Barclay Pearce Capital

- Apr 10, 2024

- 9 min read

The Morning Market Report - 10 April 2024

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

Overnight Market Highlights:

![]() Wall Street finished up mixed overnight.

Wall Street finished up mixed overnight.

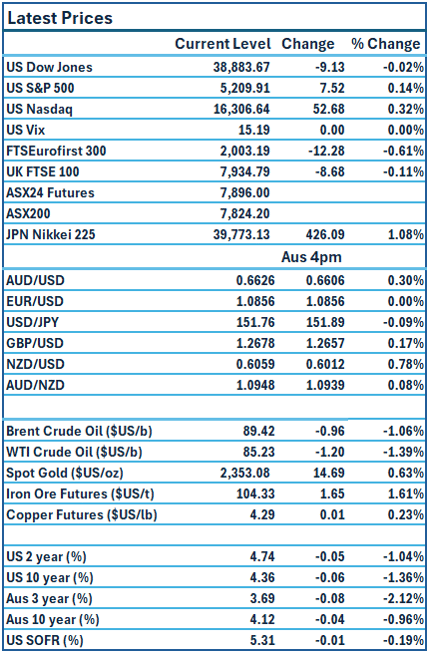

Dow Jones S&P-500 Nasdaq

- 0.02% + 0.14% + 0.32%

___________________ __________________ _________________

ASX futures are set to rise this morning.

ASX futures are set to rise this morning.

🇺🇸 US Market Overview:

The Update: The Nasdaq and S&P 500 posted modest gains on Tuesday, a day ahead of major inflation data, weighed down by financial stocks as investors braced for major U.S. banks to kick off earnings reporting season on Friday. The National Federation of Independent Business reported on Tuesday that small business optimism touched an 11-year low in March, with inflation as the most pressing concern. Source: Reuters

The Impact: Treasuries climbed, with 10-year yields dropping from the highest levels in 2024. US Federal Reserve Bank of Atlanta President Raphael Bostic reiterated his expectation for one interest rate cut this year. Bostic says that weakness in the labour market could prompt him to consider earlier and more cuts. Source: Reuters, AFR

🇦🇺 Australian Market Overview:

-

ASX futures were up 30 points or 0.4 per cent to 7895.

-

Westpac’s sentiment survey showed consumers’s mood turned darker in April as households remained concerned about their finances amid high borrowing costs. Source: AFR

🇪🇺 European Market Overview:

European markets closed lower Tuesday as investors look ahead to more key economic data this week, including U.S. inflation figures out Wednesday. The Stoxx 600 index closed down 0.6%, with the majority of sectors in negative territory following solid gains on Monday. Insurance stocks led losses, falling 1.4%, while mining stocks rose 1.3%. Source: CNBC

📈 Global Commodities Update:

Global oil prices fell for a second day on Tuesday, as talks for a ceasefire in Gaza continued, but losses were limited as Egyptian and Qatari mediators met resistance in their search to find a way out of the war. Source: CommSec

Spot gold hit a record high for the eighth session in a row, supported by central bank buying and heightened geopolitical tensions, according to analysts. Source: Reuters

⚡ Global Renewable Energy News:

Fortescue's new $116 million electrolyser plant in Gladstone, Queensland will officially open today, marking a significant step for the mining company in its green hydrogen production efforts. With nearly half of the funding coming from the Commonwealth, this facility is Australia's first capable of manufacturing hydrogen electrolysers on a commercial scale. It has the capacity to produce over 2 gigawatts annually. Situated on a 100-hectare site in Gladstone, this factory is the initial stage of Fortescue's broader manufacturing hub development. Future plans include the establishment of a hydrogen system testing facility and the implementation of Fortescue's proton exchange membrane green hydrogen project. Source: AFR

📚 European Market Report by Jack Colreavy:

The UK is going backwards in its energy security pledges according to new research from the Energy and Climate Intelligence Unit (ECIU). Out of the ten major commitments to boost energy security made two years ago, only three have been achieved. Some of the commitments behind schedule include retrofitting housing for electrification, delivering new offshore wind project CFDs, and setting out a new nuclear roadmap to deliver eight new power stations in the next eight years. The ECIU claims that the UK is “still going backwards” on its energy strategy and remains highly dependent on foreign imports.

📬 Market Insight by James Whelan:

Hydrogen Special - Theory of Thing:

Is there a future in passenger vehicles using hydrogen and how would that happen? Have the new hydrogen discoveries changed the value proposition for green and blue hydrogen? Find out here as James Whelan is joined by BPC's London head Jack Colreavy.

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer. Sign up and join the game!

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link