Jack Colreavy

- Mar 21, 2023

- 4 min read

ABSI - Credit Suisse and UBS Shotgun Marriage Shakes EU Debt Market

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

The banking crisis continues with contagion spreading from the US to the EU resulting in a shotgun arranged marriage between Credit Suisse and UBS. While problems at Credit Suisse aren’t new or surprising, the emergency transaction put together over the weekend was controversial and may cause more damage than good. ABSI examines the fallout of the latest bank failure.

It is important to appreciate the issues at Credit Suisse are not new, they have been rooted for some time. In 2018, shares were trading at ~US$17 a share but poor risk management resulted in billions of dollars of losses. The current macroeconomic environment, which saw billions in unrealised losses as a result of rapid interest rate rises, resulted in billions in withdrawals from the bank putting the final nail in the coffin.

Source: Google Finance

Despite shares trading at an anaemic ~1.92CHf per share last Friday, the UBS acquisition deal was finalised at 0.76CHf valuing the equity at 3 billion CHf. The most controversial parts of the deal were the Additional Tier 1 (AT1) bonds, valued at 16 billion CHf, were written down to zero and that shareholders won’t get to vote on the transaction.

AT1s are contingent convertible securities that were introduced in the wake of the GFC. They’re debt securities that pay high rates of interest but automatically convert to equity if a bank’s capital ratio falls below a certain threshold. In the Credit Suisse situation, the AT1 debt should’ve been converted to equity and realised a small amount of the par value through the takeover. Instead, the bondholders will have their entire principal wiped which has flipped the entire script whereby equity holders should suffer losses before debt holders.

There is one precedent for the wipe out of AT1 debt. In 2017, Banco Santander bought failing rival Banco Popular. However, in that instance both the equity holders and AT1 holders were wiped.

While the laws were changed by politicians to bypass shareholder approval on the deal, the wipeout of AT1 debt was in the T&Cs of the security. However, it is the principle of the situation which is causing the uproar and issues in the European debt markets. Despite EU regulators reassuring the market that AT1 debt issued outside of Switzerland doesn't contain the same clauses that caused the wipeout, many investors are not sticking around to take that risk. European AT1 debt notes have dropped to record lows with Deutsche Bank taking the biggest hit.

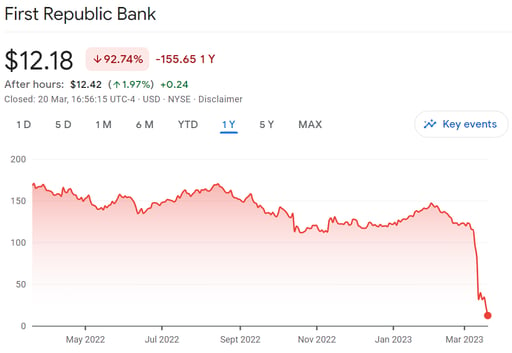

The toll on the 2023 bank crisis continues to rise and now officially stands at four victims, however it is unlikely to end there. The next failure is likely to come from First Republic bank in the US, which has seen its share price drop 90% in March despite Wall Street banks showing support by depositing over US$30 billion in the embattled bank. Until then, all eyes turn to the US Fed which is meeting on Thursday to discuss interest rates.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link