Jack Colreavy

- Feb 28, 2023

- 4 min read

ABSI - The Australian Yield Curve and its importance for all Investors

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

The bond market and its corresponding yield curve is an important indicator that should be monitored by all investors from equity, to real estate, and most certainly debt. ABSI this week analyses the large recent moves in the Australian yield curve and what it may mean for the Australian economy.

When discussing the bond market, it is important to understand the yield curve which is a graphic representation of various interest rates on bonds with different maturities, plotted against their corresponding time to maturity. In general, the yield curve slopes upward, which means that bonds with longer maturities have higher yields than those with shorter maturities. This is because investors demand a higher rate of return for tying up their money for a longer period of time. However, there are times when the yield curve can slope downward or be flat.

The shape of the yield curve can tell us a lot about the expectations for economic growth and inflation. When the yield curve is upward-sloping and steep, it typically signals that investors expect strong economic growth in the future. Conversely, when the yield curve is flat or inverted (when short-term interest rates are higher than long-term interest rates), it may signal an economic slowdown or even a recession.

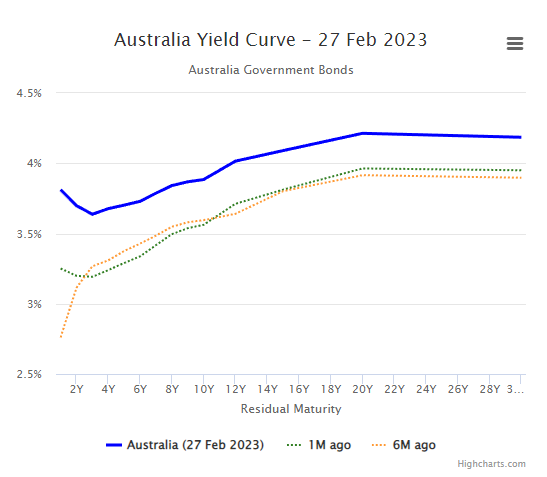

Source: World Government Bonds

There has been a lot of discussion in the BPC office recently around the large upward shifts in Australian bond yields. The chart above illustrates inversion at the short end and a relatively flat yield curve for longer date maturities but, more importantly, the large moves over the past month. The green and yellow dotted lines are very similar and represent the yield curve one and six months ago respectively. The thick blue line is the current yield curve and visually demonstrates the magnitude of the moves in yield expectations.

Recalling that yields are inverse to price, meaning that when yields rise, bond prices fall. Therefore the shift upwards in the yield curve means that Australian bond prices are crashing. The reason for the shift is due to the RBA holding firm on the mission to slay inflation at all costs and the market expectations of further rate rises. In February there was debate that the RBA may halt rate rises but instead the minutes show the RBA board discussed a 50 bps hike and subsequent interviews by Governor Lowe suggest that the hikes won’t stop anytime soon.

Source: World Government Bonds

The Australian cash rate increased 25 bps to 3.35% in February and the market expectations on 1 year yields have reset from 3.25% one month ago to the current level of 3.8% (see the above table). A 55 bps increase might not sound like much but this is a monumental shift in such a short period of time.

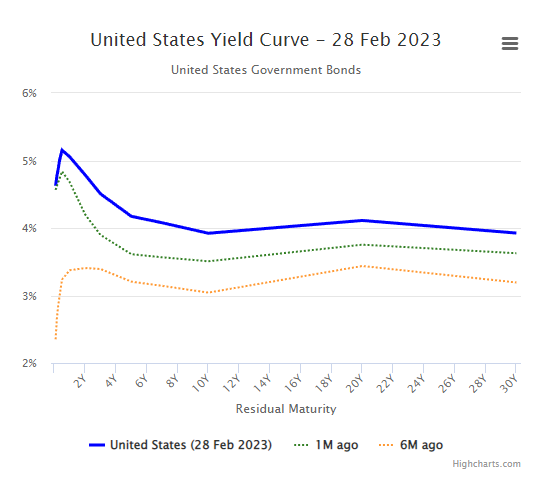

Source: World Government Bonds

Most readers would be more interested in the stock market than the bond market but it is all interrelated. An inverted yield curve generally makes headlines as a recession signal but it should be noted that the inversion needs to take between longer-dated maturities such as the 2y and 10y. The inversion on the Australian yield curve from 1y to 2y and then a relatively flat upward slope doesn’t suggest the market anticipates a recession in Australia. The current US yield curve is a better example of a recession predictor (see above). What a flat yield curve suggests is economic weakness and uncertainty and this has flowed through to the stock market recently with the gains from early in the year tapering. What investors need to look for in the yield curve moving forward is steepening which will start to occur once the RBA has more certainty in their long-term view of interest rates.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link