Jack Colreavy

- Oct 6, 2022

- 7 min read

ABSI - Turmoil In UK Financial Markets

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

UK financial markets were in turmoil last week after the new UK government leadership announced a controversial debt-funded mini-budget that materially depreciated the pound whilst sending treasury yields through the roof. The whipsaw resulted in the Bank of England (BoE) stepping into the market to suppress bond yields at a time when they’re actively raising interest rates. This contradictory move was necessary to support UK pension funds and the Liability-Driven Investment (LDI) strategy they follow. ABSI this week explains LDI and how it might be the match that causes another financial implosion.

Newly installed Chancellor of the Exchequer, Kwasi Kwarteng, unveiled a set of economic policies last week that the newly installed Tory government leadership would enact. The policies promised over £160 billion in spending over the next five years including £45 billion in discretionary tax cuts. The most controversial, from a political lens, despite only costing ~£2 billion, was the elimination of the 45% top tax bracket for taxpayers earning over £150k.

The fallout of this decision was felt from all sides, including from within the Tory party, as it was coming at a time when households are struggling from rapidly rising living costs. Unsurprisingly, the government succumbed to the pressure and reversed the decision yesterday. However, the biggest economic repercussions didn’t come from the rich getting a tax cut but from the actual fact that the government just made promises to spend billions of pounds with the only source of payment coming from the debt market.

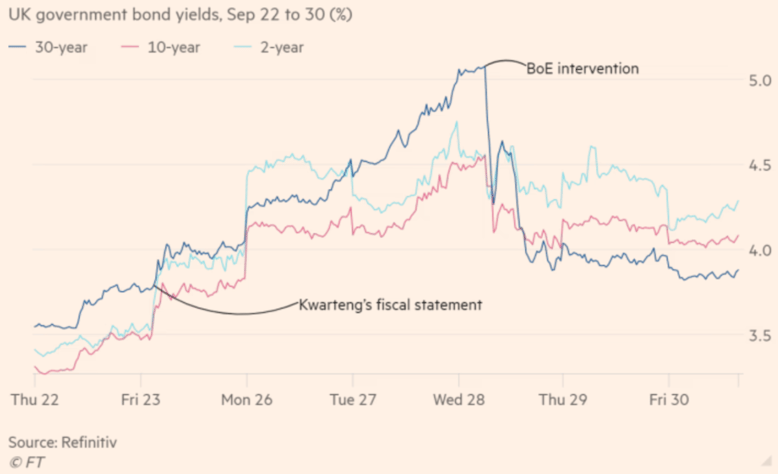

Source: Financial Times

The market baulked so much at the proposed stimulatory fiscal policy that the pound depreciated significantly against all currencies, dropping over 10p to 1.03 against the US dollar at one point, an all-time record low. Even worse, the yields on 30-year gilts (UK treasury bonds) skyrocketed 150bps from ~3.5% to over 5%. For the uninitiated, the scale of these moves in currency and bond yields was enormous, a black swan event, and set off a chain reaction throughout the UK markets that forced the BoE to intervene in order to stabilise markets.

Source: Financial Times

The primary reason for the intervention was due to the margin calls being imposed on leveraged bond investors, primarily Liability-driven investment (LDI) funds. LDI is a form of asset-liability management that matches cash flows between assets and liabilities. It is a common portfolio construction method for defined-benefit pension plans, which have explicit regular payments to beneficiaries. For companies that run a defined-benefit scheme, as opposed to defined-contribution pensions like the Australian superannuation system, the current asset base needs to match projected liabilities.

The issue is that liabilities are calculated based on forecasts of several variables such as inflation, interest rates, the amount of the benefit, and how long the beneficiary will live (remembering that this is an annual payment for the rest of their life). Regularly these pension schemes will become underfunded by their corporate sponsors, due to changes in assumptions, requiring a cash injection to increase the asset base. Importantly, a pension deficit is held as a liability on the balance sheet of a company and a cash injection is recorded as an expense in the P&L which reduces profitability and is not a good look for publicly traded companies. As a result, pensions seek to hedge their risks using the services of LDI funds.

In the UK, LDI funds are a ~£1.5 trillion bedrock of the pension market that helps hedge liabilities against interest rate and inflation risks. These funds typically purchase long-term bonds, sell them to pension funds via a repurchase agreement (repo - buy them back at a later date and a specified price), and then use the proceeds to repeat the process (creating leverage). Last week when the price of bonds plummeted, this caused massive paper losses on these leveraged bond portfolios and thus sparked a mass margin call to deleverage. This deleveraging started a death spiral that sent bond prices down further and prompted further margin calls threatening insolvency. The BoE had no choice but to step in to halt the spiral by announcing a war chest of £65 billion to create demand in the gilt market.

Critically, while the intervention by the BoE had the intended effect in bringing down yields back below 4%, the measure is only temporary with the BoE stating that the program will expire on October 14. Between now and then, LDI and pension funds need to sell assets and request cash injections from plan sponsors in order to shore up balance sheets. Considering some of these assets are highly illiquid, such as real estate, it is very likely that the BoE will have to extend the program further.

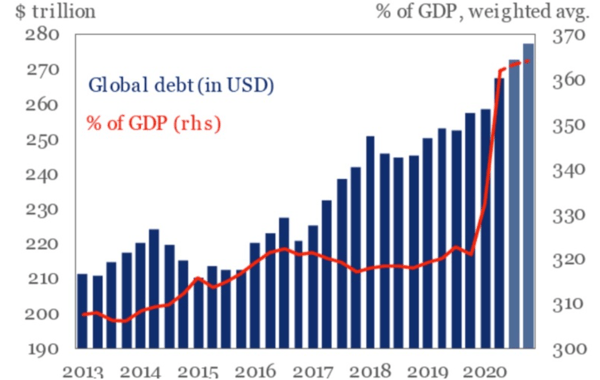

Global Debt Levels

Source: BNE IntelliNews

The events of last week have shades of the 2008 GFC, whereby a hidden pocket of leverage has the ability to cause financial contagion, infecting the rest of the market and causing collapse. While the BoE has somewhat successfully treated the symptoms, it isn’t a cure for the disease - leverage. Incentives are always misaligned and what starts off as a mechanism to hedge risk (remember credit default swaps) can quickly be dismorphed, if left unchecked, into a mechanism to juice returns. We live in a world of too much debt and given the trend in interest rates, the current level of leverage is a powder keg waiting to explode.

Read the Conversation:

Jack Colreavy:

“You would've seen the turmoil in UK financial markets last week with government bond yields absolutely skyrocketing off the back of announced tax cuts from the new government leadership. Now these tax cuts are unfunded, therefore they'll need to be debt funded. Hence, the rise in yields. The primary implication of this change in yields was the margin cause opposed on leverage bond investors, particularly liability driven investment funds.

Which are used to hedge the cash flows for defined pension plans through the use of government bonds and what's known as a repo agreement. Now, I won't go into the mechanics of all of this, but essentially these funds were over-leverage, thus creating a death spiral as they rushed for the exits. Similar to the 2008 financial crisis where credit default swaps were over leveraged by the investment banks.

Now the Bank of England has rightfully stepped in to act as a buyer of last resort, which has stabilized government bond yields. But really this is a bandaid for a bullet wound. And at the end of the day, these funds are way over leverage. And actions need to be taken less, they cause future financial contagion.

To learn more, please subscribe to, As Barclay Sees It, by clicking the link in the description below.”

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link