA

Measuring labour productivity is difficult but crucial for policymakers, businesses, and economists because it helps them assess economic performance, and make informed decisions about resource allocation. It can also be used to identify areas where improvements in technology, education, or training might be needed to boost overall economic growth. In Australia, productivity is not measured directly but the Australian Bureau of Statistics (ABS) produces productivity measures by dividing a measure of output by a measure of inputs.

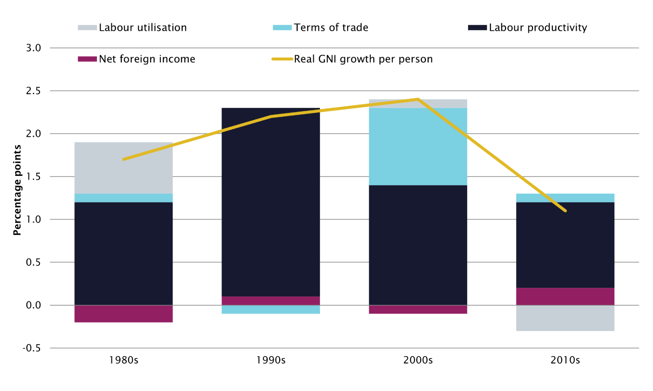

The importance of productivity is highlighted by the 2023 Intergenerational report which stated that labour productivity was responsible for over 80% of the growth of living standards in Australia over the last 30 years, measured by gross national income (GNI) per person. Higher productivity results in higher profits, lower prices, higher wages and an overall increase in GDP. When higher wages aren’t accompanied by higher productivity, the general result is inflation.

Contributions to real GNI per person growth (measured in percentage points)

Source: Australian Government

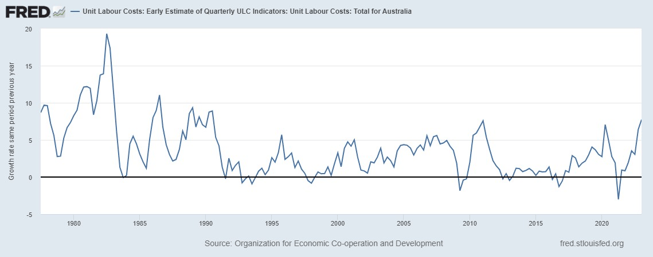

The RBA is hyper focused on productivity with Dr. Lowe, in his final speech, reinforcing “the risk that the period of high inflation could lead to wages growth and profits running ahead of the rate that is consistent with a sustainable return of inflation to target.” Given unit labour costs are growing at an annual rate of ~7.5% means that, without an increase in productivity, interest rates may need to go higher in order to bring inflation back to the target 2-3% band.

Solutions to improving productivity are varied from investment into education and infrastructure to subsidies for investment and access to cheap capital. As Dr. Lowe states “The problem isn’t lack of ideas” but is more of a political issue and that an inability to find consensus for change is exacerbating the issue. He suggests that a new independent fiscal authority with limited spending and taxing powers, such as increasing the GST, would enable the politically tough decisions to be made instead of being gridlocked by the house of Parliament and the need for politicians to be popular.

Source: St Louis Fed

It is calculated that if productivity grows by 2.5% per year, a nation can double its standard of living in 28 years. Current productivity levels in Australia languish at ~1% which will result in a 32% increase over the same period. Therefore it wasn’t hyperbole when Dr. Lowe signed off his tenure as Governor by warning “if we can’t build a consensus for changes, the economy will drift and there is a material risk that our living standards will stagnate.”

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link