Roberto Russo

- May 18, 2022

- 5 min read

Technical Analysis - Safety in Banks

Our Equities Trader, Roberto Russo, discusses Technical Analysis with regards to how investors should look to banks to mitigate current market volatility.

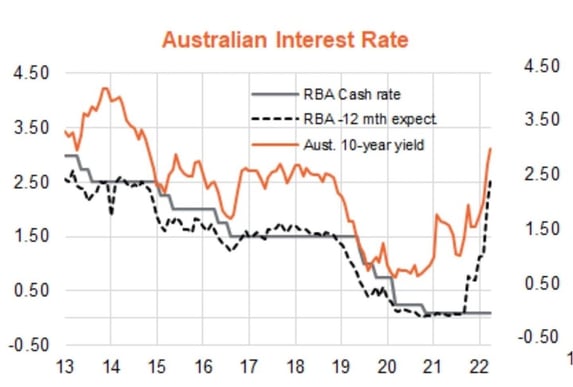

The Reserve Bank of Australia announced interest rates were rising by 0.25bp which came as a shock to investors. Immediately after the announcement was made, our index saw a quick downwards flash, which was a large overreaction by most investors. It is well understood that rates will likely continue to rise for the remainder of this year and next year too.

Here is a graph of the expected rate rise vs 10 year-yield.

This rate rise poses opportunities for investors to capitalise on. Mortgage rates are instantly increased, and term deposits are looking more attractive as several banks announced increases to their term deposit rates.

NAB (ASX:NAB)

NAB put out strong financial results for their half-year report, earning an extranet profit of 10.2% compared against 2H21, allowing the Company to lift their dividend by 6c. NAB was once the smaller of the big 4 in market value and share, however, they are slowly creeping up the ladder as more customers start shopping around for better rates.

Westpac (ASX:WBC)

Westpac beat expectations in their reports as cash NPAT & EPS are up above consensus and the dividend is also up by 1c. They have had a bit of a bumpy start since reporting with pressures of the broader market sell-off, but the banking giant is holding its own very well as it looks to provide security for investors.

Summary

Investments pose risks of many kinds, and in high volatility market conditions, it's about mitigating the known risk as much as possible to either protect or hedge the portfolio and take advantage of the wild moves in either direction.

Read the Conversation:

Roberto Russo:

“ The Reserve Bank of Australia announced interest rates were rising by 0.25 basis points, which came as a shock to investors. Immediately after announcement was made, our index saw a quick downward flash, which was a large overreaction by most investors. It is well understood that rates will likely continue to rise for the remainder of this year and next year too.

This rate rise poses opportunities for investors to capitalize on. Mortgage rates are instantly increased and term deposits are looking more attractive as several banks announced increases to then term deposit. Two banks that we have seen to be performing well are NAB and Westpac. NAB put out strong financial results for the half year report, earning an extra net profit of 10.2% compared against second half of 21, which allowed the company to lift their dividend by 6 cents.

NAB was once the small of the big four in market value and share. However, they are slowly creeping up the ladder as more customers start shopping around for better rates. Westpac beat expectations in their report as cash *inaudible* and EPS are above consensus, and the dividend is also up by 1 cent. Westpac had a bit of a bumpy start since reporting with pressures of the broader market selloff.

But the banking giant is holding its own very well as it looks to provide security for investors. Investments pose risks on many kind and in high volatility market conditions. It's about mitigating the known risk as much as possible to either protect or hedge the portfolio and take advantage of the wild moves in either direction.

To learn more about mitigating portfolio volatility via banks, feel free to contact me directly by clicking the link in the description.”

Where to from here?

Trading equities is all about having access to the right investment opportunities and making decisions based on accurate, unbiased information. Often, this means hours of research on a daily basis, keeping up with several ASX announcements, understanding economy-impacting events and regularly consuming broader news updates. If you're not an equities trader by profession, then it can quickly become rather overwhelming, especially once you have built a considerable-sized investment portfolio.

Our Equities Trading team, backed by our independent research department is the ideal solution for said situation. Our clients receive access to exclusive investment opportunities, daily ASX research reports, our expert weekly outlook on the Australian markets and direct access to our equity traders.

Trading with Barclay Pearce Capital is about building long-term returns, trust, confidence and a mutually beneficial relationship.

Trading with Barclay Pearce Capital ensures the needs of investors of all magnitudes are met by our highly skilled and attentive trading professionals.

~ Trent Primmer, Director of Trading, Barclay Pearce Capital.

Share Link