Barclay Pearce Capital

- May 8, 2024

- 9 min read

The Morning Market Report - 08 May 2024

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

Overnight Market Highlights:

![]() Wall Street ended mixed overnight.

Wall Street ended mixed overnight.

Dow Jones S&P-500 Nasdaq

+ 0.1% + 0.1% - 0.1%

___________________ __________________ _________________

Australian shares are poised to open higher.

Australian shares are poised to open higher.

🇺🇸 US Market Overview:

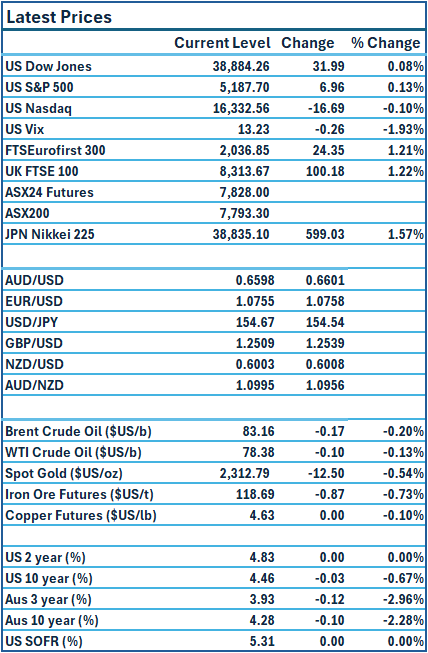

The Update: The S&P 500 and Dow Jones Industrial Average both clung onto gains to end slightly higher on Tuesday, extending recent winning streaks fueled by renewed expectations that the Federal Reserve will cut interest rates this year. Generally, the Fed and policymakers have been consistent in their message in recent weeks that rate cuts will come but the central bank is going to be cautious in implementing them. Source: Reuters

The Impact: Longer-dated Treasury yields slipped as traders focused on absorbing $125 billion in new supply this week, while a parade of Fed officials is lined up to speak on prospects for a 2024 policy pivot. Minneapolis Fed President Neel Kashkari said that the US central bank may need to hold interest rates steady for the remainder of the year. The yield on the benchmark 10-year note fell 3 basis points to 4.459%. Source: Reuters

🇦🇺 Australian Market Overview:

-

ASX futures up 14 points or 0.2% to 7828.

-

The Reserve Bank of Australia left the cash rate on hold at a 12-year high of 4.35 per cent as widely predicted by the market and economists. The central bank also sharply revised its inflation forecast to 3.8 per cent by December from 3.2 per cent, and slightly adjusted its unemployment rate projection to 4.2 per cent from 4.3 per cent. Source: AFR

🇪🇺 European Market Overview:

European markets saw solid gains Tuesday, hitting their highest level in over a month, as traders reacted to a flurry of earnings reports in the region. The regional Stoxx 600 index provisionally closed 1.15% higher, with all sectors in the green. Financial services led gains, up 2.62%. Source: CNBC

📈 Global Commodities Update:

Global oil prices fell on Tuesday on signs of easing supply concerns, while traders shifted their focus to US stockpiles data due on Wednesday. Oil prices found some support from a US government solicitation to buy more than 3 million barrels of oil for the Strategic Petroleum Reserve. Source: CommSec

⚡ Global Renewable Energy News:

Norway’s Statkraft, the biggest renewable energy producer in Europe, is looking to divest a 1.7-gigawatt portfolio of Australian assets in an auction that’s expected to draw a similar crowd of bidders seen at Tetris Energy and Yanco Delta Wind Farm. The up-for-grabs portfolio includes 1.5 GWs of wind and about 200 megawatts of solar generation assets on Australia’s east coast. The six projects are due to commence construction this year and be completed in 2027. Source: AFR

📚 European Market Report by Jack Colreavy:

More focus in the UK is starting to turn to the elections at the end of the year after a string of local elections last weekend. The Conservative Tory party, led by PM Rishi Sunak, seems to be resigning itself to losing power after the party lost 474 councillors and power in 10 councils. Labour picked up 186 new councillors, 8 new councils, and won 10 out of 11 mayoral races. The other top performers were the Liberal Democrats and Greens who picked up 104 and 74 new councillors respectively. Based on these results, probability for a hung parliament in the general election is looking more likely.

📬 Market Insight by James Whelan:

In this Special Edition of "The Theory of Thing Investment Podcast," we explore the dynamic world of investment with a focus on Impact Minerals(ASX: IPT). We uncover the eyebrow-raising story of IPT’s Lake Hope with Mike Jones, the head of an ASX-listed High Purity Alumina(HPA) explorer. Tune in for expert analysis, actionable strategies, and a deeper understanding of the HPA investment landscape.

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer. Sign up and join the game!

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link