Jack Colreavy

- Apr 23, 2024

- 4 min read

ABSI - China's Stable Rates Amid Economic Growth

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

Yesterday the People’s Bank of China left its key lending rates unchanged in April, which was largely expected after better-than-expected GDP growth announced last week. This lack of action follows on from February when Chinese monetary authorities surprised the market with a 25 bps cut to the 5-year loan prime rate. ABSI this week will focus on the Chinese macroeconomic environment.

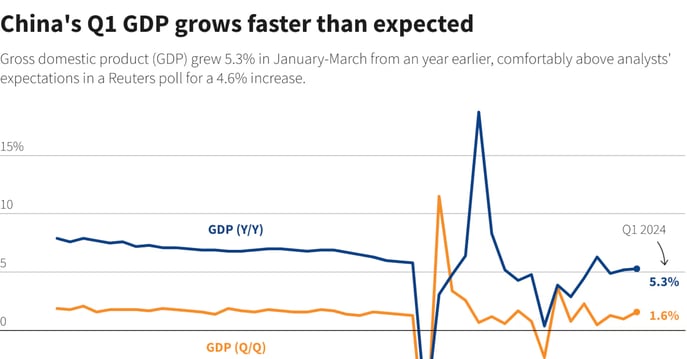

There are positive signs emerging from the Chinese economy. Last week the Chinese market got a boost when Q1 2024 GDP numbers reported that the economy grew 1.6%, smashing consensus estimates of a 0.9% rise. The result also marked the 7th consecutive quarter of growth since the negative 2.3% print in Q2 2022 and marked an increase of 5.3% over the past 12 months.

Source: Reuters

This is good news for policymakers who recently set a 5% GDP target for the year despite struggles with an ongoing property market crisis. The growth target was underwritten by the US$1.8 trillion in spending plans on infrastructure announced by many Chinese regions this year. Unsurprisingly then the top-performing sectors were industrial production, agriculture, and services.

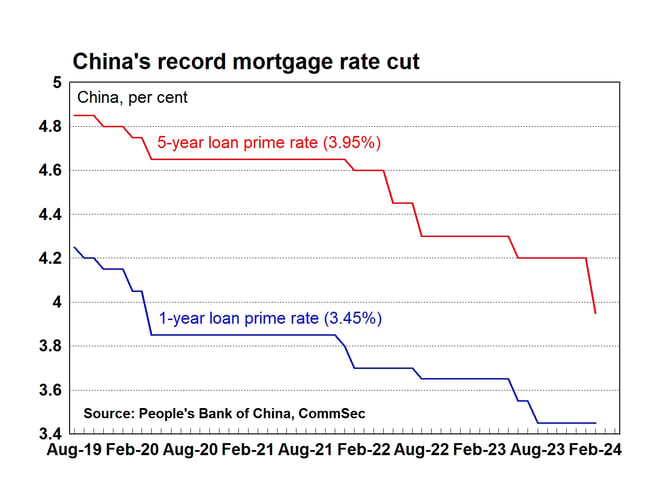

Given the recent positive news, the People’s Bank of China left interest rates unchanged this month. The one-year loan prime rate, the benchmark for most corporate loans, remains at 3.45% while the 5-year loan prime rate, the benchmark for property mortgages, is retained at 3.95%. It is important to appreciate that both rates are at all-time record lows and you may recall that the Bank reduced the 5y by a record 25 bps back in February. All this indicates is a serious intention from Beijing to kick start an economic recovery.

Source: Commsec on X

Source: Commsec on X

However, every action has an equal and opposite reaction and right now authorities are trying to balance an economic stimulus while keeping a stable currency and monitoring deflation. Across the Pacific, the US is dealing with the opposite problem as sticky inflation has put the nail in the coffin of imminent rate cuts which is driving a US Dollar surge.

While a weak Yuan would be good for Chinese exports and the economy, too much weakness can make life difficult for Chinese monetary authorities. This is because China’s currency is managed under a floating exchange rate system, where the Yuan is allowed a band in which it can fluctuate. Too much weakness in the Yuan will require Chinese banks to step into the market and defend the currency by buying the Yuan and selling foreign currency reserves.

Source: Bloomberg

The Chinese economy is by no means out of the woods yet. One strong quarter doesn’t represent an entire year, especially when it is seasonally the strongest quarter given Chinese New Year and other holidays. It is likely China will want to reduce interest rates further but will likely need to wait until cuts are made in other developed economies, such as the US, EU, and UK before it will look to cut again.

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer. Sign up and join the game!

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link