Jack Colreavy

- Sep 19, 2023

- 5 min read

ABSI - UAW Strike Throws a Spanner in the US Manufacturing Renaissance

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

The biggest financial news story of the past week has been the United Auto Workers (UAW) decision to strike after its contract expired last Thursday. The UAW has 145k members working for the big three US automakers General Motors, Ford, and Stellantis. ABSI will review the strike actions and infer the broader implications not just for the auto industry but for the recent renaissance in US manufacturing.

The biggest financial news story of the past week has been the United Auto Workers (UAW) decision to strike after its contract expired last Thursday. The UAW has 145k members working for the big three US automakers General Motors, Ford, and Stellantis. ABSI will review the strike actions and infer the broader implications not just for the auto industry but for the recent renaissance in US manufacturing.

For the first time in history, the UAW is striking across all three of the automakers which will result in a material slowdown in auto manufacturing across the US. The strikes came as a result of the current contract expiring and all parties being miles apart on a new agreement. UAW negotiators are shooting for the stars with demands for a 40% pay increase over four years with a 4-day work week, the reinstatement of defined-benefit pensions, and other additional benefits. So far, the automakers have come to the table with a 20% increase.

Source: Bloomberg

It is important to note that the entire workforce hasn’t walked off the job, only ~13k across three plants, one for each automaker, have been affected at this stage. This has been a strategic move on the UAW’s part as striking members are eligible for US$500/week from the union’s strike fund. However, the slowing/stopping of specific parts can cause the whole supply chain to break down, inflicting the most financial pain on the parent companies while minimising the financial burden on the UAW, thus enabling an extended walkout.

Potentially the biggest benefactor from the strike action is Tesla, which famously resisted unionisation of workers early in the Company’s life and has used technology to maximise the efficiency of human capital. In a recent post on X, Elon Musk claimed that “we pay more than the UAW btw, but performance expectations are also higher.” According to industry estimates, UAW worker unit labour costs are US$66/hour compared to Tesla’s US$45/hour. Due to non-unionisation, Tesla has significantly lower cash hourly wage costs but makes up for the deficit with non-cash stock options in Tesla. I don’t think it's hyperbole when Musk claims that Tesla has made some of his factory techs millionaires.

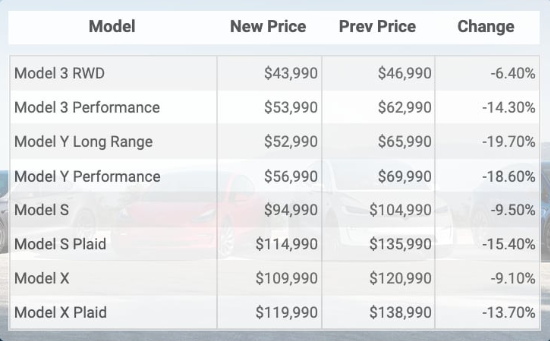

Regardless of the outcome of the negotiations, any deal will put further inflationary pressures on American-made autos from the three companies responsible for iconic models such as the Ford F150, Jeep Wrangler, and Chevrolet Colorado. This also comes at a time when Tesla has been squeezing rivals' ability to compete by aggressively lowering prices.

Contributions to real GNI per person growth (measured in percentage points)

Source: Not a Tesla App

Outside of the auto industry, the effects will be felt throughout the wider US economy and globally. While striking workers receive compensation from the UAW, the $500 is only about 40% of the weekly wage. Additionally, the follow-on effects on halting production in other factories will mean layoffs for workers and an increase in unemployment benefits being paid by the welfare system. Importantly, it would be just workers for the three auto companies affected but essentially the whole global supply chain will likely see layoffs. The result of this domino effect will be lower economic growth and higher prices for new cars unless the strike is solved quickly.

Source: Colliers

The whole situation puts a closer lens on the recent re-industrialisation of America through deglobalisation. The Covid pandemic exposed the flaws of a distributed manufacturing system, particularly concentrated in Asia. As a result, a movement has begun, particularly in the USA, to bring manufacturing back within the borders (or at least closeby e.g. Mexico). While well-intentioned government policy to subsidise new manufacturing jobs in America is having the desired investment effect, it is also exposing the critical flaw - lack of qualified human capital. A country can’t just switch on new manufacturing by building a plant; it requires large amounts of human capital that needs to be trained. Consequently, the squeeze in qualified labour supply has increased workers’ bargaining power giving unions confidence to strike in order for corporations to meet their demands.

Closing the gap on wage inequality is important but we live in a global capitalist society and overreaching by unions may see strikers join the unemployment line if they push too hard. Just ask the Teamsters union which recently contributed to the bankruptcy of US trucking giant Yellow Corp. Let's hope it doesn’t get that far.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link