Trent Primmer

- May 20, 2021

- 7 min read

Sustainability Report - Trading with Barclay Pearce Capital

Every week we publish a collection of investment opportunities for our clients and give our expert opinion and analytics about the Equity Markets.

Looking for your next trade?

We couldn't decide on what stock to feature next as they are all so exciting! Therefore, we have decided to do a whole report on the sustainability sector!

Today, we are talking about Magnis Energy Technologies (ASX: MNS) and Vital Metals (ASX: VML).

Magnis Energy Technologies (ASX: MNS)

Magnis Energy Technologies owns a direct and indirect interest of 63 per cent in IM3NY.

IM3NY has received funding and purchased equipment to fast track its operations and begin production immediately, allowing the company to produce 1.86Gwh PA from its newly refurbished warehouse, with the plan to scale up output dramatically shortly after.

Following this news, IM3NY has secured a whopping US$655 million in orders in binding offtakes.

But that's not all!

Despite having US$655 million in binding takeoffs, the Company is currently exploring a potential US listing, leaving MNS in the driving seat due to its previously mentioned 63 per cent interest.

A key highlight regarding Magnis that people have overlooked is that it appointed Mrs Mona E. Dajani to the board as a non-executive. Mrs Dajani is a Global Expert in Renewable Energy, lawyer and advisor to the Biden Administration and the US Department of Energy.

Magnis Energy Technologies (ASX: MNS) Share Price Update - 17 May 2021:

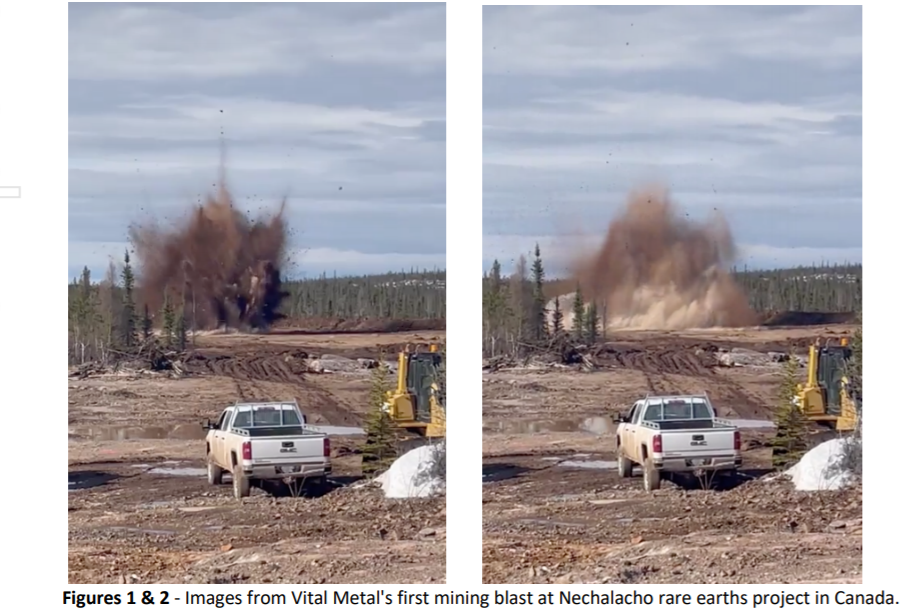

Vital Metals is an Australian Rare Earths Company that has recently completed its first project blast in Canada and have now begun mining!

Once in production next month, Vital will be the only Rare Earths producer in Canada and only the second in the whole of North America!

Talk about a tight market…

Vital has an offtake agreement with REEtec executing a 5 year deal for a supply of 1,000t REO, with an option to upgrade to 5,000t REO.

An existing resource of 1.3Mt TREO, coupled with the lack of market competition, VML is placed firmly at the front of the industry with a global shortage of REE due to trade wars with China.

The management team consists of highly experienced individuals in the REE space with ex Lynas Corporation & Northern Minerals expert Mr. Geoff Atkins.

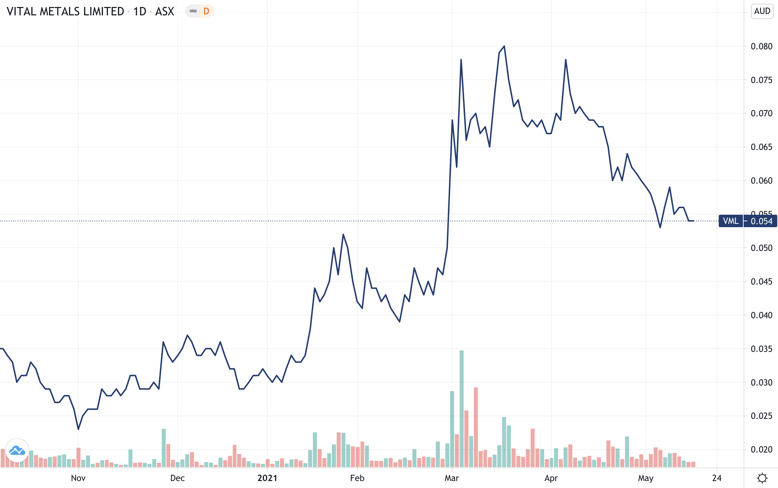

Vital Metals Limited (ASX: VML) Share Price Update - 17 May 2021:

Where to from here?

Trading equities is all about having access to the right investment opportunities and making decisions based on accurate, unbiased information. Often, this means hours of research on a daily basis, keeping up with several ASX announcements, understanding economy-impacting events and regularly consuming broader news updates. If you're not an equities trader by profession, then it can quickly become rather overwhelming, especially once you have built a considerable-sized investment portfolio.

Our Equities Trading team, backed by our independent research department is the ideal solution for said situation. Our clients receive access to exclusive investment opportunities, daily ASX research reports, our expert weekly outlook on the Australian markets and direct access to our equity traders.

Trading with Barclay Pearce Capital is about building long-term returns, trust, confidence and a mutually beneficial relationship.

"Trading with Barclay Pearce Capital ensures the needs of investors of all magnitudes are met by our highly skilled and attentive trading professionals."

~ Trent Primmer, Head of Trading, Barclay Pearce Capital.

Share Link

.png?width=380&height=119&name=Magnis%20Energy%20Technologies%20(MNS).png)

.png?width=291&name=Vital%20Metals%20(VML).png)