Jack Colreavy

- Jun 6, 2023

- 5 min read

ABSI - Debt Ceiling Deal, Interest Rate Speculation and Oil Surge

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

There have been a number of notable events affecting financial markets over the previous week from the debt ceiling deal to opaque interest rate decisions. ABSI this week provides commentary on the week that was in financial markets.

US Debt Crisis Avoided

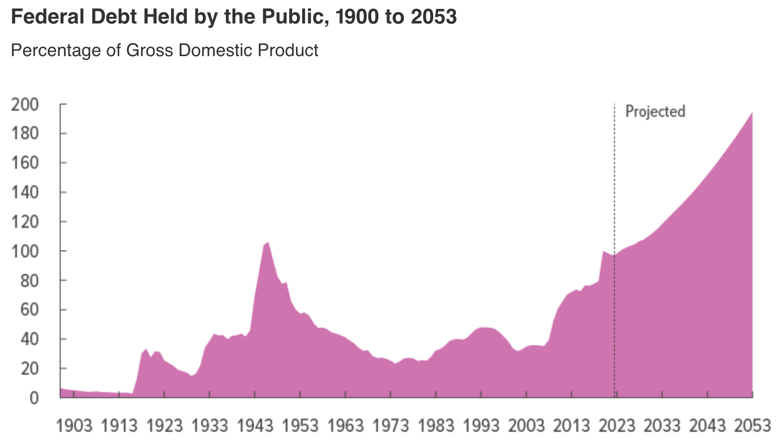

The biggest story of the past 7 days was President Biden signing into law the “Fiscal Responsibility Act 2023” , an increase in the US$31.4 trillion debt ceiling for two years, thus avoiding a potential US default on public debt. The decision came down to the wire but got done after both sides conceded ground in order to meet on mutually acceptable terms. However, it appears the hard right republicans are feeling salty with the result that didn’t achieve any meaningful spending cuts and will see Federal debt surpass US$50 trillion by 2030, according to data from the Congressional Budget Office.

Source: CBO

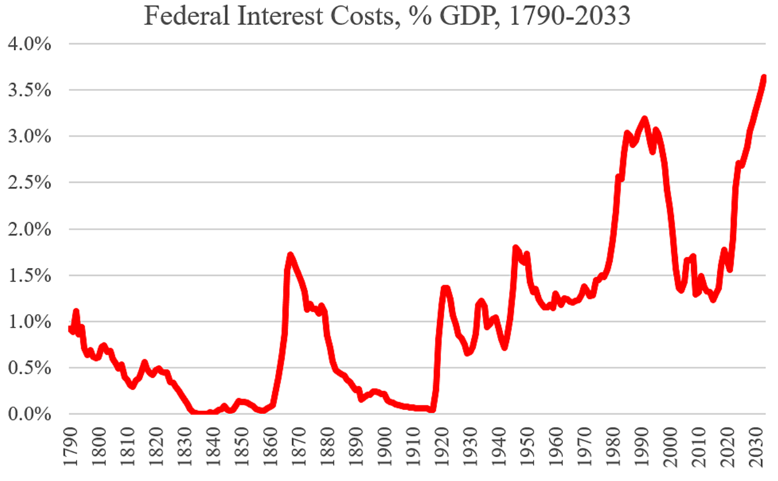

The biggest concern for many is the interest payments shouldered by the American taxpayer moving forward. Through an exponential rise in absolute debt, interest payments relative to GDP have doubled from 1.2% in 2015 to 2.4% in 2023 with the government paying US$640 billion in net interest. Moreover, with interest rates at generational highs and with no signs of abatement due to inflation, it is projected that interest costs will hit an all-time high of 3.6% of GDP by 2033 or almost US$1.5 trillion. To put that into perspective, interest repayments will be the third highest expenditure after social security and medicare; it will be a larger expense than defence spending of US$1.1 trillion.

Source: CATO

RBA Rate Decision Today

In May, the RBA somewhat surprised the market by resuming interest rate rises after a momentary pause in April due to international bank failures. Today, the RBA host their June meeting to discuss the Australian cash rate and the market is split on the outcome. The majority of economists surveyed believe that rates will remain unchanged at 3.85%. The arguments for a hold focus on a wait-and-see approach to allow for the market to fully digest the rise in rates to date and the impending mortgage refinancing cliff starting to gather steam as more loans move from fixed to floating.

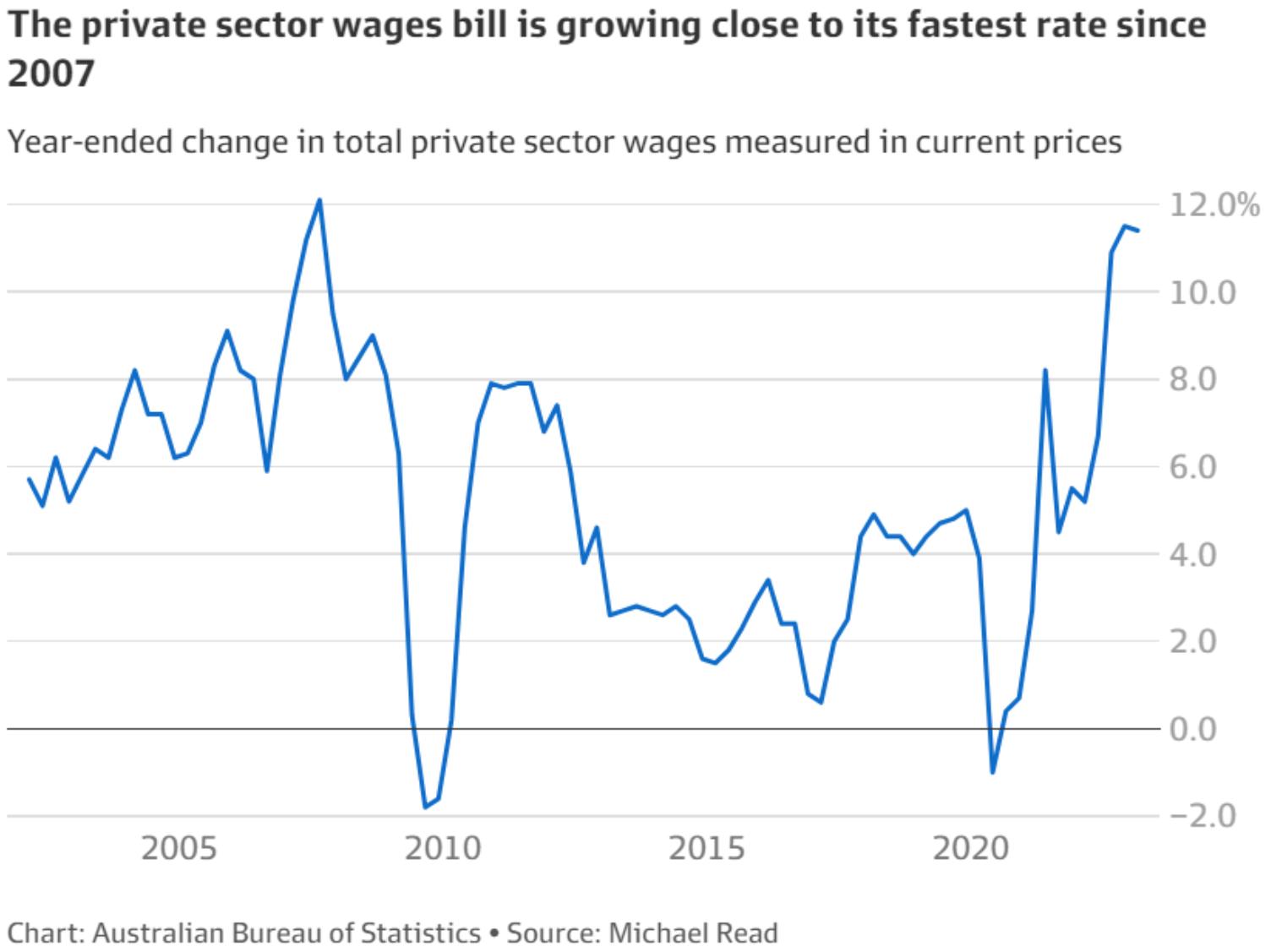

On the other side of the argument, proponents for a 25 bps rise to 4.1% point to persistent inflation, in particular core inflation, that will not be tamed without higher interest rates. An internal RBA analysis recently released concluded a 4.8% cash rate would be necessary in order to bring inflation back to 2-3%. Continually, the monthly CPI indicator printed a spike from 6.3% to 6.8% last week in-part due to the Fair Work Commission announcing a 5.75% increase in minimum award wages.

Source: AFR

In my opinion, I think the majority have it wrong again and the RBA will have no choice but to raise rates by 25 bps. Bringing inflation down to 2-3% is their number one objective and they know they risk untethered inflationary expectations without decisive action.

Oil Soars Off Macro Tailwinds

There is a spring in the step of oil prices over the past week thanks to positive economic news. The initial jump higher resulted from the passing of the US debt ceiling increase. The outcome of the deal means the avoidance of economic contagion from a slow down in the biggest global economy. On Friday, WTI crude futures rose 2.3%, or US$1.64, to settle at US$71.74 on the US debt deal.

The second oil spike came yesterday at the OPEC+ meeting where Saudi Arabia announced a 1 million barrel a day output cut from July to ensure the oil price remains in the mid-US$70s or higher. Depending on how long the cut lasts, the cut is worth an extra US$1-6/barrel in terms of fundamentals. Unsurprisingly, the oil price surged ~3% to just over US$74 for WTI crude but has since settled back to ~US$73.

Source: Bloomberg

Oil is a great barometer for the global economy given how essential it is to keep the world running. Recent weakness in the price has stemmed from the increasing probability of a recession in many parts of the world. The recent price recovery has been buoyed by the debt ceiling relief and the commitment from Saudi Arabia to cut production. However, there was a lack of unity at the OPEC+ summit and it appears the other nations are reluctant to cut their revenues in order to prop up the price. We’ll have to wait and see if the Saudi’s hold the line and cave to the pressure.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link