Barclay Pearce Capital

- Sep 5, 2025

- 10 min read

The Morning Market Report - 05 September 2025

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

Overnight Market Highlights:

![]() US stocks climbed to record highs as weak labor data boosted expectations for a September rate cut, pushing bond yields lower and lifting gains across most sectors, with tech and consumer names leading the rally.

US stocks climbed to record highs as weak labor data boosted expectations for a September rate cut, pushing bond yields lower and lifting gains across most sectors, with tech and consumer names leading the rally.

Dow Jones S&P-500 Nasdaq

+ 0.70% + 0.50% + 0.60%

___________________ __________________ _________________

The Australian sharemarket opens higher, rebounding from Wednesday’s sell-off as tech, consumer stocks, and banks lead gains, while Qantas rises on news its CEO’s bonus will be docked after a cyber breach.

The Australian sharemarket opens higher, rebounding from Wednesday’s sell-off as tech, consumer stocks, and banks lead gains, while Qantas rises on news its CEO’s bonus will be docked after a cyber breach.

Stock of Note:

Broken Hill Mines Impact Minerals Locksley Resources Pilbara Minerals

(ASX: BHM) (ASX: IPT) (ASX: LKY) (ASX:PLS)

0.585 AUD 0.090 AUD 0.235 AUD 2.305 AUD

- 6.4% + 0.0% +0.0% +0.7%

___________________ __________________ __________________ __________________

Step One Clothing Fenix Resources Emmerson Resources Silver Mines Limited

(ASX: STP) (ASX: FEX) (ASX:ERM) (ASX:SVL)

0.515 AUD 0.370 AUD 0.200 AUD 0.145 AUD

+ 1.0% + 0.0% +5.3% -3.3%

___________________ ___________________ ___________________ ___________________

Ark Mines Limited

(ASX:AHK)

0.355 AUD

+ 1.4%

___________________

🇺🇸 US Market Overview:

-

US stocks rallied after weak private payrolls data strengthened expectations for a September rate cut, driving treasury yields to multi-month lows.

-

Ten of eleven S&P 500 sectors advanced, led by consumer discretionary (Amazon +2.25%) and communication services (Meta, Alphabet +1.12%). Financials rose 1%, while utilities was the sole laggard (-0.16%).

-

Bond yields dropped to their lowest since May as traders priced in further cuts. The odds of a September Fed cut neared 100%, with some analysts expecting up to three cuts by early 2026. Broadcom firmed ahead of earnings and jumped 4.1% after-hours on a 63% surge in AI revenue.

Source: AFR, Hot Copper

🇦🇺 Australian Market Overview:

-

The S&P/ASX 200 rises 1% to 8,826.5, with nine of eleven sectors in the green, led by tech, consumer stocks, and the big four banks.

-

The Australian sharemarket opens higher, tracking Wall Street’s gains and recovering from Wednesday’s sharp sell-off, as expectations for a rate cut build.

-

Qantas lifts after news that CEO Vanessa Hudson’s bonus will be docked following the airline’s recent cyber breach.

Source: AFR, Market Index

🗓️ Key Events This Week:

- US August employment report - tonight

Source: HotCopper

⚡️ Global Renewable Energy News:

BlueScope site ‘the size of Sydney CBD’ put up for $10b industry hub

"A section of BlueScope’s Port Kembla steelworks site, the size of Sydney’s CBD, could be developed into a $10 billion jobs hub as Australia’s largest steelmaker looks to monetise unused parts of its vast real estate portfolio.

A proposal is before the NSW government to rezone 2 million square metres of BlueScope-owned land at the Port Kembla steelworks on the state’s South Coast near Wollongong that would allow industries in the manufacturing, education, technology and renewable energy sectors to transform the area into an employment hub.

BlueScope will still own the land, which covers an area the equivalent size of Circular Quay to Central Station, but the rezoning will allow high-value industries that work alongside the steelworks to develop the area, in what the ASX-listed giant says is one of the largest industrial land revitalisation projects in the world.

The development of the port, which is 90 minutes from Sydney’s CBD, could generate $3.26 billion annually, create 20,000 jobs and double the Illawarra’s $20.6 billion contribution to the NSW economy if it is developed to its full potential, according to BlueScope’s Port Kembla land transformation report.

The development will have an educational aspect as BlueScope is partnering with TAFE NSW, the University of Wollongong and the council.

Source: AFR

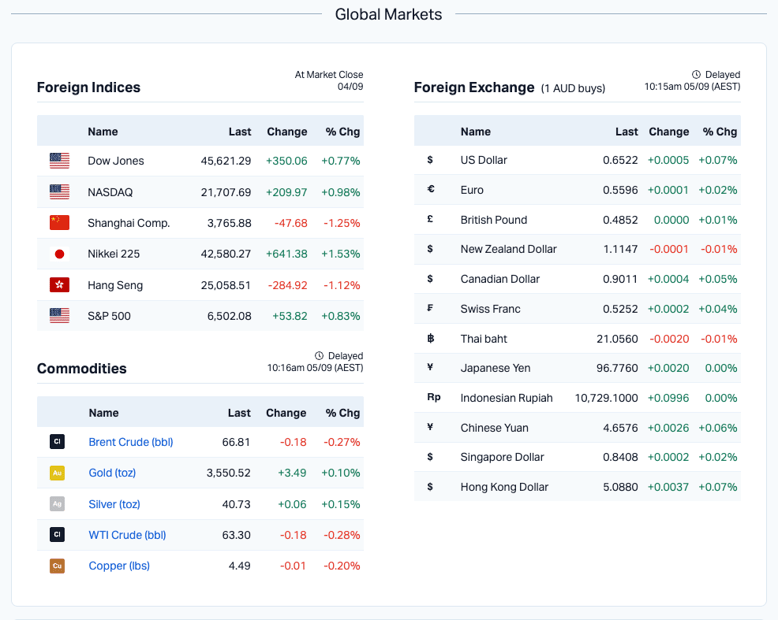

📈 Commodities Price Update:

- Iron ore (Dalian): up 0.71% to US$108.80

- Brent crude: down 61 US cents or 0.9% to US$66.99

- Gold (spot): down US$14.09 or 0.4% to US$3,545.21

- Silver (spot): down 65 US cents or 1.59% to US$40.54

- Copper (LME): down 0.84% to US$9,891.50

- Nickel (LME): down 0.23% to US$15,260

- Lithium carbonate (China spot battery grade): down 1.23% to US$9,271

- Uranium (spot): steady at US$76.25

Source: HotCopper

🌐 Global Commodities Update:

-

Iron Ore: Benchmark ore on the Dalian Exchange edges 0.71% higher to US$108.80 per tonne, as Tangshan steelmakers restart output after parade-related shutdowns, though analysts flag a build-up in construction steel inventories that could pressure demand.

-

Metals: A modest greenback rally sparks profit-taking in precious and industrial metals; spot gold slips 0.4% to US$3,545.21 after hitting record highs, copper retreats 0.84% to US$9,891.50, and nickel, aluminium, zinc, tin and lead all weaken in a broad decline.

-

Oil: Brent crude settles 0.9% lower at US$66.99 a barrel, extending losses as traders brace for OPEC+ to boost output this weekend, raising fears of further supply glut in an already saturated market.

Source: AFR, HotCopper, Market Index

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link