Barclay Pearce Capital

- Feb 28, 2024

- 9 min read

The Morning Market Report - 28 February 2024

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

Overnight Market Highlights:

![]() Wall Street was mixed overnight.

Wall Street was mixed overnight.

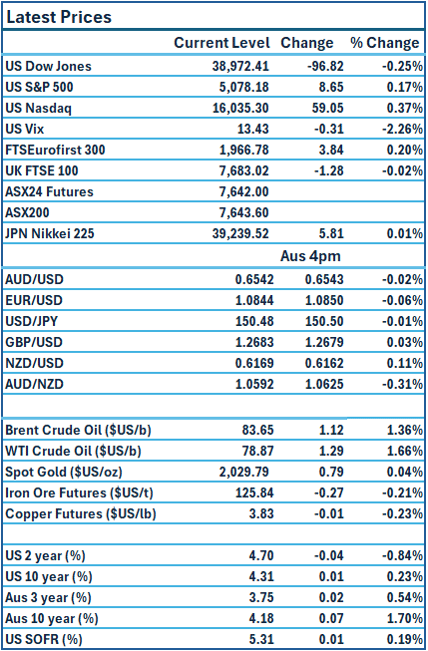

Dow Jones S&P-500 Nasdaq

-0.25% +0.17% +0.37%

___________________ __________________ _________________

ASX is set to open higher this morning.

ASX is set to open higher this morning.

🇺🇸 US Market Overview:

The Update: The S&P 500 and the Nasdaq Composite ended Tuesday’s session with modest gains as investors prepared for key inflation data to be released later this week. Consumer confidence slipped in February as worries escalated over a potential labor market slowdown and an uncertain political environment, according to a Conference Board gauge released Tuesday. Data from the U.S. Department of Commerce released on Tuesday showed that orders for long-lasting goods declined more than expected in January. Source: CNBC

The Impact: The spotlight is on Thursday's January personal consumption expenditures price index (PCE), the Fed's preferred inflation gauge. Should the PCE reading resemble recent inflation readings on consumer and producer prices, it could compel the Fed to hold rates at current levels longer than the market is anticipating. Fed Governor Michelle Bowman on Tuesday indicated she is in no hurry to cut rates, given upside risks to inflation that could stall progress or even cause price pressures to resurge. Other data due this week that could help shape expectations from the Fed include the second estimate of gross domestic product, jobless claims and manufacturing activity. Source: Reuters

🇦🇺 Australian Market Overview:

-

ASX futures up 11 points or 0.1% to 7632.

-

Today is set as the most important day of the week with Australia's January CPI on the schedule and a policy meeting at the Reserve Bank of New Zealand. The RBNZ now has a 20% chance of rising interest rates. This is a stark contrast to most other advanced economies - the US, Europe, the UK and Australia will most likely be down - not up. Source: AFR

🇪🇺 European Market Overview:

Europe markets on Tuesday closed slightly higher, amid shaky global sentiment and ahead of U.S. and European inflation data later in the week. The Stoxx 600 index ended up 0.2%, with most sectors in positive territory. Mining stocks gained 1.7%, while media stocks fell 1.1%. Source: CNBC

📈 Global Commodities Update:

Oil rose overnight, bolstered by pockets of strength in physical crude markets, while traders weighed the potential for OPEC+ to extend its output cuts. Source: AFR

⚡ Global Renewable Energy News:

Vietnam's goal is to generate between 100,000 to 500,000 metric tons of hydrogen annually by 2030 as a crucial aspect of its energy transition strategy, as outlined in its recent hydrogen development plan. By 2050, this production target is set to surge to 10-20 million tons, encompassing green hydrogen, according to a government report examined by Reuters. This initiative to produce, distribute, and utilize hydrogen is aimed at fulfilling the nation's objectives concerning climate action, sustainable development, and achieving net zero emissions by 2050, as stated in the document. Source: AFR

📚 European Market Report by Jack Colreavy:

Great news for green hydrogen power with Geopura securing a £56m investment which includes £30m from the UK Infrastructure Bank. The financing will increase the manufacture and supply of Geopura’s hydrogen power units (HPUs) that aim to displace the estimated US$300b installed base of diesel generators. The hydrogen train keeps rolling.

📬 Market Insight by James Whelan:

Brookside Energy (ASX:BRK):

1. Producing oil and gas company based in Oklahoma. Significant cash flow generator with no debt positioned at the beginning of a commodities super cycle.

2. Currently drilling 4 wells in an area of proven oil production. Will double oil and gas production by the end of the year. Have announced a buyback scheduled to begin Oct 24. Recent additions to the Board seem positive for the name.

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season is set to kick off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer when announced. Until then, sign up and get tipping for Round 1.

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link