Jack Colreavy

- Sep 28, 2021

- 7 min read

ABSI - The world needs more semiconductor chip manufacturing diversity

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

One of the lessons learnt from the pandemic is how much the world relies on semiconductors with chip shortages causing bottlenecks in a range of different industries. ABSI takes a deep dive into the semiconductor industry, looking at the major players and the need for better manufacturing diversity.

Recently, General Motors (NYSE:GM) announced that it was shutting down production of its flagship EV, the Chevy Bolt, through October due to the semiconductor chip shortage. GM isn’t alone with an array of industries negatively affected by the supply shortage. A Teikoku Databank survey recently revealed that 115 listed companies in Japan had been negatively affected since April 2021 by the lack of semiconductor supply. This comes as no surprise given the increasing use of semiconductors in scores of everyday products with the media dubbing the shortage “chipageddon”.

It is difficult to ascertain the reason for the chip shortage beyond the banner of “pandemic induced”. Digging deeper, it appears that Covid was the straw that broke the camel’s back and there have been issues in the industry for years. The primary driver is the demand which has been growing much faster than supply as more consumer products integrate semiconductors. This demand growth is putting pressure at all levels of the supply chain from specialised equipment, to shipping, and in the skilled labour force required to operate semiconductor fabrication plants. Finally, adding to the perfect storm were two disruptions at major plants - a fire in a Japanese facility and the aberrant winter snowstorms in Texas causing production to shut down.

These disruptions draw attention to the crux of the problem which is the foundry business model that microelectronics operates under. The most recognisable names in semiconductors, such as Intel and Samsung, are what's termed Integrated Device Manufacturers (IDMs) which handle every aspect of the process - design, fabricate, and sale. However, a better representation of the semiconductor industry is the Integrated Circuit Designers (ICDs), who design and sell semiconductor chips but outsource the manufacturing to pure-play foundries.

Pure-play foundries are becoming the business model of choice for the industry which is great news for Taiwan which is the dominant player, supplying 63% of global semiconductor market share. Interestingly, most of this market dominance can be attributed to one company, Taiwan Semiconductor Manufacturing Co (TSMC) (TPE:2330). TSMCs revenue from the 12 months to June 30, 2021, was a record US$53.2b and it is reported that they own a market share of over 50%. TSMC’s importance will continue to magnify with the completion of the world’s only 3nm foundry reportedly costing in excess of US$20b to build. For context, most foundries manufacture at 10nm with only TSMC and Samsung currently able to produce 5 nm chips for the high-end electronics market.

With the world increasingly more reliant on semiconductors and with the majority of the world’s semiconductors produced in Taiwan,

What moral hazard is being presented to the world from this situation?

Taiwan is officially known as the Republic of China and is a country in Asia that shares a maritime border with the People’s Republic of China. Recently, the tensions between the two countries have started running hot as China seeks to “reunify” the territory despite the Taiwanese people resisting these advances and seeking to become a fully independent democracy. PRC President Xi Jinping, under his “One China” policy, has expressed his desire to peacefully reunify Taiwan with mainland China but hasn’t ruled out the use of force. This palpable tension is highlighting the risk that if China were to escalate the situation, at best, the world could see a semiconductor shortage as supply is disrupted, and in a worst-case scenario, the world could see China control the manufacturing of over 70% of the world’s semiconductors.

Neither situation is particularly palatable and therefore it is crucial that the world diversifies its semiconductor manufacturing base. With the increasing demand and importance of semiconductors, Australia should look to establishing itself as a viable alternative to Taiwan.

The Latest from BPC Research

Regis Healthcare Limited (ASX:REG) -

A$2.00 Share Price | A$600m Market Cap

REG engages in the provision of residential aged care services. It offers aged care facilities, retirement villages, home care, day therapy, and a day respite program. As the impact of the COVID-19 pandemic continues to be felt across the industry, REG has performed strongly, reporting revenue from services of A$701.4m, up 3.5% on PCP, EBITDA of A$137.8m, which includes average occupancy of 88.9% (FY20: 88.2%), and NPAT of A$19.9 million, with a final dividend of 4.63 cents per ordinary share (50% franked), taking full-year dividends to 6.63 cents per ordinary share.

Despite trying conditions due to Covid 19, REG is well-positioned for growth with an aging Australian population increasing the market size for age-related services over the preceding decades.

REG is currently trading at a one-year forward P/E of 25.1x and offers a gross yield of 5.4%.

BPC Research has a price target of A$2.05 for REG, a 2.5% premium to the current value.

Harvey Norman Holdings Limited (ASX:HVN) -

A$4.93 Share Price | A$6.1b Market Cap

HVN is engaged in the retail and franchise business, property development and digital systems. The company acts as a franchisor, sells furniture, bedding, computers, communications and consumer electrical products, invests in property, leases premises, does media placement, provides consumer finance and other commercial loans & advances. The Group operates in New Zealand, Singapore, Malaysia, Slovenia, Croatia, Ireland and Northern Ireland.

HVN is engaged in the retail and franchise business, property development and digital systems. The company acts as a franchisor, sells furniture, bedding, computers, communications and consumer electrical products, invests in property, leases premises, does media placement, provides consumer finance and other commercial loans & advances. The Group operates in New Zealand, Singapore, Malaysia, Slovenia, Croatia, Ireland and Northern Ireland.

As a COVID-19 benefactor, HVN has delivered strong growth for FY21 reporting EBITDA of A$1.5 billion, up by 54.2% on FY20, and record NPAT of A$841.4 million, up by 75.1%, with an EPS of 67.53 cents. The Harvey Norman brand currently operates under 192 franchised complexes in Australia and 107 company-operated stores internationally.

HVN is currently trading at a one-year forward P/E of 13.2x and offers a gross yield of 10.6%.

BPC Research has a price target of A$5.81 for HVN, an 18% premium to the current value.

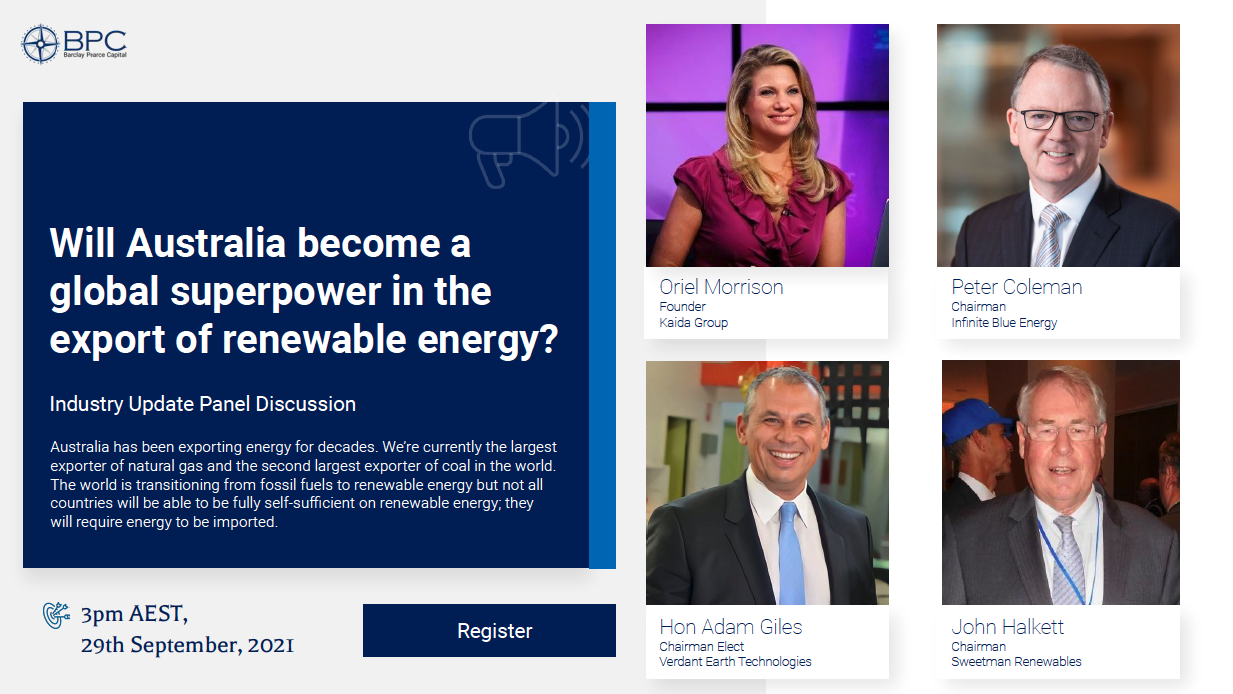

Australian Renewable Energy Webinar

Barclay Pearce Capital is hosting a free digital panel discussion regarding the Australian renewable energy sector on the 29th of September, 3pm AEST. Our industry experts comprise representatives from the Australian energy giants of tomorrow and will seek to answer the question:

“Will Australia become a global superpower in the export of renewable energy?”

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link