Roberto Russo

- Nov 5, 2021

- 6 min read

Technical Analysis - Reporting Season

Our Equities Trader, Roberto Russo, discusses Technical Analysis within the reporting season.

In the month of October, we saw some very interesting setups appear across the board. With many traders speculating on upcoming quarterly results, it was clear to see what companies were more favourable leading up towards the end of the month.

Recent weakness in the market has also brought forward some opportunities with traders making the most out of the recent volatility.

Eclipx Group Ltd:

ECX announced to the market their full-year earnings on 03/11 allowing confluence to take control on a great chart setup, which has been fully momentum-driven since the crash.

Life 360:

360 has been tracking upwards with full momentum since the start of 2021 with no end in sight, recommendations from the big end of town came in thick and fast. Looking at a strictly technical aspect, there have been several potential entry points on a breakout trade especially the day before earnings came out.

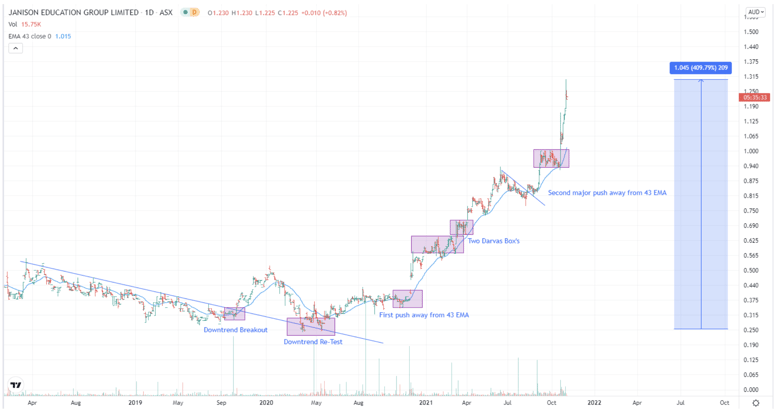

Janison Education:

A chart similar to 360, JAN has provided several entry points moving upwards as earnings are keeping fundamentals strong. Since pulling away from the 43EMA back in November 2020, JAN has not stopped its rapid momentum move and every breakout or support test has been a valid entry point forming several strong bullish TA setups.

Summary

I have been a strong believer in the use of confluence within trading. The reasons for this include the growth of a portfolio as it is a key ingredient to maintaining confidence in specific selections, and steering away from unexpected volatility, especially during reporting season. There is nothing more aesthetically pleasing than a great chart with some great fundamentals behind the stock.

Where to from here?

Trading equities is all about having access to the right investment opportunities and making decisions based on accurate, unbiased information. Often, this means hours of research on a daily basis, keeping up with several ASX announcements, understanding economy-impacting events and regularly consuming broader news updates. If you're not an equities trader by profession, then it can quickly become rather overwhelming, especially once you have built a considerable-sized investment portfolio.

Our Equities Trading team, backed by our independent research department is the ideal solution for said situation. Our clients receive access to exclusive investment opportunities, daily ASX research reports, our expert weekly outlook on the Australian markets and direct access to our equity traders.

Trading with Barclay Pearce Capital is about building long-term returns, trust, confidence and a mutually beneficial relationship.

Trading with Barclay Pearce Capital ensures the needs of investors of all magnitudes are met by our highly skilled and attentive trading professionals.

~ Trent Primmer, Director of Trading, Barclay Pearce Capital.

Share Link