Barclay Pearce Capital

- Dec 5, 2023

- 4 min read

Short note after an amazing month - Market Map with James Whelan

New job, new firm but the same Free Whelan. Thank you for your continued support and keep unlocking valuable insights into the global market every week with us!

Good afternoon,

A little late and a little busy on the note as we put the final ribbon on the last deal of the year. Another successful venture and thanks to all who participated.

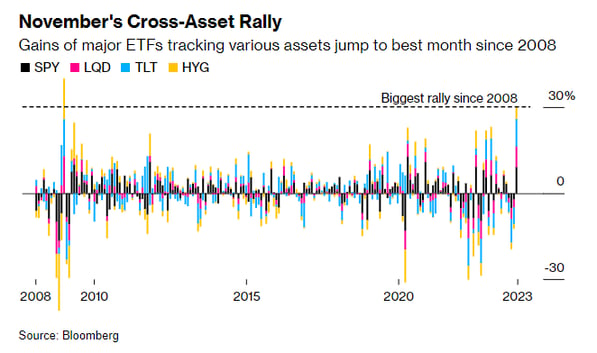

Now for November and wow what a blindingly good month. If you'd like to see two charts that are closely related please observe:

Source: Bloomberg

The price of the US 10 year controls the world and when the yield on it moves from ~5% to ~4.25% you see markets put on a casual "everything rally" and, as I said at the beginning of the month, you'll enjoy being invested.

Again beware of the folks out there saying "since 2008...what else happened in 2008??? hmmmm???" you know the type. Steer clear of them like potholes.

It's the most wonderful time of the year for this sort of thing to get pedalled around.

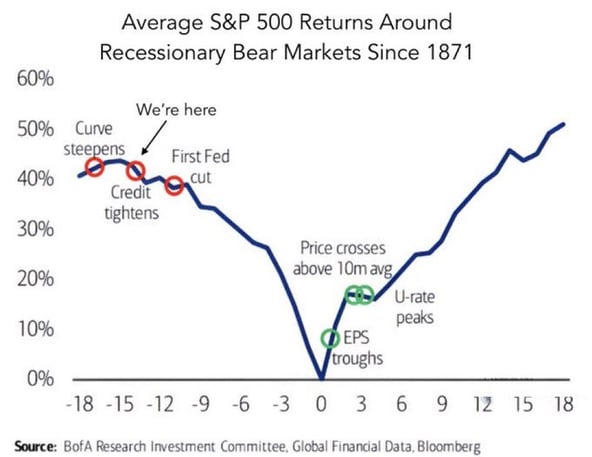

That being said, this is fascinating.

Source: BOF A Research Investment Committee, Global Financial Data, Bloomberg

If you can understand it, it's fascinating, that is.

Effectively it echoes something I've said before that returns on markets tend to drop from the first cut onwards. Because usually the first cut is for some reason that's usually not good and the process is already started of a recession. Sell into pre-recession and buy when it's declared.

Just one problem sums up 2023 and that's the fact everyone has been predicting a recession this year (since last year) and it's now December and I don't see no reccession.

I'll put my hand up and say that yes I was one of those too. Consensus recession.

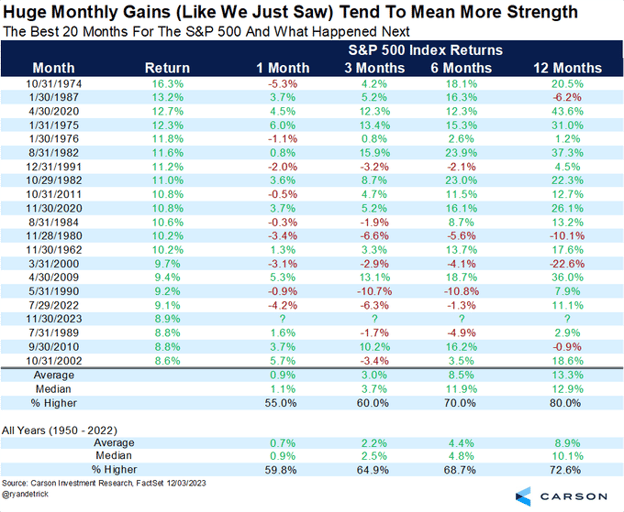

Stats that matter

Source: Carson Investment Research, FactSet 12/03/2023

Amazingly, and I can't figure out how, but a strong month usually means a strong year to follow.

13.3% up on average and higher 80% of the time.

Stay invested.

Here's a link to the podcast to fill in the details you're after especially on gold which sees fresh highs on dropping yields and increased geopolitical tensions (apparently)

Finally here's a little something with Chairman Mao absolutely losing it when he sees Henry Kissinger's wife for the first time. Priceless reaction.

Stay safe and all the best,

James

Share Link