Barclay Pearce Capital

- Feb 7, 2024

- 9 min read

The Morning Market Report - 7 February 2024

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

Overnight Market Highlights:

![]() Wall Street ended up on Tuesday.

Wall Street ended up on Tuesday.

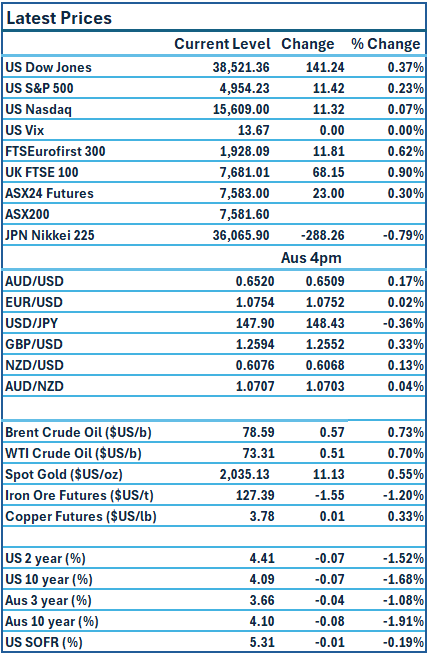

Dow Jones S&P-500 Nasdaq

+0.4% +0.2% +0.07%

___________________ __________________ _________________

ASX is set to rise this morning.

ASX is set to rise this morning.

🇺🇸 US Market Overview:

The Update: Stocks rose on Tuesday as Wall Street assessed the latest batch of corporate earnings and the timeline for rate cuts from the Federal Reserve. Federal Reserve Bank of Cleveland president Loretta Mester suggested she’s not in a rush to begin cutting interest rates, saying policymakers will probably gain confidence to cut rates “later this year” if the economy evolves as expected. Minneapolis Fed President Neel Kashkari said the central bank is "not done yet" with inflation although he noted it had come down quickly with three-month and six-month inflation data "basically" at the Fed's 2% goal. Source: CNBC, Reuters, AFR

The Impact: This morning's market sentiment has been tempered by recent statements from Federal Reserve Governors. Expectations for rate cuts in March and May have been diminished, leading the market to anticipate cuts later in the year. Overnight, there was minimal activity in response to the absence of significant US economic data. Treasury yields held steady above 4%, influenced by the hawkish tone of the Federal Reserve Governors' remarks. As earnings reports for the previous quarter continue to roll in, over half of S&P 500 companies have shown an impressive year-over-year increase of more than 8%. Source: Reuters, CNBC

🇦🇺 Australian Market Overview:

- ASX futures up 50 points or 0.7% to 7583.

-

The RBA board on Tuesday left the cash rate unchanged at 4.35 per cent and indicated cuts were unlikely in the immediate term. Reserve Bank governor Michele Bullock says she is yet to be convinced inflation is on a sustainable path back to target. NAB forecasts have one rate cut priced in before the year end. Source: AFR

- National Australia Bank Group CEO and managing director Ross McEwan will step down from the role in April. Source: AFR

🇪🇺 European Market Overview:

European markets closed higher Tuesday, as investor confidence remained robust despite the lack of a clear timetable for interest rate cuts. Source: CNBC

📈 Global Commodities Update:

Oil prices rose Tuesday as U.S. domestic crude production is expected to plateau this year after setting a record in 2023. Source: CNBC

⚡ Global Renewable Energy News:

The German government has approved a plan to provide $17 billion in subsidies for gas power plants capable of transitioning to hydrogen, according to the economy ministry. This initiative aims to support renewable energy and accelerate the shift to low-carbon generation. The ministry suggests developing hydrogen transition plans by 2032 to facilitate the complete switch to hydrogen in these plants between 2035 and 2040. Germany has committed to tendering 8.8 GW of new hydrogen plants, along with up to 15 GW initially running on natural gas before transitioning to the hydrogen grid by 2035 at the latest, as agreed with the European Commission last year. Source: Reuters

📚 European Market Report by Jack Colreavy:

Commercial property is in a tailspin globally but the extent was recently highlighted in London when a 12-storey tower in Canary Wharf, an unofficial financial district, has reportedly been sold for a 60% loss on its 2017 purchase price. The news is another nail in the coffin of Canary Wharf following the planned exit of major banking tenants such as HSBC, who plan to move back into the city. It is likely we will see the conversion of these towers to residential as the demand for commercial real estate wanes due to hybrid work cultures.

📬 Market Insight by James Whelan:

A few weeks back I posted a buy thesis on China A Shares. And wow was that a tense few days. A fair amount of the Chinese market went “limit down” on Monday over fears of…everything.

However, we held firm (as good value investors do) and our chosen ETF CETF never really saw an awful day and is now looking strong as an ox.

Product choice and conviction will usually win in the end.

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link