Barclay Pearce Capital

- Mar 6, 2024

- 10 min read

The Morning Market Report - 06 March 2024

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

Overnight Market Highlights:

![]() Wall Street fell overnight.

Wall Street fell overnight.

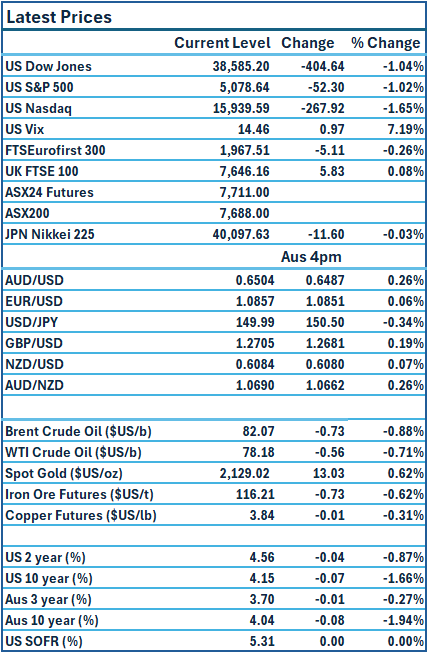

Dow Jones S&P-500 Nasdaq

-1.04% -1.02% -1.65%

___________________ __________________ _________________

ASX is set to open lower this morning.

ASX is set to open lower this morning.

🇺🇸 US Market Overview:

The Update: Stocks fell for a second session Tuesday, as steep declines in major tech names such as Apple dragged the broader market further from the record highs recently reached. Apple slipped almost 3% on the back of a report from Counterpoint Research that found iPhone sales plunged in China in the first six weeks of 2024. One reason cited for the pullback was renewed concern about China’s economy. China's 2024 policy agenda outlined a target GDP growth of around 5%, which has been dubbed ambitious. Data showed U.S. services industry growth slowed in February as employment declined, but a measure of new orders grew to a six-month high, signalling underlying strength in the sector. Source: CNBC, Reuters, AFR

The Impact: The declines in stocks overnight were primarily due to stock-specific news, such as Apple and Tesla reports indicating poor demand for their products. That coupled with concern over China's economic outlook for the year, saw some profit-taking on the mega-cap stocks. Bond yields fell and gold rose overnight as investors indicated a level of uncertainty in the market. Investors are also anxiously awaiting more clues about interest rate policy from economic data, including the crucial non-farm payrolls report, due out on Friday. The outlook for rate cuts still remains priced in for June, as Jerome Powell will speak before lawmakers on Thursday and Friday AEDT. He is expected to remain on the hawkish side as more consistent data is needed before rates can be cut. Source: Reuters

🇦🇺 Australian Market Overview:

- Australia’s current account returned to surplus in the December quarter, as iron ore and coal exports soared in a much-needed boost to the economy, which lessens the risk of a recession. The number came in at a surplus of $11.8 billion. Source: AFR

- GDP data will be released on Wednesday with forecasts suggesting economic activity grew 0.3 per cent in the December quarter, from the third quarter, taking the annual expansion to 1.4 per cent, from 2.1 per cent a year ago. Source: AFR

🇪🇺 European Market Overview:

European stocks closed lower Tuesday as markets struggled to find positive momentum ahead of the European Central Bank meeting later this week. The ECB is expected to hold interest rates steady on Thursday even as inflation shows more signs of easing. Source: CNBC

📈 Global Commodities Update:

Oil prices softened on skepticism over China's economic growth plan ahead of the latest weekly U.S. crude inventory reports. Source: Reuters

Gold touched an all-time high as market participants solidified their bets that the Fed will begin lowering its key policy rate in June. Source: Reuters

⚡ Global Renewable Energy News:

The Australian government plans to create a $2 billion finance program aimed at supporting green energy and infrastructure projects in South-East Asia. This initiative aims to capitalize on the increasing demand for renewable energy in the region leading up to 2050. Prime Minister Anthony Albanese will unveil this facility during a CEO summit held alongside the ASEAN meeting in Melbourne on Tuesday. Source: AFR

📚 European Market Report by Jack Colreavy:

In a boost for UK investments, particularly UK equities, Australia’s largest superannuation fund, AustralianSuper, has made a commitment to invest another £8 billion into the UK by the end of the decade. This will take AustralianSuper’s total investment into the UK to over £18 billion and follows similar commitments from IFM Investors and Aware Super. UK Chancellor of the Exchequer, Jeremy Hunt, isn’t satisfied and is looking to change the rules around pension investment in the UK including a “name & shame” mechanism forcing UK pension funds to disclose how much cash is invested in the UK.

📬 Market Insight by James Whelan:

Brookside Energy (ASX:BRK):

1. Producing oil and gas company based in Oklahoma. Significant cash flow generator with no debt positioned at the beginning of a commodities super cycle.

2. Currently drilling 4 wells in an area of proven oil production. Will double oil and gas production by the end of the year. Have announced a buyback scheduled to begin Oct 24. Recent additions to the Board seem positive for the name.

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer when announced. Until then, sign up and get tipping for Round 1.

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link