Jack Colreavy

- Mar 19, 2024

- 5 min read

ABSI - Copper Price Spike May Signal a New Bull Run

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

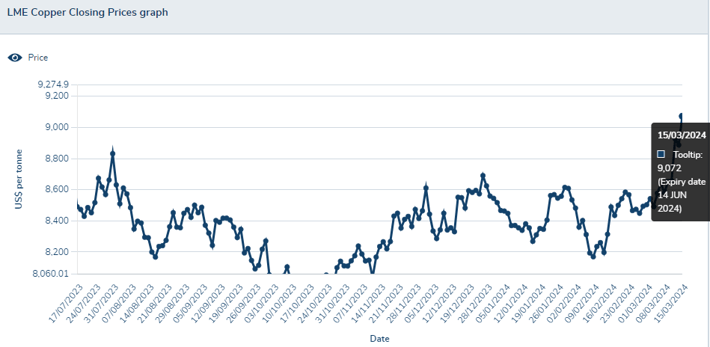

Copper was the new gold last week, stealing the spotlight when the price of the commodity broke out of its languishing trading range to soar to an 11-month high. The price spike was attributed to a commitment from Chinese smelters to cut production. ABSI will look at the current dynamics for copper and what it may mean for future pricing.

It is important to appreciate copper's historical use as a leading indicator for the global economy. Due to copper’s range of industrial applications such as construction, manufacturing, and electronics, it has traditionally been used to gauge the economic health of the global economy, resulting in the nickname “Dr. Copper”. However, new industrial trends may mean that the correlation of copper with the broader economy is breaking.

The reason for the demise of Dr Copper is due to the crucial role copper is playing in the green energy transition. Copper is a durable and inexpensive conductor of electricity and is therefore utilised in the production of renewable energy infrastructure, electric vehicles, transmission infrastructure, and energy storage systems. As a result, the global commitments to electrification and carbon-free energy solutions are providing huge tailwinds for demand and therefore the price of copper, fracturing the link to overall economic health.

Source: LME

After bouncing from lows below US$5,000/t during Covid, copper went on a huge bull run that culminated in an all-time record high recorded in March 2022 at ~US$10,730/t. Since then the price has retreated and has been trading in a fairly tight range between US$8,000 and US$8,600/t for the past 12 months. But last week saw some of the busiest days for trading in copper as the price rallied to over $9,000/t.

The catalyst for the breakout in price was due to planned production cuts from Chinese smelters, who control ~50% of global production. The smelters had no choice after spot treatment charges, fees smelters earn to process copper concentrates into the final metal, collapsed to single digits due to a lack of supply of copper concentrate.

Supply deficits in copper concentrate is a story as old as time but for the past few years this has been amplified with the halt in production at the Cobre Panama mine, one of the world’s largest, owned by First Quantum Minerals following a supreme court ruling and nationwide protests over environmental concerns. Copper bulls will point to the low treatment fees as evidence that the supply gap is finally coming home to roost and that copper prices will be significantly higher for the rest of the decade.

Source: Bloomberg

On the other side of the coin is the rapid expansion of copper smelting capacity, primarily in India and Indonesia, which means higher competition in the market and sustained lower treatment fees that won’t necessarily translate to higher metal prices. This will especially hold true if incumbents refrain from making output cuts and try to persist in a loss-making environment. While there will be consistent demand from the energy sector, other areas of copper demand have declined due to consumer and housing weakness, particularly in China and the US, which keeps a ceiling on price.

At the end of the day, the proposed production cuts from Chinese smelters are bullish for the price of copper, however, there were no explicit quotas for the cuts so it remains to be seen what each individual smelter chooses to do. There is also the issue of smelters in other regions that have made no commitment to cutting capacity. Citibank released a report in December 2023 outlining a US$15,000 price target for copper in 2025. I think this is too bullish and it's likely that it will take some time for the market to catch up to the new smelting capacity. While profit margins may be tight for smelters, this is still great news for copper miners who have the pick of the litter when it comes to selling their copper concentrates.

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer. Sign up and join the game!

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link