Jack Colreavy

- Feb 22, 2022

- 9 min read

ABSI - The beginning of the end for coal power in Australia

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

There has been a lot of news to digest in the Australian coal power scene in the last week, from the early shutdown of Eraring power station to the surprise AGL takeover bid from Brookfield and climate-activist Mike Cannon-Brookes. ABSI this week breaks down what coal’s retirement from the Australian grid will mean for the energy grid moving forward.

Currently, 16 coal-fired power stations remain in Australia, supplying ~60% of Australia’s energy needs, and last Thursday the largest of them, the 2880 MW Eraring power station owned by Origin Energy, announced that it will seek to shut down the plant seven years early by August 2025. The closure of such an energy asset creates a massive hole in the National Energy Market (NEM), as Eraring supplies ~20% of NSW’s energy needs. Origin has indicated that it intends to build a 700 MW battery on the site but many criticise, including Federal energy minister Angus Taylor, that “closure without like-for-like replacement puts affordability and reliability at risk”.

News then broke over the weekend that Canadian asset manager, Brookfield and billionaire Aussie climate-activist, Mike Cannon-Brookes were teaming up in an A$8 billion bid for power giant AGL Energy (ASX:AGL). The A$7.50 per share bid was only a small 4.6% premium to Friday’s close of A$7.16, but the pair promised early closure of AGL’s three coal-fired power plants with a combined nameplate capacity of 6,901 MW. This would no doubt be causing more headaches for the Australian Energy Market Operator (AEMO) and the Federal government, despite the fact that the bid came with a promise of A$10 billion in renewable investment to replace the coal-fired power stations.

While the shut down of coal generation in Australia is welcome news and an inevitability, it is vital that the transition occurs in planned stages to ensure supply and price stability in the grid. It is important to note that the reason for the acceleration of the demise of coal power is due to the structure of the NEM.

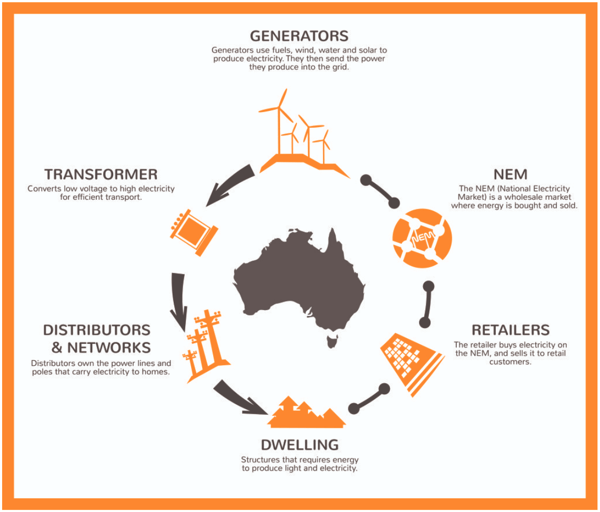

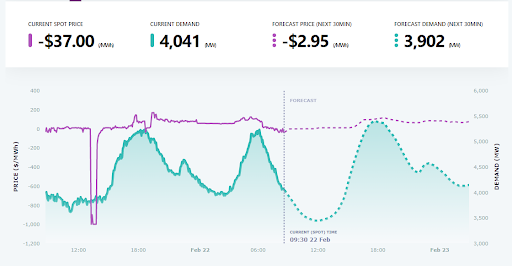

The NEM is Australia’s largest wholesale energy network, delivering ~80% of electricity consumption in Australia. It’s essentially a marketplace where energy generators sell to energy retailers with the spot price being set at 5 minute intervals according to supply and demand. In 2017, renewables contributed 15% to the NEM, but this has since doubled to 30% in 2021. Moreover, about half of the new renewable energy added to the grid is from rooftop solar, making it Australia’s largest virtual power station at ~15.6GW. Importantly, the effect of so much solar in the network is extremely low, or negative, prices during the day. In fact, at the time of writing, prices in Victoria are -$37 MW/h which means energy generators need to pay to put electricity into the grid.

Under this system, baseload coal power stations are becoming increasingly uneconomical, which is the primary reason for the spate of early retirements. The problem for the network is that baseload power is vital during the morning and evening peaks when renewable generation is at its lowest. Large-scale batteries and green hydrogen are the renewable energy storage solutions. However, these options are still in their infancy and so there begins a race for the necessary infrastructure to be built before all fossil fuel baseload generators are turned off.

A potential stay-of-execution to the AEMO may be the trump card that the Federal government has up its sleeve in the form of the Foreign Investment Review Board (FIRB). The FIRB has the power to veto foreign takeovers of critical infrastructure. Brookfield bought Victorian poles and wires business, AusNet Services for A$18 billion last year, so there is a valid case that their acquisition of Australia’s largest energy generation company would be anti-competitive. Regardless, the genie is out of the bottle and this issue will only compound as more renewable energy comes onto the grid, thus continuing to accelerate the demise of coal power generation in Australia.

The Latest from BPC Research

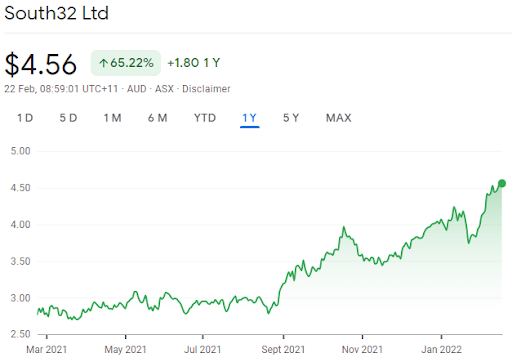

A$4.56 Share Price | A$21.2b Market Cap

S32 is a diversified mining and metals company that deals in the mining and metal production, from a portfolio of assets that included alumina, aluminium, bauxite, energy coal, metallurgical coal, manganese ore, manganese alloy, nickel, silver, lead and zinc.

Source: Google Finance

In its H1FY22 results, S32 announced a ~32% increase in revenue to US$4.6b, underlying EBITDA up 138% to US$1.9b, and a 5% growth in NPAT to US$1.03b. As a result, underlying EPS grew 671% to 21.6 US cps and announced an interim fully franked dividend of 8.7 US cps.

S32 aims to grow its exposure to the metals critical to a low carbon future, while exiting lower returning operations in order to reshape and improve its portfolio. S32 has advanced decarbonisation activities by adding copper exposure with Sierra Gorda; agreed to increase its share of green aluminium production at Mozal Aluminium and Brazil Aluminium; completed the Taylor Deposit PFS, confirming its potential to be a low cost operation in the first quartile of the industry’s cost curve; and divested South Africa Energy Coal and TEMCO, and agreed to sell Metalloys.

S32’s portfolio is well positioned for a rapid transition to a low carbon economy, with demand for most of S32’s commodities set to grow significantly with the uptake of low carbon technologies. S32 currently trades on a one-year forward P/E ratio of 7.1x and has a gross yield of 8.4%.

BPC Research currently holds a BUY recommendation for S32, with a target price of A$6.86.

Bluescope Steel Limited (ASX:BSL) -

A$18.83 Share Price | A$9.3m Market Cap BSL is a provider of innovative steel materials, products, systems and technologies, headquartered in Australia with operations spread across North America, Australia, New Zealand, Pacific Islands and throughout Asia.

BSL is a provider of innovative steel materials, products, systems and technologies, headquartered in Australia with operations spread across North America, Australia, New Zealand, Pacific Islands and throughout Asia.

Yesterday, BSL announced it delivered record underlying EBIT of A$2.2b, a 32% improvement YoY, in H1FY22. Other notable financial results include a 62% increase in revenue to A$9.4b and 398% growth in NPAT to A$1.6b. The Company has conducted A$285m in buybacks since August 2021, which resulted in a 402% increase in EPS to 329.1 cps and contributed to a 25 cps reported interim dividend. Additionally, the board has authorised a further A$700m in share buybacks over the next 12 months.

BSL’s strong financial result comes off the back of high demand in global steel products and the Company is positioning for long term sustainable growth and returns. They are continuing to evolve their approach to safety by building capacity and driving a greater focus on engagement and learning. A comprehensive climate change strategy has been launched and announced collaborations with Rio Tinto, to explore technical and process options for low emissions steelmaking, as well as Shell, to explore and develop renewable hydrogen projects at Port Kembla.

BSL expects Underlying EBIT in H2FY22 to be in the range of $1.20 billion to $1.35 billion – which would be second only to last half when looking back over BlueScope’s 20-year listed history. These expectations are subject to spread depending on foreign exchange and market conditions.

BSL currently trades on a one-year forward P/E ratio of 3.4x and has a gross yield of 4.1%.

BPC Research currently holds aa BUY recommendation for BSL, with a target price of A$22.70.

Read the Conversation:

Jack Colreavy:

“ Electricity generation is in the news at the moment. Last week, Australia's largest coal fire power plant announced that they'd be shutting seven years earlier in 2025. And then this week, AGL, which is Australia's largest energy generator with three coal fire plants, got a takeover bid from climate activist Mike Cannon-Brookes.

Now this brings to the conversation the inevitability of coal fire power in the grid, but the need for a staged transition to ensure grid reliability and price stability. The national energy market has a spot price marketplace where prices are set every five minutes. Due to the 15 gigawatts of solar currently in the system, we are seeing negative prices during the day, which is making these coal fire plants very uneconomical and thus accelerating their demise. So in order to have a staged transition, we're going to need to see an acceleration of storage solutions such as large scale batteries and green hydrogen. To learn more about this power issue, please subscribe to ABSI by clicking the link in the description.”

H2X Global in the ideal growth market

H2X Global Limited has been featured in Stockhead discussing how the Company is positioning Pure Hydrogen Corporation (ASX:PH2) for significant growth and advancement.

PH2 Managing Director, Scott Brown says "H2X has been a tremendous investment and we are bullish on its outcome as they look to have operations in other countries."

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link