Jack Colreavy

- Apr 2, 2024

- 4 min read

ABSI - Cocoa Crisis: Easter Price Surge

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

Easter has come and gone, and while many may be nursing a chocolate hangover they may also be nursing a hit to the wallet as cocoa prices, the primary ingredient in chocolate, set all-time record highs last week. In the spirit of Easter, ABSI this week will focus its analysis on the cocoa market and what it may mean for our chocolate habits in the future.

After five straight days of gains last week, Cocoa futures have soared to all-time record highs breaching the US$10,000/tonne barrier for the first time. The gains follow a similar trend since the start of the year which has seen the price of cocoa increase over 150% since the start of the year and over 250% in the past 12 months. It is important to note that these prices are in nominal terms and when inflation is taken into account the market for cocoa isn’t as bad as in the 1970s with the record high equal to ~US$27,000/tonne in 2024 currency terms.

The underlying cause of the great cocoa inflation stems primarily from the supply side more so than the demand (though that is a factor). Sparking last week’s futures surge was news from Ghana, the second-largest grower, that cocoa farmers were set to lose access to a foreign funding facility. Looking more broadly, there have been poor weather conditions and crop disease in West Africa, the region responsible for ~75% of cocoa, which has devastated the supply of beans to chocolatiers.

Catastrophic weather conditions can’t shoulder the entire blame, it is just one factor in an industry rife with problems. For example, West Africa beans are majority grown by small and poor farms that barely make a living wage. This results in a lack of reinvestment into new crops and technology resulting in declining annual yields and supply gaps as demand continues to increase year-on-year.

Source: x.com

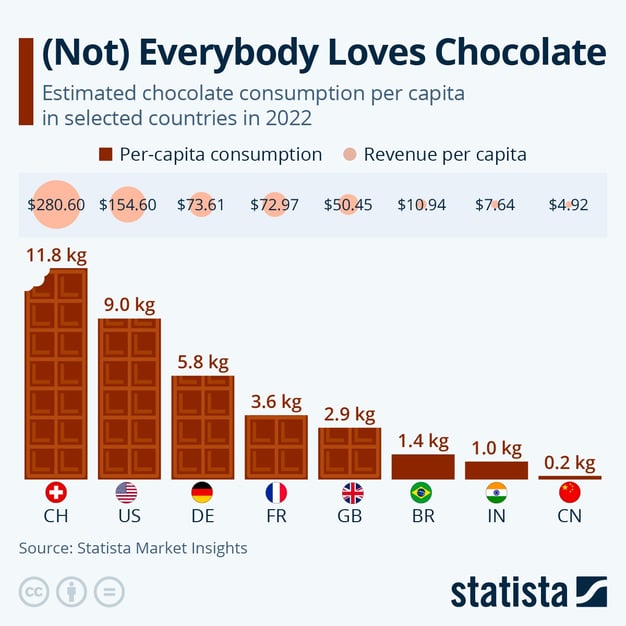

Speaking of demand, it does play a role in the equation. It is estimated that the chocolate industry market size was ~US$120 billion in 2023 and is forecasted to compound at 4.1% to 2030. Switzerland still leads the way in consumption, 11.8kg per capita, but the emerging middle class in countries like China and India is a large driver of growth. For context, Australia consumes approximately 4.9kg per capita.

Source: Statista

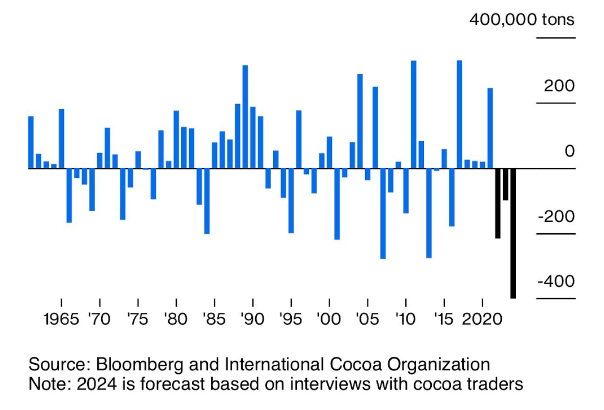

With all that has been said, it is estimated that the cocoa market will suffer the largest supply deficit in 2024 for the third consecutive season. It is estimated that the deficit in 2024 will be in the range of 300-500k tonnes. For EU chocolate producers, this will be even tougher as the EU has implemented deforestation regulation which prohibits working with suppliers cutting down existing rainforest for farming.

On a final note, the above isn’t a full explanation for the explosion in prices of late. Part of the equation is the fact that we’re talking about Cocoa Futures. Futures were developed as a hedging mechanism for commodity producers to lock in a price for their products but, like most financial products, have been hijacked by commodity speculators to trade. While the initial spike in cocoa prices was due to Ghana news, this instigated a frenzy in short sellers trying to cover their positions. It also affects legitimate cocoa producers who would’ve been margin-called on their hedge before their crop was ready for sale.

Here’s hoping you got your chocolate fill over the Easter holiday season because it's likely we’ll see higher final product prices in the long term.

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer. Sign up and join the game!

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link