Jack Colreavy

- Dec 20, 2022

- 5 min read

ABSI - Predictions for precious metals prices in 2023

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

Research from ANZ bank released yesterday touted gold to outperform equities in 2023 due to global recession fears. This headline prompted me to look at the global physical market for precious metals which showed some surprising trends that investors should take note of. For the final ABSI of the year, we will take a dive into these trends and what it may mean for precious metal prices in 2023.

Gold has always been an important and interesting asset; it is also surprisingly divisive. While possessing industrial properties, approx. 11% of gold production is used in industry for electronics, defence, medicine, and space etc, gold has always been widely held as a store of value for monetary purposes. In fact, fiat currency is only a recent phenomenon with gold serving as the default currency in human history up until 1976, when the gold standard was severed.

At the time of the ending of the gold standard, gold was worth US$42.22/oz. Today it is trading at ~US$1,800/oz and ANZ Research thinks that it will trend higher to US$1,900/oz in 2023. The reasoning for this consensus is that tight monetary policy from 2022 and ongoing inflationary pressures will likely slow economic growth, providing an environment typically positive for gold due to its status as a safe haven during turbulent times.

Source: Google Finance

Taking this backdrop into account, it is important to appreciate the trading environment that encompasses gold and other precious metals through futures contracts. For the uninitiated, a futures contract is an agreement between two parties to transact on the price of a good now to be delivered at a future date. Given that price is a function of supply and demand for physical goods, when a commodity is paper traded via a futures contract it has less of an impact on the fluctuation of price unless physical delivery occurs.

The Commodity Exchange Inc. (COMEX) operates the world’s largest futures and option market for trading metals, providing a platform for two parties to hedge or speculate on the price of these assets. Critically, these contracts stipulate for physical delivery unless they’re rolled, which is the action most traders take as they don’t wish to own the actual physical gold. However, there is an option to take delivery of the physical asset and COMEX guarantees these deliveries within their own system. The problem is that, like a bank, COMEX doesn’t hold enough gold in reserve if every contract needed to be physically settled, which is why COMEX distinguishes between “Registered” (available for delivery) and “Eligible” (not available for delivery) on their physical stock.

It is difficult to calculate the ratio but it is speculated that a paper to physical gold ratio runs as high as 200:1, meaning for every 1 oz of physical gold there is 200 oz of paper speculating on the price of the asset. A “vault-run”, akin to a bank-run, is a scenario whereby a surge in demand for physical delivery sends the price of the precious metal higher as shorts scramble to find stock of the underlying physical to make good on the delivery in the futures contract. This type of scenario is why it is important to keep an eye on stock-levels at COMEX.

Source: Zero Hedge

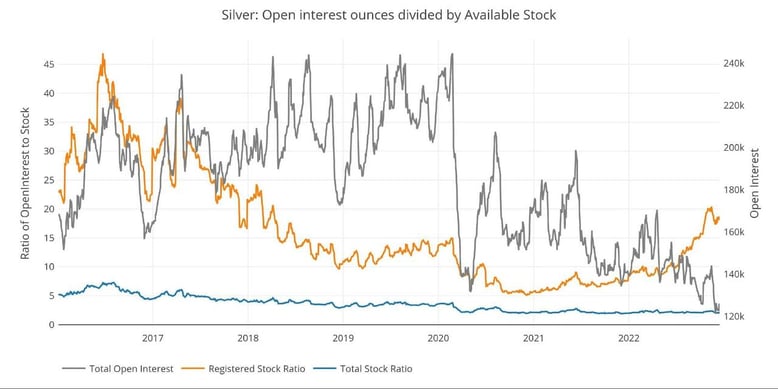

Analysing the above table we can see a worrying trend that should be closely watched in 2023. Over the past year, COMEX has lost 31.6% of its gold inventories, 37.9% of palladium, 65.9% of platinum, and 15.9% of silver. The removal of over 10m oz of gold is noteworthy but the 64.2% reduction is “Registered” silver is the canary in the coal mine. While the silver remains in the COMEX vaults, it isn’t available for delivery which is why the paper to physical ratio on the COMEX exchange is as high as 20.4 paper contracts for each physical ounce of “Registered” silver in the COMEX vaults in November (gold line in the chart below). Gold isn’t off the hook either with the recent decline in inventories pushing the open interest as high as 4.5 in November as well. Keeping note that the higher this ratio, the higher the probability of a vault run.

Source: Zero Hedge

From a macroeconomic perspective, 2022 has been an interesting year with inflation and interest rates dominating the conversation. Looking forward to 2023, I believe the conversation will start to pivot away from inflation and start to focus on the effects of our first tight monetary policy cycle in over 15 years.

This is the reason why analysts are upgrading their precious metals forecasts for 2023. Given that potential demand to flock to safety, it would be prudent to also keep on eye on these thinning precious inventory levels given they could provide a major catalyst for gold to reach fresh all-time record highs in the not too distant future.

Have a happy and safe holiday season, and I will see you in the new year.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link

.jpg?width=652&height=442&name=image9-5%20(1).jpg)