Barclay Pearce Capital

- Mar 13, 2024

- 10 min read

The Morning Market Report - 13 March 2024

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

Overnight Market Highlights:

![]() Wall Street stocks rose overnight.

Wall Street stocks rose overnight.

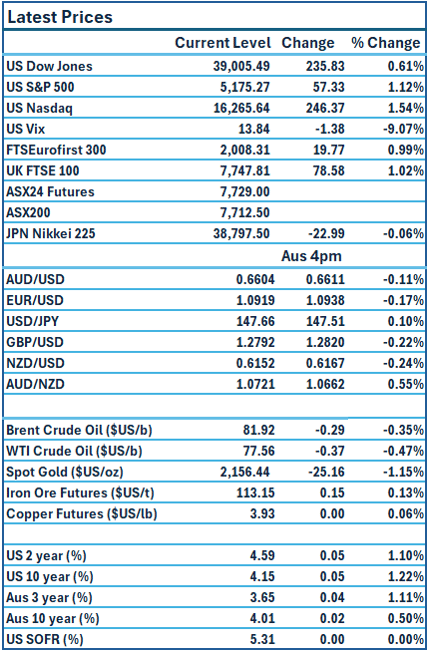

Dow Jones S&P-500 Nasdaq

+0.61% +1.12% +1.54%

___________________ __________________ _________________

ASX is set to open higher this morning.

ASX is set to open higher this morning.

🇺🇸 US Market Overview:

The Update: Stocks jumped Tuesday after fresh U.S. inflation data was about in line with expectations. The consumer price index climbed 0.4% in February and 3.2% year over year, the Bureau of Labor Statistics said on Tuesday. Economists polled by Dow Jones expected a 0.4% increase last month and 3.1% year over year. Core inflation, which strips out food and energy from the headline reading, climbed 0.4% in February, compared to a forecast gain of 0.3%. Source: CNBC

The Impact: Bond traders reacted to the inflation data by pushing yields higher in a signal they’re less optimistic about the pace of US Federal Reserve interest rate cuts. The benchmark US 10-year yield climbed 5 basis points to 4.15 per cent, with the US 2-year treasury advancing to 4.6 per cent. National Australia Bank said interest rate futures traders now expect 85 basis points of cuts in 2024, versus 91 basis points before the inflation data. The data being slightly stronger than expected did not phase the markets, as more data needs to be seen by the Fed. Now all paths lead to June being the beginning of the rate-cutting cycle. Source: AFR

🇦🇺 Australian Market Overview:

-

ASX futures up 12 points or 0.2% to 7727.

- Business conditions improved in February as the economy remained robust in the new year amid elevated inflation and slowing growth, a National Australia Bank (NAB) survey showed on Tuesday. Retail price growth, in particular, rose sharply to 1.4% in quarterly terms after slowing over the Christmas/New Year period, in a sign that further progress on inflation is unlikely to be smooth over the months ahead. NAB’s index of business confidence index fell 1 point to 0 index points, and the index of business conditions rose 3 points to +1. Source: AFR

- ANZ expects the Reserve Bank of Australia to shift to a neutral stance by the May meeting. “We continue to favour a November start to the rate cut cycle,” said Adam Boyton, head of Australian economics at ANZ. Source: AFR

🇪🇺 European Market Overview:

European markets closed higher on Tuesday as global investors digested the latest U.S. inflation report. The Stoxx 600 index closed up 1%, extending the morning’s gains. Sectors mostly ended the session in the green, with autos up 2.4%, while utilities fell 1.2%. Source: CNBC

📈 Global Commodities Update:

Global oil prices dipped on Tuesday after the US Energy Information Administration (EIA) raised its 2024 outlook for domestic oil output growth by 260,000 barrels per day to 13.19 million barrels, versus a previously forecast rise of 170,000 bpd. The boosted forecast could be due to higher assumed oil prices, said UBS analyst Giovanni Staunovo. Source: CommSec, Reuters

⚡ Global Renewable Energy News:

Investment in fresh, large-scale renewable energy capacity plummeted by nearly 80% last year due to various challenges such as grid constraints, sluggish planning processes, delays in environmental approvals, increased expenses, and a tight labour market. Kane Thornton, CEO of the Clean Energy Council, characterised 2023 as a particularly challenging year. The industry's leading body reported that new financial commitments for replacing generation to compensate for the closure of coal-fired power stations dropped to $1.5 billion, down from $6.5 billion in 2022. This marked the lowest level of new commitments to large-scale renewables - considered a crucial indicator for future growth - since the CEC began monitoring investment in 2017. Source: AFR

📚 European Market Report by Jack Colreavy:

The Sterling has had a strong start to the year outperforming 90% of the world’s currencies in 2024 YTD. Against the US Dollar, the pound has climbed to US$1.288, its highest level since July 2023. This is in contrast to a low in Oct 2023 of US$1.21. The strength in the currency is an indication from the market that the domestic economy has turned a corner as real income growth continues and inflation dissipates.

📬 Market Insight by James Whelan:

Wellnex Life (ASX:WNX) recently released their half-yearly and I'm happy to say the runway is clear.

- Strong start to the second half of FY24 with brand sales for the first 2 months of $2.3 million at a margin of 45%.

- February brand sales were $1.43 million and an operating profit of $301,000.

All the plans for the company once the Pain Away acquisition was done are now in play. Expect the revaluation of the stock to take place over the coming weeks as this is realised.

(Full disclosure, we have clients who hold WNX and we recently raised money for them)

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer when announced. Until then, sign up and get tipping for Round 1.

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link