Aran Anandakumar

- Apr 22, 2021

- 5 min read

As Barclay Sees It - April 2021 - Cryptocurrency Edition

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

As cryptocurrency becomes increasingly renowned throughout the world, many are asking, is this the next big bubble or a revolutionary breakthrough?

It's been a breakout year for Cryptocurrency, with Bitcoin, along with other altcoins reaching all-time highs. The digital currencies are coming into their own as their market matures and their appeal broadens into the mainstream, with larger investors and institutions climbing on board.

What is Cryptocurrency?

The formal definition for cryptocurrency is a digital or virtual currency that is secured by cryptography, which makes it nearly impossible to counterfeit or double-spend. Most cryptocurrencies are decentralised networks based on blockchain technology, which is a decentralised technology spread across many computers that manage and record transactions. A defining feature of cryptocurrencies is that they are generally not issued by any central authority, rendering them theoretically immune to government interference or manipulation.

Market

Currently, there are more than 6,700 different cryptocurrencies traded publicly, according to CoinMarketCap.com, a market research website. As cryptocurrencies continue to proliferate, raising money through initial coin offerings (ICOs), coupled with their surging demand, their total value rises. The current total value of all cryptocurrencies as of April 13, 2021 is in excess of US$2.2T, with Bitcoin, the original and most popular currency, valued at approximately US$1.2T. This is followed by Ethereum, which is valued at US$263B, and Binance Coin which has a market capitalisation of US$87B.

Bitcoin

The easiest way to understand the landscape of cryptocurrency is through Bitcoin, the original and most popular cryptocurrency, which was invented in 2008 as a decentralised digital currency. In 2020 a wave of interest from mainstream investors and institutions helped push the price of Bitcoin from US$7,200 in January to above US$29,000 in December and finally to where it now sits at ~US$55,000 in April 2021. But the innovative digital asset, maintained by a decentralized swarm of so-called miners, has a long history of volatility with most observers expecting a large pullback in price, similar to that seen last week.

The Believers

In 2021, the crypto industry has consolidated, matured and is seeing real traction with institutional investors, with well-known firms such as Ark Invest pouring into crypto investment vehicles like the Grayscale Bitcoin Trust (GBTC), and a parade of influential hedge fund heads like Paul Tudor Jones, Stan Druckenmiller, and Bill Miller have bought into bitcoin.

But the institutions that may prove most pivotal to broad crypto adoption are the publicly traded tech and payments companies that are now finally warming to crypto.

PayPal announced last October that it would allow customers to buy, hold and sell cryptocurrency directly from their PayPal account with President and CEO, Dan Schulman stating:

“The shift to digital forms of currencies is inevitable, bringing with it clear advantages in terms of financial inclusion and access; efficiency, speed and resilience of the payments system; and the ability for governments to disburse funds to citizens quickly.”

This was followed by Square announcing earlier in October that it bought 4,079 bitcoins at a cost of US$50m as an investment for its balance sheet and Tesla, which bought US$1.5B worth of bitcoin in January 2021, amounting to 10% of its cash reserves.

In the general market, many supporters of the cryptocurrency see Bitcoin as the currency of the future and are racing to buy them now, presumably before they become more valuable. Other supporters like the technology behind cryptocurrencies, the blockchain, because it’s a decentralized processing and recording system and can be more secure than traditional payment systems. There are also market participants that like the fact that cryptocurrency removes central banks from managing the money supply since over time these banks tend to reduce the value of money via inflation. However, there are also speculators who invest in the crypto market purely as speculation and have no interest in the currencies’ long-term acceptance as a way to move money.

The Skeptics

On the other hand, skeptics say the momentum can't be sustained, with many saying a hard crash is inevitable. Their view is that unlike real estate or stocks or bonds, Bitcoin is an asset with no underlying value with Robert Shiller, Nobel Prize winning economist at Yale known for his work on bubbles, stating "The idea that this thing is intrinsically valuable is, I think, misplaced."

A number of other award-winning economists have warned against Bitcoin, saying it is a speculative bubble stating “Like many economists, I don’t understand why its price isn’t zero.” From worthless to the currency of the future, the disparity of views on the value of Bitcoin is significant.

In part that's because the cryptocurrency is intangible. "It is essentially a currency that is based on nothing except mathematics," says James Ledbetter, editor and publisher of FIN, a financial technology newsletter. "It doesn't correspond to anything in the real world."

Furthermore, the semi-anonymous nature of cryptocurrency transactions makes them well-suited for a host of illegal activities, such as money laundering and tax evasion. This was evident in last week’s price drop off, which was initially attributed to rumours the US Treasury Department is looking at new anti-money laundering regulations that are carried through digital assets.

The currency also faces criticism due to its price volatility, with some stating that it is too volatile to be a store of value, the large amount of electricity it consumes (carbon footprint) and the vulnerabilities of the infrastructure underlying them.

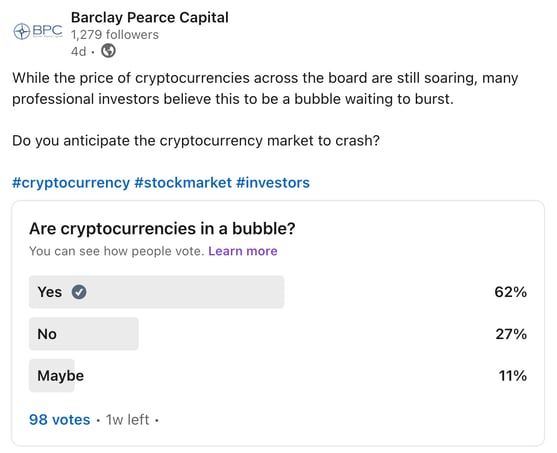

LinkedIn Poll: Are Cryptocurrencies in a bubble?

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link