Barclay Pearce Capital

- Mar 20, 2024

- 10 min read

The Morning Market Report - 20 March 2024

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

Overnight Market Highlights:

![]() Wall Street advanced higher overnight.

Wall Street advanced higher overnight.

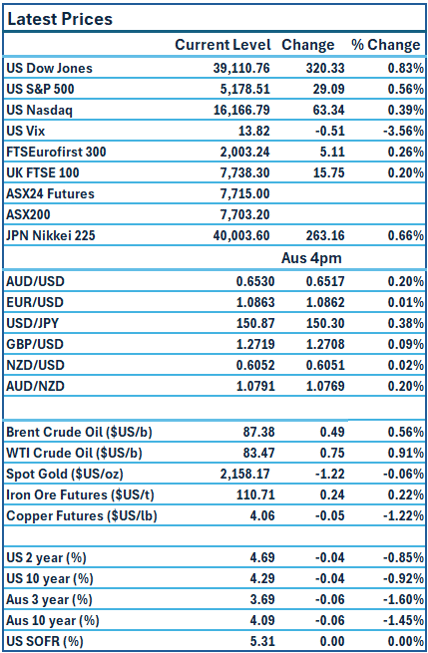

Dow Jones S&P-500 Nasdaq

+0.83% +0.56% +0.39%

___________________ __________________ _________________

ASX is set to open slightly higher this morning.

ASX is set to open slightly higher this morning.

🇺🇸 US Market Overview:

The Update: Wall Street's three major indexes closed higher on Tuesday, extending gains seen on Monday. Shares in Nvidia bounced off early losses and investors looked ahead to the Federal Reserve's policy meeting conclusion on Wednesday for clues on interest rate policy. Shares in Nvidia closed up 1% after it revealed pricing and shipment plans for its hotly anticipated Blackwell B200 artificial intelligence chip, which it says could be 30 times faster than current chips. The central bank is expected to keep rates unchanged Wednesday. Source: Reuters, CNBC

The Impact: Robust inflation data has pulled back bets for the first rate cut in June to about 59% from about 69% at the start of last week, according to the CME FedWatch Tool. Fed chairman Jerome Powell is expected to reiterate that the central bank is keen for more evidence that inflation is cooling, and he’s likely to temper near-term bets for a rate cut. Treasury yields dipped broadly, boosting stocks. The rate on the benchmark 10-year Treasury was down more than 4 basis points at 4.295%. Source: Reuters, CNBC, AFR

🇦🇺 Australian Market Overview:

-

ASX futures up 13 points or 0.2% to 7715.

-

The RBA yesterday held the cash rate at 4.35% which was widely expected. The Australian dollar fell about 30 pips to 65.2c from 65.6c after the decision. In a press conference completed after the decision had been handed down, RBA governor Michele Bullock said data suggested the central bank was “on the right track” in its battle against inflation, but stressed the outlook for the cash rate remained uncertain. In a more dovish outlook, the RBA post-meeting statement that "the board is not ruling anything in or out", was a shift from February's statement that "a further increase in interest rates cannot be ruled out”. Source: AFR

🇪🇺 European Market Overview:

European markets closed slightly higher Tuesday, as global investors looked to the start of the U.S. Federal Reserve’s two-day policy meeting. Source: CNBC

📈 Global Commodities Update:

Global oil prices rose to multi-month highs for the second straight session on Tuesday, as traders assessed how Ukraine's recent attacks on Russian refineries would affect global petroleum supplies. Source: CommSec

⚡ Global Renewable Energy News:

On Wednesday, the U.S. Department of Energy announced the allocation of $750 million to initiatives spanning 24 states aimed at enhancing the capability to generate and utilise clean hydrogen. This fuel, deemed vital by President Joe Biden's administration, is pivotal in mitigating fossil fuel consumption and curbing emissions from industries like aluminium and cement that are challenging to decarbonise. The supported projects focus on various facets of the hydrogen sector, encompassing research and development of electrolyser production, ensuring robust supply chains for these devices, and implementing strategies for recycling essential materials like iridium used in hydrogen production. Source: Reuters

📚 European Market Report by Jack Colreavy:

A recent Lloyds survey is demonstrating positive sentiment that the UK economy is bouncing back as most sectors return to growth. In the surveys, 10 out of 14 participants reported an expansion in output which is two more than in January and the most since April 2023. This comes off the back of positive GDP data that showed a return to growth in January at 0.2% for the month. All signs are positive for 2024 to be a bumper year for the UK.

📬 Market Insight by James Whelan:

Something there is that doesn't love a mining conference?

Day 1 Recap of the Mining News Select Mining Conference with some good meetings and some just filling in the time (welcome to the show).

This isn't the tip of the day but I met the Stelar Metals CEO. Lithium in Broken Hill and they're having a hard time of it. Oddly enough currently trading at a cash-to-market cap ratio of *checks notes* ... 1x.

But for mine the blowaway presentation was Cavalier Resources, looking for gold and nickel in WA. Conviction shown by the CEO to bring finds to production and the capability to do so. They just released a PFS for one of their gold tenements with a greatly upgraded reserve. I'll do more digging but keep an eye on CVR.

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer. Sign up and join the game!

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link