Barclay Pearce Capital

- Aug 4, 2021

- 6 min read

Profit reporting season for ASX listed companies has started and expectations are high

ABC News released an article discussing the concept around reporting season for ASX listed companies and the impact it may have on their share price.

A vast amount of Australian companies are expected to report their financial results for the previous year. If you currently invest in stocks or are considering doing so, the following article will explain why reporting season is essential and what to expect.

Not only for those of us living through the epidemic but also for Australian companies, the past financial year has been unprecedented.

In saying this, some companies have prevailed, some have suffered but are starting to recuperate, and others, for instance, travel agencies, are still severely impacted.

The ABC news article states:

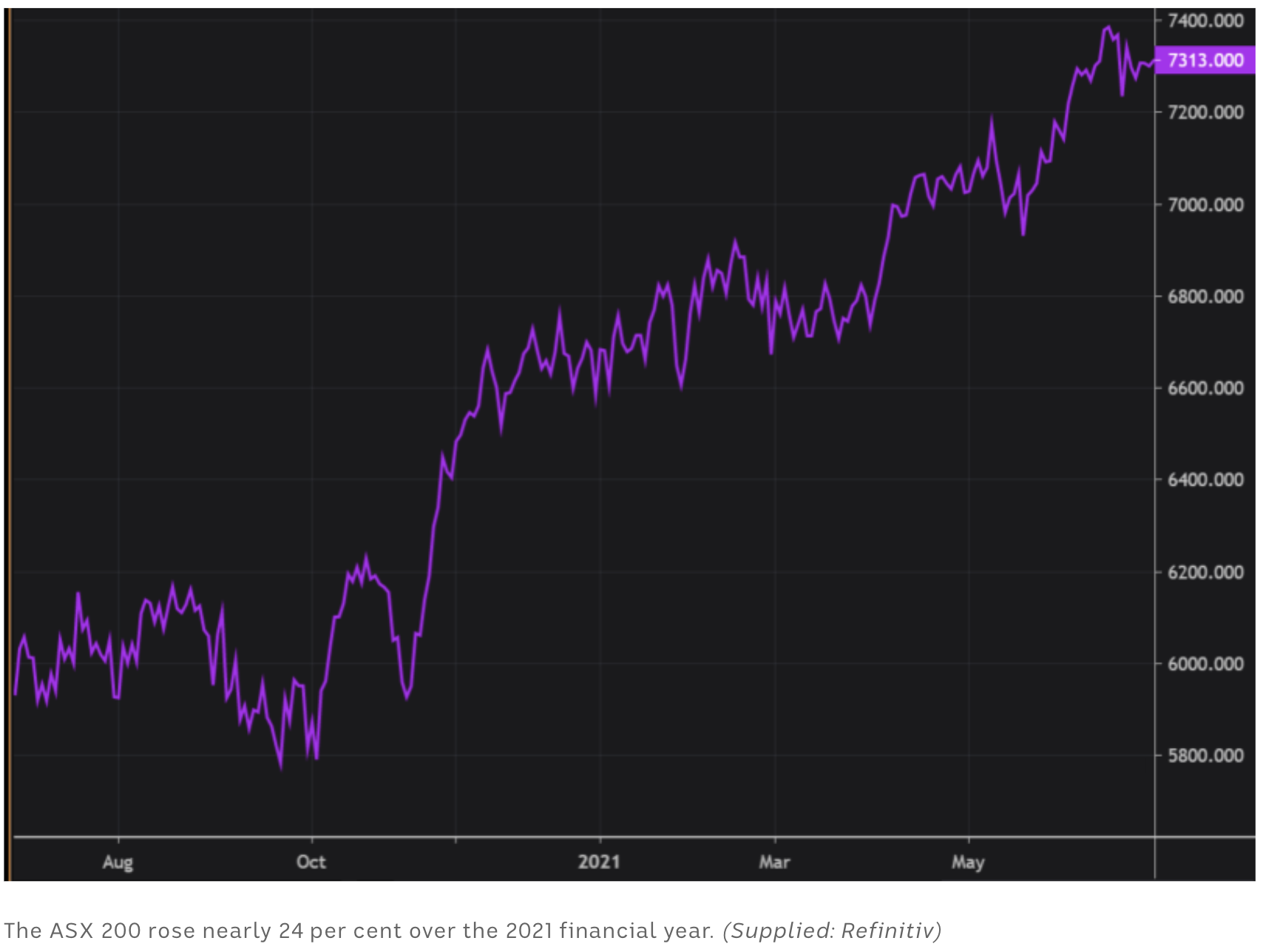

"It's been an extraordinary period for those who own shares in Australian companies too. The Australian share market rose by more than 20 per cent over the year to June 30 and it continues to hit new highs."

Reporting season has begun for ASX listed companies, which may cause significant ramifications for potential and/or current investors.

What exactly is reporting season?

The article defines reporting season as:

"a period of a few weeks when many of Australia's publicly listed companies disclose the details of their finances — and it happens twice a year."

Companies listed on the ASX must adhere to disclosure regulations, which includes releasing financial reports twice a year summarising their financial situation for the previous six months, and whether they have generated a net profit or loss.

The article states that:

"Typically, the reporting happens in February, providing a snapshot as at the end of December, and then again in August, following the end of the financial year on June 30."

OK, but why should I care?

The article conveys that:

"Paying attention to a company's results come reporting season will provide a window into how its finances stack up, what its strategy is and how management is viewing the outlook."

Financial reports provide a wealth of information that can assist you in determining whether or not a company is a smart investment.

This includes:

"How sales are tracking, what the major sources of revenue are, how high costs are, how much debt it must repay and how fast it's growing."

Another significant aspect to recognise during reporting season is if shareholders will receive a dividend payment, and if so, how much will it be?

What is a dividend?

The article defines a dividend as:

"A payment returning some of a company's earnings back to its shareholders."

In furtherance,

"You can choose to either receive a dividend payment as cash, which gives you the flexibility to invest that money in other stocks if you like, or you can automatically reinvest your dividends in the same stock, growing your shareholding in the company."

What could happen to stock prices during reporting season?

The article communicates that:

"In the case of the results that will be released this August, they will mostly cover either the period of July 2020 through to June 30 this year, or the first half of 2021.

This coincides with a big rally on the Australian share market, with the ASX 200 gaining nearly 24 per cent over the financial year and hitting fresh highs."

In saying this:

"The share prices of some companies are at record highs too, meaning there could be less potential for shares to rise much more, even if their results are strong.

And if a company disappoints, its share price could fall sharply from current highs."

Commsec analysts say:

“Earnings results in the next six weeks should justify current lofty valuations of the Australian share market.”

How are companies likely to have performed?

It would be an understatement to say that a lot has transpired between July 1 last year and June 30 this year considering the wave of COVID outbreaks, lockdowns and border closures.

The article states that:

"Australia's economy began growing again after its first recession in three decades and unemployment dropped below pre-pandemic levels."

Nevertheless,

"Overseas, Joe Biden was inaugurated as US President following his election in November.

Countries such as India grappled with severe COVID-19 outbreaks, while others such as Israel and Canada vaccinated the vast majority of their populations.

Commodity prices rallied, with iron ore a standout despite ongoing trade tensions between Australia and China, while oil prices recovered from the lows of 2020."

All of this, according to most experts, bodes well for Australian companies during reporting season.

Positive surprises are expected to outnumber negative surprises by a factor of 2:1, according to Citi analysts, predicting a high level of dividend payments to shareholders throughout the market, with the miners leading the way.

Positive surprises are expected to outnumber negative surprises by a factor of 2:1, according to Citi analysts, predicting a high level of dividend payments to shareholders throughout the market, with the miners leading the way.

"Given the rise in iron ore prices, miners are expected to be a standout, with strong results and big dividends for shareholders, as Rio Tinto has already demonstrated."

Additionally,

"INVESTSmart's Evan Lucas says companies that have benefitted from the working-from-home trend will have done well again, including retailers such as Nick Scali, Temple & Webster, JB Hi-Fi and Harvey Norman. But he does think things may have peaked for that sector, and the end of JobKeeper could have also had an impact.

RBC Capital Markets' Karen Jorritsma expects weak results from travel and aviation companies, especially given the renewed uncertainty brought by the coronavirus Delta variant. And, she's also not expecting a strong performance from childcare providers, which she says remain under pressure despite the government support they have received."

A determining factor of the said situation is "whether or not companies saw a slowdown in the last couple of months."

Read the full ABC News article here.

Want to open a Trading Account with us? Leave your contact details in the form below and our trading team will get back to you as soon as possible!

Share Link