Barclay Pearce Capital

- Apr 3, 2024

- 9 min read

The Morning Market Report - 03 April 2024

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

Overnight Market Highlights:

![]() Wall Street fell overnight.

Wall Street fell overnight.

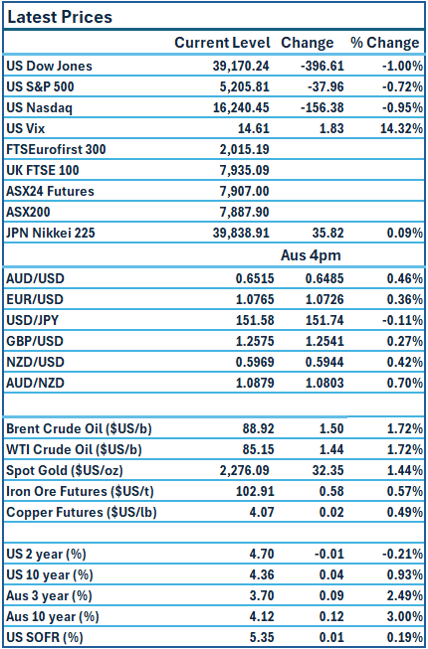

Dow Jones S&P-500 Nasdaq

- 1% - 0.7% - 1%

___________________ __________________ _________________

ASX futures are set to fall this morning.

ASX futures are set to fall this morning.

🇺🇸 US Market Overview:

The Update: The three major U.S. stock indexes fell about 1% on Tuesday and the yield on benchmark 10-year Treasuries hit a four-month high after data showing strong labour demand raised the prospect that the Federal Reserve could delay cutting interest rates. U.S. job openings, a measure of labour demand, edged up 8,000 to 8.756 million on the last day of February. Source: Reuters

The Impact: Reports released in recent days showed strength in manufacturing and jobs, underpinning a narrative of US resilience that has been gaining momentum all year. There is a bearish sentiment in bond markets as predictions on rate cuts are being scaled back due to the latest data and gains in commodities. Investors are now pricing in less than 3 rate cuts by the end of the year, diverging from the Feds prediction of 3 cuts. The services ISM will be released early tomorrow morning. If there is a strong read in the data, like the manufacturing data, there could be further pushback on the predictions of rate cuts, pushing bond yields up. Source: AFR

🇦🇺 Australian Market Overview:

-

ASX futures are down 30 points or 0.4% to 7907.

-

The RBA minutes released yesterday reiterated the banks' neutral bias on interest rates – dropping the mild tightening bias previously held. Source: AFR

🇪🇺 European Market Overview:

European stocks shifted lower Tuesday as major markets returned to action after the Easter weekend and investors looked ahead to the start of a new trading quarter. Source: CNBC

📈 Global Commodities Update:

Brent crude briefly rose above $89 a barrel for the first time since October, as oil supplies faced new threats from Ukrainian attacks on Russian energy facilities. Ukraine struck one of Russia's biggest refineries on Tuesday. Source: Reuters

⚡ Global Renewable Energy News:

The Albanese government will dedicate $1 billion in subsidies, grants and other forms of support to the domestic production of solar panels, including in the coal-rich Hunter Valley. With just 1 per cent of solar panels installed in Australia manufactured domestically, Mr Albanese has deliberately chosen Liddell to launch the policy to assure coal workers they have a future in clean energy. There are no details behind the announcement. Instead, the Australia Renewable Energy Agency (ARENA) will consult the industry to design and deliver the initiative, along with the government. Source: AFR

📚 European Market Report by Jack Colreavy:

The European market is buzzing on the M&A news that Formula One parent company, Liberty Media, is set to acquire the motorcycle racing league MotoGP valuing the league at €3.5bn.

MotoGP holding company, Dorna Sports, will remain an independently run company with management retaining ~14% of the equity, but the deal will bring in a parent that has a great track record of reinvigorating sport, most notably F1.

📬 Market Insight by James Whelan:

James highlights the increasingly inverted state of the US twos ten curve - a longstanding indicator of a possible pending recession. Despite this potential warning sign, he emphasises the counterintuitive strength and resilience of the global market, which appears to defy traditional economic indicators, reinforcing the importance of continued investment.

James puts forth a few key insights, he underlines the potential value in European financials, despite the region’s economic ‘carnage’, referencing Morgan Stanley's recent European conference. Here, he offers insight into the historical multiples of the European financial sector, signalling potential value for investors. Furthermore, James advises diversification into smaller cap markets, notably gold stocks, predicting an increase in M&A activity over the subsequent 12-18 months.

Finally, James references a possible shift in focus toward smaller cap sectors such as miners and resources, as major fund managers and advisors reassess their portfolios. However, he also notes the relative underperformance of smaller caps in contrast to their larger counterparts. Lastly, he identifies China and India as emerging markets worth watching, despite their inherent risks, flagging specific interest in India as an ‘absolutely incredible’ economic opportunity going forward.

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer. Sign up and join the game!

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link