Jack Colreavy

- Jan 27, 2022

- 10 min read

ABSI - How do stock markets react to war?

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

The world is again potentially on the verge of war with tensions continuing to rise on the Ukraine and Russian border with threats of a Russian invasion. Continually, we can’t forget about Taiwan and their resistance to Chinese unification. ABSI this week aims to analyse the key factors that affect stock market performance in the midst of global conflict.

In response to Russian President Vladimir Putin amassing 100,000 troops on the Ukraine border, where they had previously annexed Crimea in 2014, the US has put troops on standby for deployment. Meanwhile, governments around the world are recommending their citizens in Ukraine leave the country immediately and are pulling their own diplomats.

All these actions are pointing to a high probability of conflict in Europe. Coupling this with tensions between China and Taiwan, it comes as no surprise that the “Doomsday Clock” is currently set to 100 minutes to midnight a.k.a complete destruction of human civilisation. As a reference point, the farthest the clock has been set from midnight was 17 minutes in 1991 at the signing of the Strategic Arms Reduction Treaty between the US and Soviet Union.

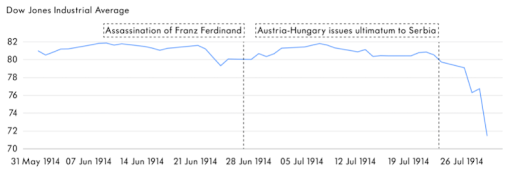

So with the real prospect of war upon us, it is important to reflect on previous stock market performance during these troubling times. If we go back to WWI (1914-1918), markets didn’t flinch at the assassination of Franz Ferdinand but when Austria-Hungary declared war on Serbia on 28 July, the stock market sold off as investors sought out liquidity. Three days later all stock markets were closed and when they reopened in 2015, the Dow Jones traded higher off the back of US neutrality and the boom for the US economy. Noteworthy, the index was 40% off its 1913 highs. In other financial markets, commodities soared on supply chain constraints and surging demand, while sovereign debt grew by previously unprecedented amounts.

Dow Jones Performance 31st May to 27th July 1914

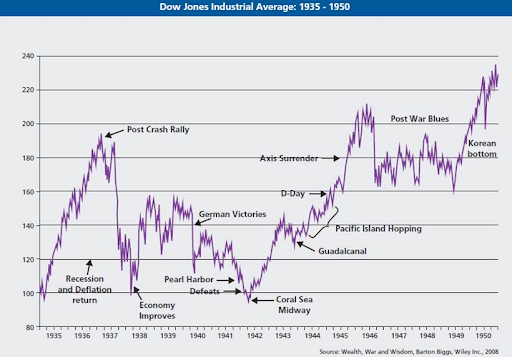

Turning to World War II (1939-1945), it was a different story for US markets with the Dow Jones tracking the performance of the Allies against the Axis. Early in the war, the Axis powers had the upper hand which resulted in very negative sentiment in the stock market for the US, whilst German stock markets roared higher. However, by mid-1942 the fortunes of the US military turned in the Pacific which saw the stock market bottom out at 55% below prewar highs in 1937. From here, the stock market went on a huge bull run through to the end of the war. In contrast, prices on the German DAX were frozen in 1943 and the market ended up closing for several years before it was eventually completely restarted at the bottom.

Dow Jones Performance 1935 to 1950

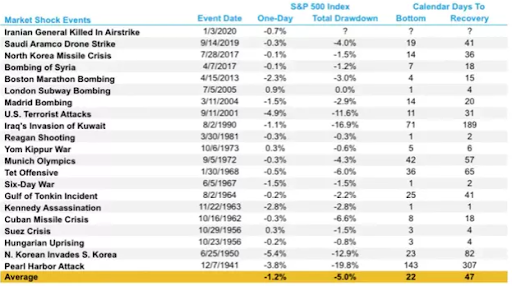

It is important to appreciate that technology and human nature has changed since the Earth’s last major conflict in WWII. A 2020 research note by LPL Financial found that stocks are ignoring geopolitical risk and bouncing back from these events at a faster pace than ever. In their review of 20 major geopolitical events, the avg. drawdown in markets was 5% and these losses were recovered within an avg. 47 trading days. However, if you exclude WWII from the data, the avg. drawdown is 4.2% and this is recovered in 33 trading days.

Geopolitical Events & Stock Market Reactions

The “war puzzle” is a phenomenon developed from Swiss Finance Institute research, which found that in cases of a surprise war, the outbreak of war causes stock prices to decrease. In contrast, when there is a pre-war build-up phase, the prospect of war lowers stock prices but the actual outbreak of war increases them. Following the war puzzle logic, given the recent sell-off in global financial markets, which isn’t solely attributed to the prospect of war, investors should expect strength in the stock market IF war outbreaks.

The Latest from BPC Research

Pinnacle Investment Management Group Ltd (ASX:PNI) -

A$11.31 Share Price | A$2.3b Market Cap

PNI is an Australian-based investment management company with principal activities including developing and operating investment management businesses and providing distribution services, business support and responsible entity services to the Pinnacle Affiliate.

Source: Google Finance

It is important to note, within the PNI affiliate network, there are 18 diverse strategies with the potential to produce significant fees each year, and 11 of those had the potential to crystallise in 1H22. In January, four affiliates reported performance fees for 1H22 totaling ~A$18.0m with PNI’s net share of these performance fees being in the order of A$6.2m.

PNI also advises that it expects the net return on Principal Investments for 1H22 to be in the order of A$2.0m. This amount is made up of ‘Dividends and Distributions’ received of A$1.9m and ‘Fair value gains/losses on financial assets at fair value through profit or loss’ of $0.1m, which includes the losses from hedging equity market exposures.

Pinnacle is set to announce 1H22 results on the 3rd February 2022. The stock currently trades on a forward P/E of 26.2 and a gross dividend yield of 4.3%.

BPC Research holds a BUY recommendation on PNI with a Price Target of A$13.28.

A$2.65 Share Price | A$165.6m Market Cap

DSK is an Australian specialty retailer of Home Fragrance Products, offering a range of Dusk branded premium products at competitive prices from its 115 physical stores and online store. Dusk's products include candles, ultrasonic diffusers, reed diffusers, essential oils and fragrance related homewares.

In a recent H1 trading update, the Company flagged sales to be down 12.0% to A$80m, total like-for-like sales (LFL) down 10.1%, and stores LFL down 11.5%. The bright spot is online sales which are up 4.3%, delivering A$7.4m to total sales. Finally, DSK is expecting a slight improvement in pro forma gross margins at 68%, and pro forma EBIT is expected to finalise in the range of A$21.0m - A$21.5m, compared to A$28.3m in 1H FY21, despite adding 6 new stores in the period and taking total store network to 128 stores.

The weakness in earnings is due to government-mandated store closures in NSW, Victoria, and ACT. This reduced the number of store trading days by approximately 24% and when stores were open, foot traffic in centres was significantly lower as shoppers exercised caution to avoid the possibility of infection as the Omicron variant of COVID-19 escalated through December.

The acquisition of Eroma is expected to be completed in Feb and DSK expects this business to be a strong contributor to group earnings and EPS in its first full year of ownership. DSK currently trades on a one-year forward P/E ratio of 9.2x and offers a net dividend yield of 11.6%.

BPC Research holds a BUY recommendation for DSK, with a Price Target of A$4.42.

Koch Metals enters non-binding heads of agreement with Tulla Resources

Tulla Resources (ASX:TUL) is pleased to advise that it has entered into a non-binding heads of agreement with Koch Metals Limited in relation to an off-take arrangement and funding for its iron ore at the Norseman Project.

Hon Adam Giles, Chairman of Koch Metals said: “On behalf of myself and the Koch board, we are pleased to enter into the arrangement with Tulla Resources and look forward to a long and fruitful relationship.”

Read the Conversation:

Jack Colreavy:

“With troops amassing on the Russian Ukrainian border, plus tensions between Taiwan and China continuing to bubble, the prospect of war has never been higher. So how do stock markets react to war? This is the question I sought to answer in this week's ABSI. Now, this is a well-researched question and there are a number of theories out there, the most interesting being the war puzzle theory developed by the Swiss Finance Institute. Now their research found that when war came as a surprise, stock markets reacted very negatively.

However, if there was a buildup to a conflict, then the stock market would react negatively during the buildup, but then positive once the war actually started. So following this war puzzle logic, and given the very negative sentiment in markets at the moment, we can expect that if war was to break out between Europe and Russia, we could potentially see a stock market rally. To learn more about how stock markets react to war, please click the link in the description.”

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link

.jpeg?width=150&name=Dusk%20Group%20Limited%20(DSK).jpeg)