Jack Colreavy

- Dec 9, 2022

- 4 min read

ABSI - New bull market or bear market rally?

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

The stock market is an interesting beast, I don’t need to tell you that. The latest conundrum is the rally across several global markets including the US S&P 500 which has posted gains in October and November. ABSI this week takes a look at some of the latest data points which may help indicate whether this is a new bull market or just another bear market rally!

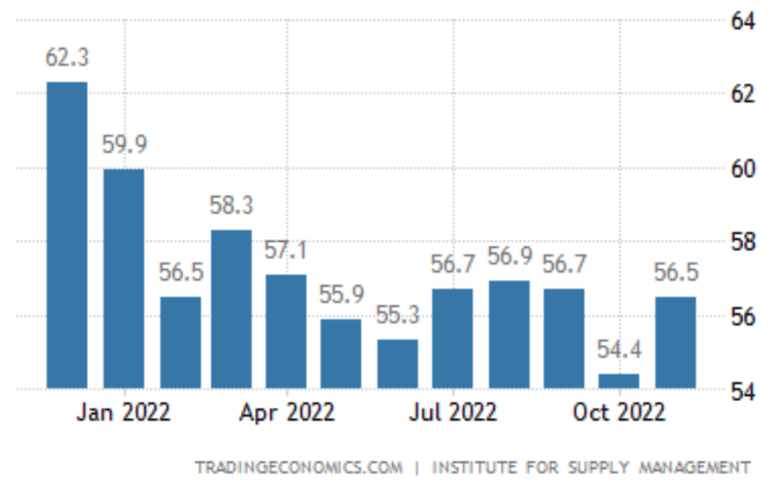

Markets were weaker yesterday off the back of a surprisingly strong US ISM Services PMI, which clocked in at 56.5 for November, up from a 2-year low of 54.5 last month. The data points within the index were all broadly higher with business activity and employment up, pricing pressures down, lower than expected reduction in inventories, and a decline in backlogs and supplier deliveries as a result of an improvement in supply chains. The reason for such a reaction by markets is that PMI has a strong correlation with GDP making it a reliable leading indicator. PMI, or Purchasing Managers Index, is a monthly survey from over 400 companies in 19 different sectors with an outcome over 50 indicating economic expansion.

US ISM Services PMI

Source: Trading Economics

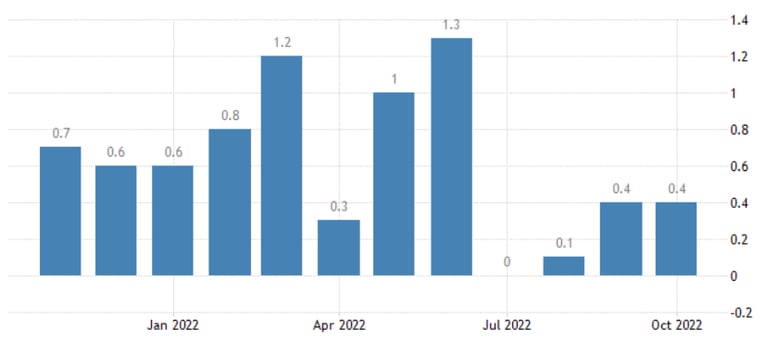

Inflation is the data point of 2022 with all eyes keenly focused every month on the CPI result. In the US, which has been extremely aggressive in raising interest rates to fight inflation, it appears that the tides are changing with annualised CPI declining for the past 4 months to 7.7% in October, down from the June peak of 9.1%. Furthermore, it is highly likely we will see further declines as previous months of very high inflation are replaced with potentially lower months, in particular in March 2021 inflation for the month was 1.2% so March 2022 might see a material reduction in the inflation rate. However, despite the encouraging declines, inflation is still annualising at 4.8% (0.4%*12) which is well above the Fed’s target of 2%. This indicates that rates will need to stay higher for longer until monthly inflation is in the 0.1% to 0.2% range.

US Month-on-Month Inflation Rate

Source: Trading Economics

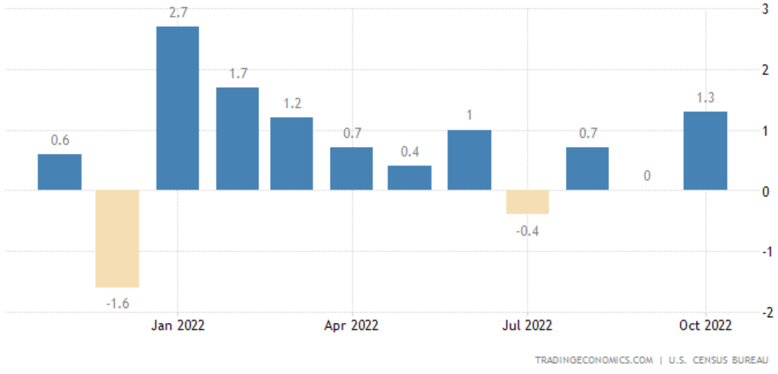

Retail sales are another great leading economic indicator that takes the pulse of the people. The indicator is not adjusted for inflation, but generally, a positive number is indicative of positivity for the future amongst consumers who are willing to spend and not save for harder times ahead. Again I’ll look at US retail sales and they surprised many with a 1.3% gain in October with auto and gas sales leading other gains in food and beverage, furniture, and building materials. Hobbies and electronics were the weakest performing sectors. This strong result indicates resilience in retail spending, despite a rising cost of living. It will be interesting to see if there is a repeat of last year when sales dropped significantly in December due to holiday shopping being pushed forward to earlier months.

US Month-on-Month Retail Sales

Source: Trading Economics

The US market, as the leading global economy, is showing a lot of positive signs which may be a reason for the surge in equity markets for the past few months. I think the critical focus has been CPI and will continue to hold abnormal influence on the direction of the market into 2023. However, we’re also witnessing the phenomenon of good news being bad news, such as the Services PMI data yesterday. The negative reaction to good news is the hypothesis that a strong economy will give the Fed greater flexibility to raise interest rates. Until this type of sentiment reverses, it will be extremely difficult to forecast the direction of equity markets. I will say though that continued falls in CPI with other economic data remaining strong will be the catalyst for that change in 2023.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link