Jack Colreavy

- Jun 13, 2023

- 4 min read

ABSI - The PGA Tour, DP World Tour, and LIV Golf Merger: A Controversial Unification Under Scrutiny

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

The golf world was abuzz last week with the announcement of a merger between the PGA Tour, the DP World Tour (European PGA Tour), and the Saudi-backed disrupter LIV Golf. The response to the announcement has been varied, to say the least, with many praising the unification of the game while others are calling hypocrisy on the PGA for caving to pressure so quickly and accepting investment from the Saudi Arabia Public Investment Fund (PIF). ABSI loves an M&A story and this week will review the biggest corporate news in sport this year and outline why it will probably fall apart.

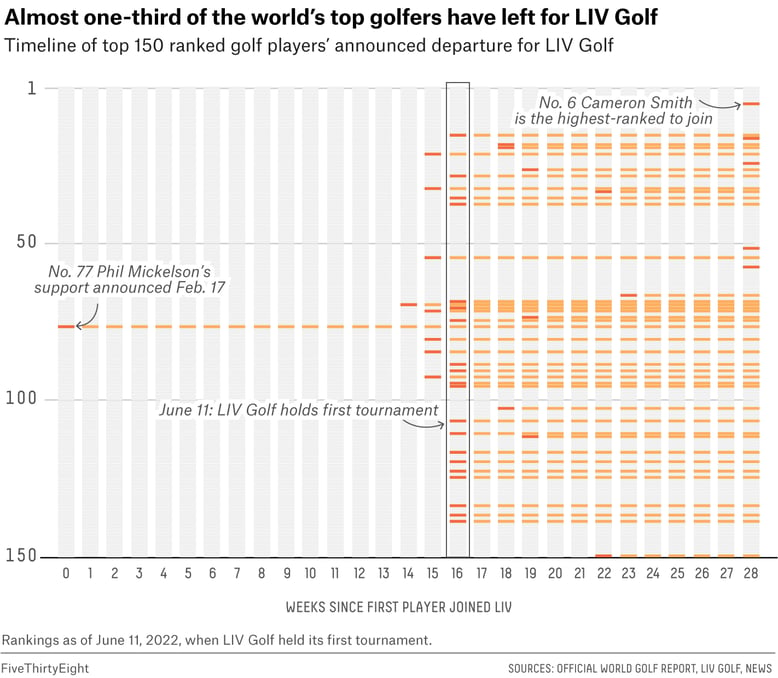

The world of professional golf was thrown into the spotlight in 2022 when an upstart golf tour, LIV Golf (Roman numerals for 54), launched with the backing of the Saudi PIF, among the world's largest sovereign wealth funds with ~US$620 billion in assets. The disruptor was quick to make its mark, using US$100m+ signing bonus as a way to lure the biggest names in professional golf to come play for the new tour including hall of famer Phil Mickelson, reigning PGA Champion Brooks Koepka, and reigning British Open champion Cam Smith; in all LIV managed to sign 7 of the top 10 golfers.

Source: FiveThirtyEight

Founded in 1929, the PGA Tour is the largest professional golf tour in the world which operates a number of tournaments globally to its members. The PGA Tour operates an interesting business model in that it's a not-for-profit and that in order to become a member, a golfer must subcontract and licence their image to the PGA Tour. In exchange, the golfer is able to compete in PGA events for prize money. Importantly, the PGA has exclusive rights to the golfer and must obtain permission from the PGA to compete in other events.

Ultimately the PGA exclusivity resulted in those players moving to LIV golf having to resign from the PGA and being banned from PGA events. The biggest consequence of this action was that LIV events weren’t eligible for world ranking points and would exclude these players from the golf major events, which aren’t run by the PGA but form the field based on the world ranking.

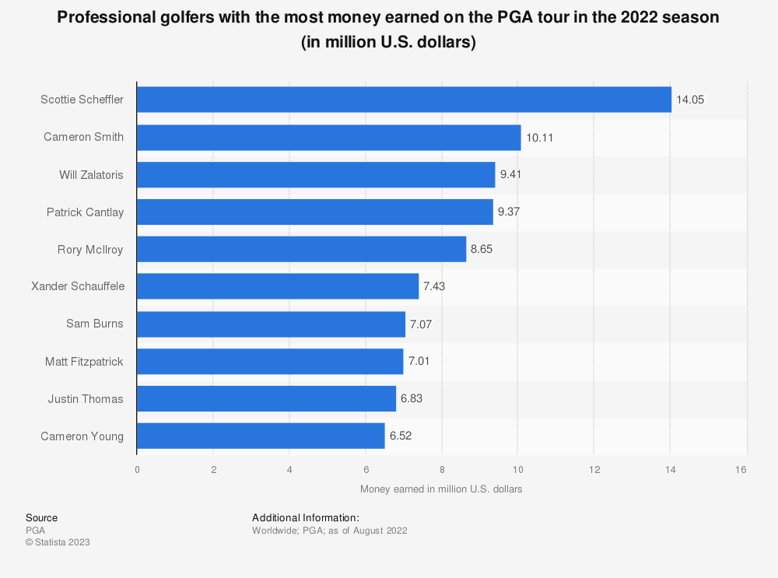

Source: Statista

There are many reasons why people are against LIV golf such as breaking tradition with new formats and fracturing the game by causing animosity between players. However, the biggest contention is the fact that the sport is bankrolled by the Saudi PIF, a country with a horrendous human rights track record that is attempting to “sportswash” their history. While conscious of sports-washing, I am in favour of LIV golf as a tour that is reinvigorating the sport for a younger audience and recognising players by paying them more. For context the PGA Tour’s annual wage bill is ~US$183m with the CEO, Jay Monahan, making US$14.2m in 2020 according to the Wall Street Journal.

Therefore it came as a huge surprise to the world when the merger was announced last week with many crying hypocrisy at the PGA at condemning their own players for taking Saudi money and then turning around and orchestrating a merger. Details are still light but the nucleus will be to form a new for-profit company that will hold the commercial interests of all three entities and will be run by Jay Monahan with the board chaired by Saudi PIF chair Yasir Al-Rumayyan.

In my opinion, I don’t see the merger completing for a myriad of reasons, the biggest being antitrust lawsuits. Currently, the PGA and LIV are in a heated battle in the courts with LIV suing on antitrust grounds claiming monopolistic behaviour while the PGA has countersued on the poaching of PGA players. With the merger, these suits will be dropped but it opens the door for the US Federal Trade Commission (FTC) to lodge its own antitrust suit. Despite each tour continuing to operate independently, the fact that they will be united under common ownership will come under intense scrutiny. Moreover, the merger will become a political pawn with politicians likely to weaponise the issue of the Saudi PIF owning a large ownership stake in the largely American PGA Tour likely to not sit well with American voters.

Don’t expect the story to end here.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link