Barclay Pearce Capital

- Sep 17, 2025

- 10 min read

The Morning Market Report - 17 September 2025

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

Overnight Market Highlights:

![]() UUS stocks eased slightly ahead of tonight’s Fed decision, with the S&P 500, Nasdaq, and Dow all edging lower as markets priced a near-certain 25 bp cut while dismissing odds of a larger move.

UUS stocks eased slightly ahead of tonight’s Fed decision, with the S&P 500, Nasdaq, and Dow all edging lower as markets priced a near-certain 25 bp cut while dismissing odds of a larger move.

Dow Jones S&P-500 Nasdaq

- 0.30% - 0.10% - 0.70%

___________________ __________________ _________________

The ASX 200 edged 0.3% higher to 8,877.7, led by mining gains on stronger iron ore, while the Aussie dollar hit a 10-month high ahead of the Fed’s rate decision.

The ASX 200 edged 0.3% higher to 8,877.7, led by mining gains on stronger iron ore, while the Aussie dollar hit a 10-month high ahead of the Fed’s rate decision.

Stock of Note:

Broken Hill Mines Impact Minerals Locksley Resources Pilbara Minerals

(ASX: BHM) (ASX: IPT) (ASX: LKY) (ASX:PLS)

0.580 AUD 0.085 AUD 0.620 AUD 2.170 AUD

- 3.3% + 6.3% +26.5% +0.5%

___________________ __________________ __________________ __________________

Step One Clothing Fenix Resources Emmerson Resources Silver Mines Limited

(ASX: STP) (ASX: FEX) (ASX:ERM) (ASX:SVL)

0.550 AUD 0.400 AUD 0.250 AUD 0.150 AUD

- 1.8% + 0.0% +2.0% -3.2%

___________________ ___________________ ___________________ ___________________

Ark Mines Limited

(ASX:AHK)

0.315 AUD

+ 3.1%

___________________

🇺🇸 US Market Overview:

- US equities eased slightly as traders trimmed positions ahead of tonight’s Fed decision, with the S&P 500 closing 0.13% below its record, the Nasdaq down 0.07%, and the Dow off 126 points (-0.27%).

- Futures priced a 96.1% chance of a 25 bp rate cut, while odds of a larger 50 bp move sat at just 3.9%, with strategists warning a bigger cut would look politically driven.

- In Fed developments, an appeals court rejected Trump’s bid to remove Governor Lisa Cook, while the Senate confirmed economic adviser Stephen Miran to the Fed board.

Source: AFR, Hot Copper

🇦🇺 Australian Market Overview:

- The S&P/ASX 200 rose 24.7 points, or 0.3%, to 8,877.7, with eight of 11 sectors higher; the All Ordinaries also gained 0.3% as the Australian dollar hit a 10-month high at US66.76¢.

- Materials led gains as miners tracked stronger iron ore (~US$107/t), with BHP up 0.5%, Rio Tinto 1.9% and Fortescue 1.1%.

- Local shares opened weaker as Wall Street’s rally lost steam ahead of the Federal Reserve’s rate decision and outlook.

Source: AFR, Market Index

🗓️ Key Events This Week:

- US interest rate decision - tonight

Source: HotCopper

⚡️ Global Renewable Energy News:

Renewables hit fresh speed bump as Victoria delays offshore wind plans

"The Victorian government has pushed back its timeline for the rollout of offshore wind farms in Gippsland after developers said they were not willing to progress their projects without certainty over government funding support.

Victorian Energy Minister Lily D’Ambrosio told an industry conference on Tuesday that the state’s plan to hold a competitive auction for project underwriting in September had been indefinitely delayed at the request of developers.

The announcement comes just days before the federal government announces its 2035 emissions reduction target. The transition of Australia’s electricity system to renewables will contribute to the vast bulk of emissions cuts to 2030 and beyond.

Victoria is banking on having two gigawatts of offshore wind power up and running by 2032 and four gigawatts by 2035, which underpins the Allan government’s broader goal to have 95 per cent of its electricity sourced from renewables by 2035."

Source: AFR

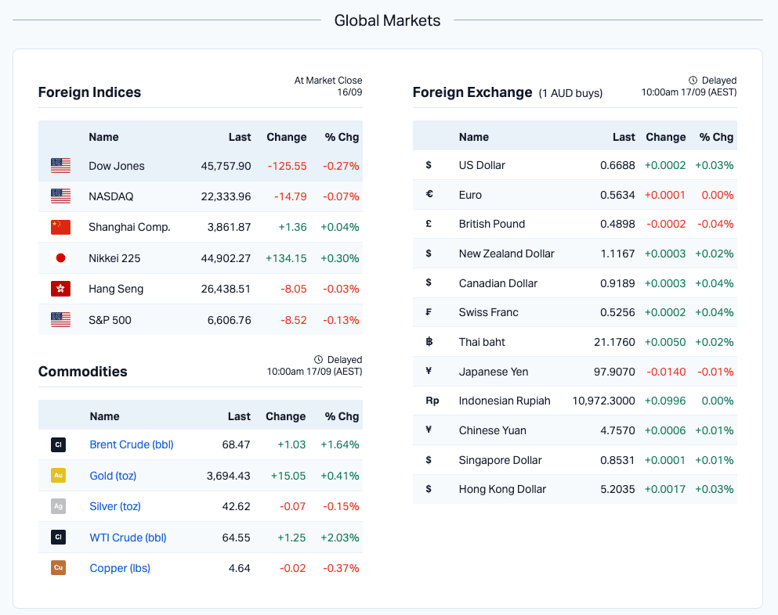

📈 Commodities Price Update:

- Iron ore (Dalian): up 0.82% to US$112.94

- Brent crude: up US$1.03 or 1.53% to US$68.47

- Gold (spot): up US$10.51 or 0.29% to US$3,689.91

- Silver (spot): down 11 US cents or 0.26% to US$42.58

- Copper (LME): down 0.68% to US$10,117

- Nickel (LME): up 0.13% to US$15,445

- Lithium carbonate (China spot battery grade): up 0.63% to US$9,035

- Uranium (spot): up 0.33% to US$76.25

Source: HotCopper

🌐 Global Commodities Update:

- Gold: Spot gold traded above US$3,700/oz for the first time before easing to US$3,689.91 (+0.29%), while US futures settled at a record US$3,725.10; however, the NYSE Arca Gold BUGS index slipped 2.34% as miners lagged.

- Iron Ore: Prices rebounded 0.82% to US$112.94/t on stronger Chinese steel output, though BHP (-1.26%) and Rio Tinto (-0.44%) retreated in US trade.

- Copper: Pulled back 0.68% to US$10,117/t on profit-taking ahead of the Fed’s rate decision, after touching a 15-month high.

- Oil: Brent crude rose US$1.03 or 1.53% to US$68.47/bbl as Ukrainian strikes on Russian refineries fueled supply concerns.

Source: AFR, HotCopper

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link